Insiders Are Betting Millions on These 2 Stocks — Here’s Why You Might Want to Follow Their Lead

When stock markets are in flux, it’s time to dig a little deeper to find the right investments. Investors will look for all sorts of signs, based on the earnings forecasts or charts – but one of the clearest signs of all is put up by corporate insiders.

These are the company officers who are charged with ensuring profits and returns. They are answerable to Boards of Directors and to shareholders, who expect them to build a company that supports a solid share value. These insiders, the C-suite residents and the Directors, have a deeper knowledge of their firms’ inner workings, and they can use that knowledge to inform their own trading.

The key to understanding their trading moves is simple. Insiders will sell shares for a whole host of reasons – but they’ll only buy for one: they think the shares will gain. So when corporate insiders start putting millions into their own companies’ stocks, investors should take note.

Bearing this in mind, we used the Insiders’ Hot Stocks tool from TipRanks to point us in the direction of two stocks flashing signs of strong insider buying, which warrant a closer look. Furthermore, these stocks have garnered approval from some Wall Street analysts and offer solid upside potential. Let’s take a closer look.

Erasca, Inc. (ERAS)

We’ll start with Erasca, a clinical-stage biopharma firm working on precision medicines to fight cancer. The company’s portfolio of research projects is focused on the RAS/MAPK pathway and features three approaches to this commonly signaled cascade. First, there are drug candidates to target the upstream and downstream ends of the MAPK pathway nodes; second, there are candidates targeting the midstream node, RAS; and finally, there are drug candidates that attack the escape routes enabled by other proteins.

The RAS/MAPK pathway is a common cascade path in the development of multiple cancers. RAS is the most commonly mutated oncogene, while the MAPK pathway is a related and frequently altered signaling pathway. Together, they underlie approximately 5.5 million new cancer diagnoses every year, around the world. Erasca has taken a holistic approach to fighting this cancer pathway to improve treatments and treatment outcomes.

On the pipeline, Erasca has no fewer than 12 active research programs. Among the most advanced of its programs is the multi-pronged research track on naporafenib, an experimental drug with potential applications in the treatment of several cancers. The company announced recently that it will begin dosing patients in the SEACRAFT-2 pivotal trial, a Phase 3 study of naporafenib in the treatment of NRAS-mutant melanoma during 1H24. In addition, it has already had begun dosing patients in the SEACRAFT-1 Phase 1b trial of naporafenib in combination with trametinib for the treatment of patients with RAS Q61X solid tumors. Specifically, this Phase 1b trial is targeting a form of melanoma. Initial data is expected for release in Q2-Q4 2024.

When we turn to the insiders, we find that Jonathan Lim, company President and CEO, recently bought 1 million shares, paying a total of $2.02 million. Lim now owns almost $69 million worth of the company.

The CEO is not the only bull here. Chris Shibutani, 5-star analyst from Goldman Sachs, rates ERAS stock a Buy, with a $6 price target that suggests a gain of ~167% in the next 12 months. (To watch Shibutani’s track record, click here)

Backing his bullish stance, Shibutani writes: “The clinical-stage programs that remain in focus continue on their developmental timelines apace with prior guidance. On the balance of the year, we could see additional results from the Phase 1b HERKULES-3 study of the triple combination of ERAS-007 + encorafenib + cetuximab in BRAFmut CRC (which produced encouraging preliminary results presented at ASCO), with dose expansion data still anticipated 2H23E – 1H24E. Initial monotherapy dose escalation data for ERAS-801 in GBM are also on track for a readout in 2H23E… We continue to view the pipeline refocusing as logical from an operational point of view, and we anticipate the aforementioned upcoming readouts to be potentially value-generating.”

Overall, ERAS shares have a unanimous Strong Buy consensus rating, based on 4 recent positive analyst reviews. The stock is selling for $2.25 and the average target, at $11, implies a one-year upside of ~388%. (See ERAS stock forecast)

Coty, Inc. (COTY)

Next on our list is Coty, a renowned cosmetics company with an extensive portfolio. Coty owns more than 50 cosmetic, skincare, and fragrance brands, including Adidas, Vera Wang, Burberry, Calvin Klein, Hugo Boss, Max Factor – it’s a long list, but you’ll recognize most of the names from magazine ads or from the local department store’s cosmetic counter.

The company, which today is based in the Netherlands, was founded in Paris back in 1904. Since then, it has built a stable business on its array of well-known brands and boasts a sound position in the cosmetic industry.

For its fiscal year 2023, which ended on June 30, the company had $5.55 billion in total revenue. In the last quarter of fiscal ’23, Coty reported a top line of $1.35 billion, up 16% year-over-year, and $40 million better than the forecast. The non-GAAP EPS came in at 1 cent, a penny below the estimates. Strong revenue growth in both the Prestige and Consumer beauty segments supported the top-line gains.

In a notable development, Coty put 33 million common shares on the market last month, and that led to the major insider buy. Maria Aramburuzabala, a company Director, purchased 500,000 shares at a total cost of $5.4 million. This brings her stake in the company up to $14.9 million.

For Raymond James analyst, Olivia Tong, the key point is the upcoming holiday season, when Coty’s business typically picks up. She writes, “With Fragrances accounting for 60% of COTY’s sales, mostly in prestige brands, and the key holiday period approaching, we see opportunity for continued upsides for COTY. Management raised its sales guide four times during FY23 and we see potential for another positive announcement when the company reports F1Q24 results, or possibly earlier.”

“Better than expected Fragrance demand has been a key driver of COTY’s upsides in recent quarters and with industry fill rates now back in the mid-to-high 90s again after recovering from glass and other component shortages last year, fragrance houses can also return to gift sets to also support the category, particularly important heading into the holiday season,” Tong added.

To this end, Tong rates COTY shares an Outperform, while her price target, of $15, points toward a 57% upside on the one-year horizon. (To watch Tong’s track record click here)

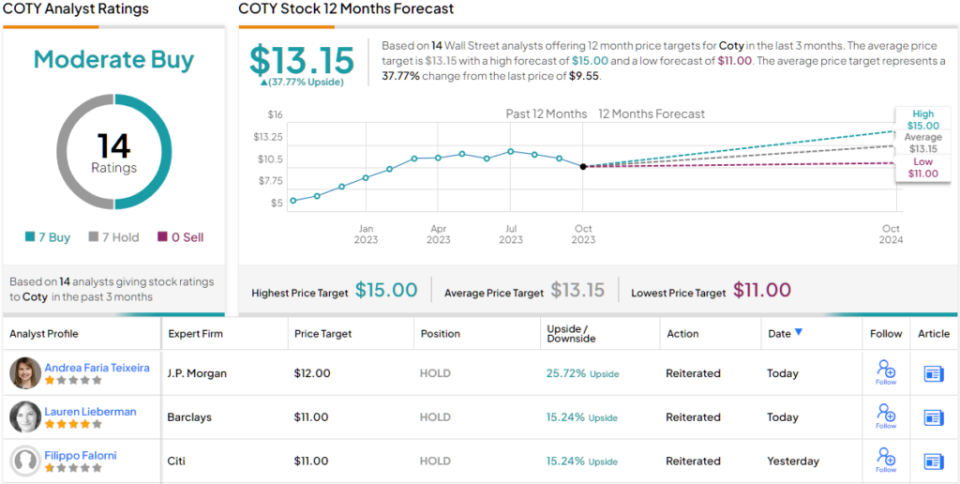

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 7 Buys and Holds, each, add up to a Moderate Buy consensus rating. The stock is selling for $9.55, and its $13.15 average price target suggests it will gain ~38% in the year ahead. (See COTY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.