Insider Sell: Yelp Inc's COO Joseph Nachman Sells 6,000 Shares

On September 27, 2023, Joseph Nachman, the Chief Operating Officer (COO) of Yelp Inc (NYSE:YELP), sold 6,000 shares of the company. This move is part of a series of insider sell transactions that have been occurring over the past year.

Yelp Inc is a multinational corporation headquartered in San Francisco, California. The company develops, hosts, and markets Yelp.com and the Yelp mobile app, which publish crowd-sourced reviews about businesses. It also operates an online reservation service called Yelp Reservations.

The insider, Joseph Nachman, has been with Yelp Inc since 2007 and has served in various leadership roles, including Senior Vice President of Revenue and Vice President of Sales. As COO, Nachman is responsible for overseeing the company's day-to-day operations and ensuring its financial performance and growth.

Over the past year, Nachman has sold a total of 57,452 shares and has not purchased any shares. This recent sale of 6,000 shares is part of this trend.

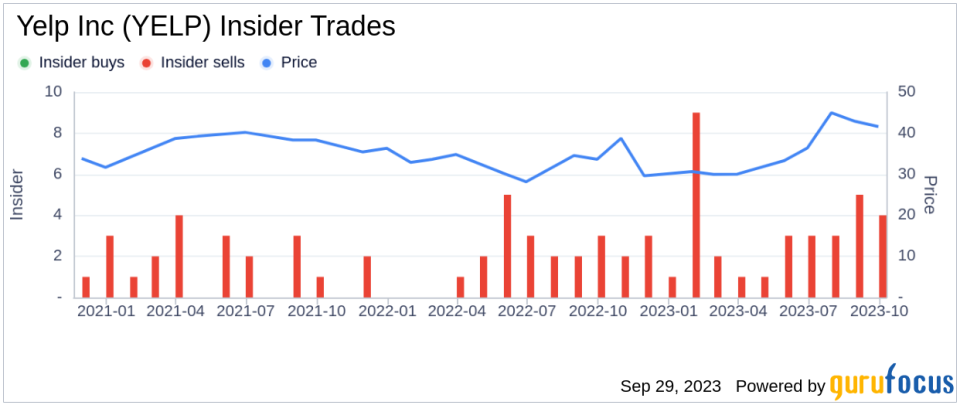

The insider transaction history for Yelp Inc shows a total of 37 insider sells over the past year, with no insider buys. This could indicate that insiders believe the stock is currently overvalued, leading them to sell their shares.

On the day of Nachman's recent sell, Yelp Inc's shares were trading at $42.3 each, giving the company a market cap of $2.86 billion. The price-earnings ratio was 69.32, significantly higher than the industry median of 20.84 and the company's historical median price-earnings ratio.

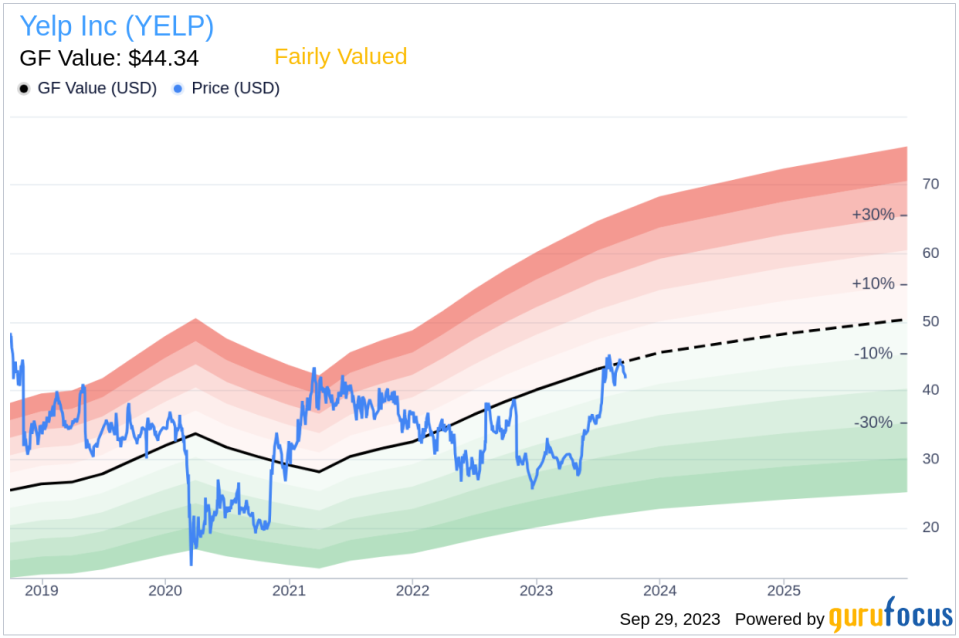

According to GuruFocus Value, Yelp Inc's stock is fairly valued. With a price of $42.3 and a GuruFocus Value of $44.34, the stock has a price-to-GF-Value ratio of 0.95. The GF Value is an intrinsic value estimate that takes into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

In conclusion, the recent insider sell by Yelp Inc's COO Joseph Nachman is part of a larger trend of insider sells over the past year. While the company's stock is currently fairly valued according to GuruFocus Value, the high price-earnings ratio and the lack of insider buys could be cause for investor caution.

This article first appeared on GuruFocus.