Insiders Pour Millions Into These 2 Stocks Under $10 — Here’s Why Wall Street Thinks They Could Double (or More)

Investors are constantly looking for different ways to beat the market and there are several routes to follow in that pursuit.

One common strategy is to keep track of the insiders’ moves. By insiders, we mean the corporate officers responsible for their own companies’ performance, who also naturally know the inner workings of the firms they work for better than anyone else. When they are seen picking up shares of company stock – by law they are required to make the transactions public – it sends a strong signal to investors that something is up, and they must believe the shares offer good value at current levels.

Now, that’s one way. Another is to keep an eye out for recommendations from Wall Street’s stock experts. It is their job after all to point out which equities represent the best opportunities in any given climate.

So, when specific stocks are being picked up by the insiders and at the same time, certain analysts are saying they are primed for some serious gains – triple-digit, no less – investors should naturally take note.

We’ve made the search for such stocks a little easier and by using the Insiders’ Hot Stocks tool have dug up the details on two names that fit that exact profile. Further adding to their appeal, both of these equities are currently going for under $10 a piece, providing investors with a relatively cheap point of entry. Here’s the lowdown.

Heron Therapeutics (HRTX)

We’ll start with Heron Therapeutics, a biotech company creating top-tier treatments that address unmet medical needs in pain management and chemotherapy-induced nausea and vomiting (CINV). The company’s expertise lies in crafting patient-centric solutions that utilize cutting-edge science and tech, primarily based on pharmacological agents that are already approved.

A biotech’s mission is to get its own product approved. Heron has already come good on that front, having several approved medications on the market.

These include Zynrelef, an extended-release solution painkiller used in adults to lessen pain from small to medium-sized wounds post-operation. The drug was given the go-ahead by the FDA in May 2021, while the treatment was also given label expansion in December 2021, making it available for use in a broader range of surgeries.

During this year’s first quarter, the company filed an sNDA that will let Zynrelef cover more indications, specifically soft tissue and orthopedic surgical procedures. This will make it available to treat ~14 million annual procedures, roughly doubling from the present ~7 million annual procedures Zynrelef can cover with the current label. A PDUFA date is set for October 23.

The first quarter also saw the launch of Aponvie, another drug from Heron’s acute care solutions pipeline. Aponvie is an injectable emulsion of aprepitant approved to prevent post-operative nausea and vomiting (PONV).

Despite these events, the shares have been on the backfoot this year. Evidently, one insider thinks the time is right to pounce. Director Adam Morgan recently picked up 2,486,744 shares, currently worth over $4.1 million.

The company also has a fan in Cantor analyst Brandon Folkes, who, products aside, highlights a change in the C-suite that could help propel shares forward.

“We expect continued uptake of Zynrelef, an ex-U.S. partnership on the product, and an Aponvie launch to drive potential near-term upside for the stock,” Folkes explained. “We expect that longer term, the vial access needle and prefilled syringe products will drive longer-term runway to Zynrelef revenue, while Aponvie could provide upside to near-term numbers… The new CEO, Mr. Collard, articulated his vision to drive commercial excellence at Heron, and we expect investors to see the ‘fruits of his labor’ in the coming quarter (Heron will report Q2 earnings this Wednesday, Aug 9).

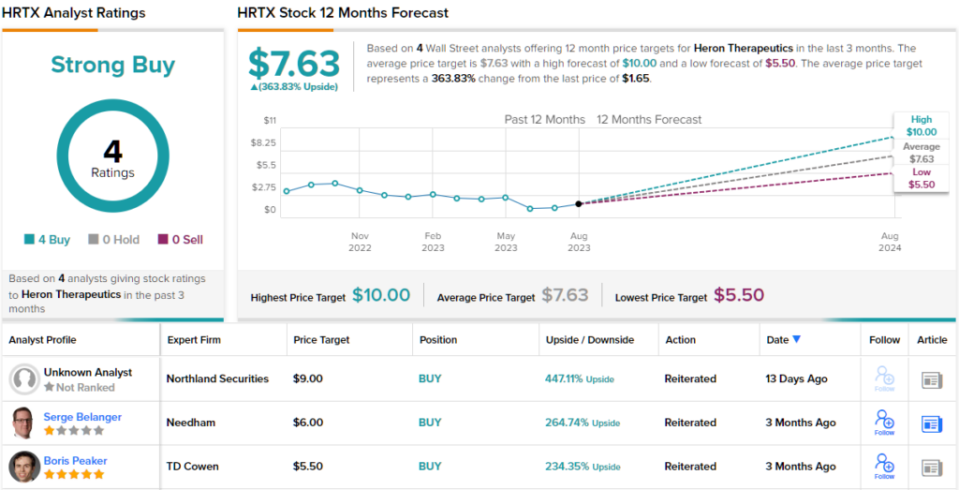

These comments form the basis for Folkes’ Overweight (i.e., Buy) rating while his $10 price target makes room for huge gains of 508% over the coming months. (To watch Folkes’ track record, click here)

That’s an optimistic target, but it’s not as if the rest of the Street is significantly less upbeat. The average target stands at $7.63, suggesting shares will climb ~364% higher over the one-year timeframe. All told, the stock garners a Strong Buy consensus rating, based on a unanimous 4 Buys. (See HRTX stock forecast)

Inozyme Pharma (INZY)

We’ll stay in the biotech space for our next name. Inozyme Pharma’s focus is on developing treatments for rare diseases with a specific focus on abnormal mineralization disorders.

The company’s lead candidate is INZ-701, currently undergoing clinical testing as a potential therapy for ENPP1 Deficiency and ABCC6 Deficiency, rare disorders caused by low levels of inorganic pyrophosphate (PPi) and adenosine. Right now, there are no therapeutic options for patients affected by these conditions – disorders where patients suffer badly with a mortality rate up to 50%.

With biotechs, it’s all about potential catalysts, and here Inozyme has several coming up from the ENPP1 deficiency program.

In September, the company expects to have an interim data readout from cohorts 1-3 in the Phase 2 segment of the ongoing Phase 1/2 study in adults, followed by topline data from the same groups in the first quarter of next year.

The ENERGY-3 study, a pivotal trial in pediatric patients should kick off this October (with topline data expected in mid-2025). Interim data from the ENERGY-1 trial, a Phase 1b study in infants should also see the light of day sometime in 2H 2024.

With all this to come, one insider obviously sees good things ahead and has been busy loading up. Director Robert Lorne Hopfner recently purchased 833,333 shares, which currently command a market value of almost $4.2 million.

All of this activity has also caught the attention of Wedbush analyst David Nierengarten, who thinks investors should take action ahead of the upcoming readouts. He writes, “In the near-term, we believe the main catalysts for shares remain the interim data readout from cohorts 1-3 in the Ph 2 portion of the INZ-701 study in adult ENPP1 deficiency which is expected in September, followed by topline data from the study in 1Q24… With multiple data catalysts over the next 18 months and clear paths to registration in view, we would be buyers of INZY shares ahead of the upcoming interim data in adult ENPP1 deficiency.”

To this end, Nierengarten has an Outperform (i.e., Buy) rating for the shares to go alongside a $15 price target. The implication for investors? Upside of 213% from current levels. (To watch Nierengarten’s track record, click here)

This is another stock with positive reviews only – 5, in total – all naturally adding up to a Strong Buy consensus rating. There are big gains projected here too; at $20, the average target implies shares will appreciate by ~315% in the months ahead. (See INZY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.