Insider Sell: Yelp Inc CFO David Schwarzbach Offloads 2,750 Shares

In a notable insider transaction, David Schwarzbach, the Chief Financial Officer of Yelp Inc (YELP), sold 2,750 shares of the company on November 15, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

David Schwarzbach has been serving as the CFO of Yelp Inc, a company that operates a platform connecting people with local businesses. His role includes overseeing the financial operations and strategy of the company, making his trading activities particularly noteworthy. Over the past year, the insider has sold a total of 27,000 shares and has not made any purchases, indicating a trend that warrants a closer look.

Yelp Inc is a well-known player in the online business review space. The company's platform allows users to rate and review businesses, making it a valuable resource for consumers seeking trustworthy recommendations. Yelp's business model revolves around advertising revenue from businesses that wish to promote their services on the platform. As of the date of the insider's recent sale, Yelp Inc had a market cap of $3.099 billion, reflecting its significant presence in the digital advertising market.

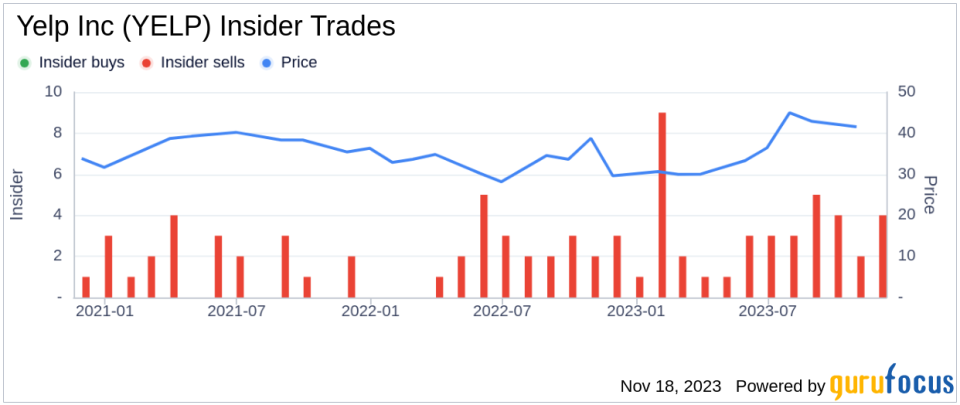

Insider trading activities, such as those of the insider, can provide a window into the sentiment of company executives and major shareholders. In the case of Yelp Inc, the past year has seen no insider buys but a total of 40 insider sells. This pattern may suggest that insiders, including the CFO, believe the stock may be fully valued or that they see better investment opportunities elsewhere.

On the day of the insider's recent sale, shares of Yelp Inc were trading at $45.21. The company's price-earnings ratio stood at 35.92, which is above the industry median of 20.52 but below the company's historical median. This valuation metric indicates that Yelp's earnings are priced at a premium compared to the industry average, yet they are trading at a discount relative to the company's own historical standards.

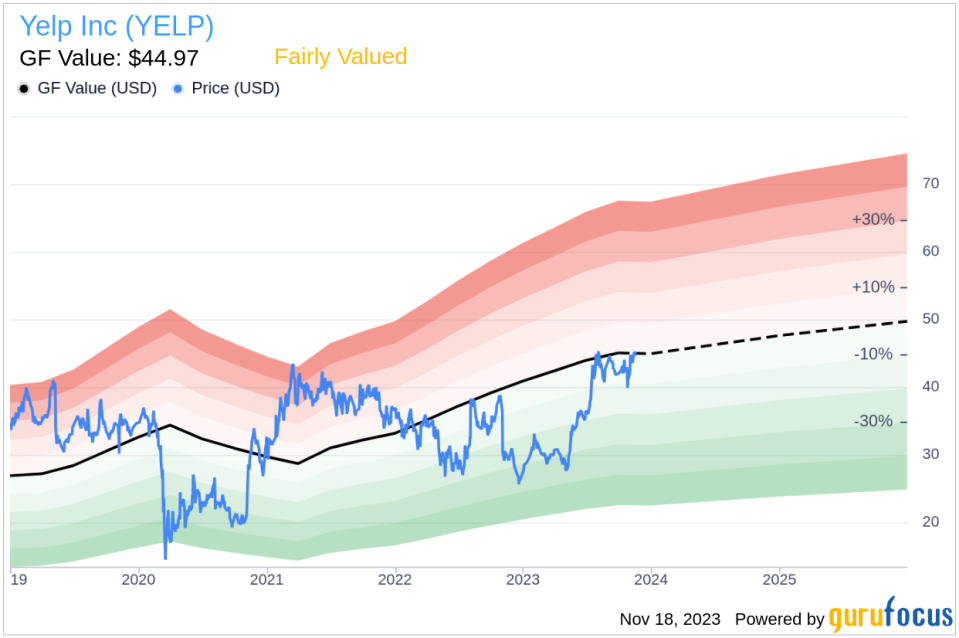

When assessing the stock's valuation, the price-to-GF-Value ratio is a critical measure. With a share price of $45.21 and a GuruFocus Value of $44.97, Yelp Inc's price-to-GF-Value ratio is 1.01, suggesting that the stock is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above illustrates the recent selling pattern among Yelp Inc's insiders. This visual representation can be a useful tool for investors trying to gauge the internal perspective on the stock's future direction.

The GF Value image provides an additional layer of analysis, comparing the current share price with the estimated intrinsic value. This comparison can help investors determine if the stock is trading at a fair price, overvalued, or undervalued.

While insider selling does not always imply negative prospects for a company, it is essential for investors to consider this information in the context of other financial metrics and market conditions. For Yelp Inc, the insider's decision to sell shares could be influenced by personal financial planning or diversification needs. However, the consistent pattern of insider selling over the past year, coupled with the stock's valuation metrics, may lead some investors to adopt a more cautious stance on the stock.

Investors should also consider the broader economic environment, competitive landscape, and Yelp Inc's growth prospects when evaluating the significance of the insider's trading activity. As with any investment decision, due diligence and a comprehensive analysis of the company's fundamentals and market position are crucial.

In conclusion, the recent insider sale by Yelp Inc's CFO, David Schwarzbach, is a development that warrants attention. While the stock appears to be fairly valued based on the GF Value, the pattern of insider selling could be a signal for investors to take a closer look at the company's financial health and future growth potential. As always, investors are encouraged to conduct their own research and consider a multitude of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.