Insiders Buy the Dip in These 2 Beaten-Down Stocks, Analysts Say They Could Be Ready to Bounce Back — Here’s Why You Should Pay Attention

Whether you’re a seasoned trader or a novice, the oldest piece of advice in economics still holds true: buy low and sell high. The challenge lies in determining the right time to purchase stocks that are undervalued or to sell those that are overpriced.

There are plenty of signs to crack that code, but one of the clearest is the insiders’ trading patterns. The insiders are corporate officers, companies’ higher-ups, whose positions put them ‘in the know.’ Therefore, monitoring their trades, especially when they’re buying in bulk, can provide valuable insights into the company’s potential direction.

The bulk trades always deserve a closer look, so we’ve opened up the Insiders’ Hot Stocks tool from TipRanks to find two stocks that have both been the subject of million-dollar-plus insider buys.

According to analysts, these stocks are Buy-rated and offer considerable upside potential. Additionally, they have been beaten-down in recent months, making them attractive investments for those looking to buy low and potentially profit from a rebound.

Cerevel Therapeutics Holdings (CERE)

We’ll start with Cerevel Therapeutics, a specialist in neuroscience working on new treatments for neurological conditions such as Parkinson’s, epilepsy, and schizophrenia. Cerevel’s work uses a combination of advanced biology and chemistry to understand neurocircuitry and the central nervous system’s receptor pharmacology. The company’s approach is based on finding highly specific solutions to the challenges presented by neuroscience-related diseases.

Cerevel was founded in 2018 through a partnership between the Big Pharma giant Pfizer and Bain Capital. Since then, Cerevel has developed a diversified research pipeline, featuring five clinical-stage drug candidates: investigational therapies targeting schizophrenia and psychosis, panic disorder, Parkinson’s, and apathy related to dementia. We’ll center our attention on the four that take the lead.

At the forefront is drug candidate tavapadon, which is currently undergoing evaluation in a set of Phase 3 studies for Parkinson’s treatment. The drug has the potential to be the first in its class of D1/D5 selective partial agonists, both as a monotherapy and adjunctive treatment. Data from the first of these studies, TEMPO-1, is expected in 1H24, with data from TEMPO-2 and TEMPO-3 to follow in 2H24.

Elsewhere in the pipeline, Cerevel is running a Phase 2 proof-of-concept trial for darigabat, a new drug candidate with potential in the treatment of both epilepsy and panic disorder. The Phase 2 REALIZE trial is looking at the drug for use against focal epilepsy, with data expected in the middle of next year. The company also recently initiated a second Phase 2 proof-of-concept trial, testing darigabat for the treatment of panic disorder.

In addition, the company is working on CVL-871, a potential treatment targeting dementia-related apathy. At present, the company is in the midst of a Phase 2a exploratory trial. Nevertheless, the trial timeline is undergoing reassessment due to persistent challenges encountered by clinical sites in accurately identifying the suitable patient cohort for this application.

Finally, the fourth leading clinical program centers around emraclidine, which is currently undergoing evaluation in a pair of Phase 2 trials for schizophrenia treatment. Known as EMPOWER-1 and EMPOWER-2, these trials explore emraclidine’s efficacy as a once-daily medication, obviating the need for titration. Enrollment in the studies has been slower than anticipated, however, and data releases are now expected in 2H24; news of this delay sparked a sharp drop in Cerevel’s shares this month, with the stock being down 27% so far in August.

Cerevel’s share decline did not seem to concern insiders or Wall Street analysts. In fact, we find two ‘informative buys’ by company officers this month. The smaller of these, a $501,794 purchase of 21,880 shares, was made by chief business development and strategic operations officer Paul Burgess. The larger purchase, of 83,857 shares, was made by the company President and CEO Ronald Renaud, who put down nearly $2.01 million.

From the Street’s analysts, we can check in with Stifel analyst Paul Matteis, who takes note of the data delay but maintains a bullish stance on Cerevel.

“While the announced emraclidine delay is disappointing, it’s not shocking to us, and ultimately, we still believe that if pivotal trials replicate the compelling ph1b data in schizophrenia, the stock can go much higher from here… With a new CEO/CFO at the helm, we expected management to take a fresh look at the business, and given that multiple other programs were delayed, it’s somewhat unsurprising to see emraclidine data get pushed by a new team who (by our read) is incentivized to be more conservative and ideally, under-promise and over-deliver,” Matteis opined.

“We believe the upside case for the stock is clear-cut: with five clinical stage medicines pursuing significant opportunities in neurology, there are multiple ways to win, and the risk/reward looks compelling to us,” the analyst summed up.

Along with this outlook, Matteis gives CERE shares a Buy rating with a $42 price target that implies a robust 90% upside for the next 12 months. (To watch Matteis’ track record, click here)

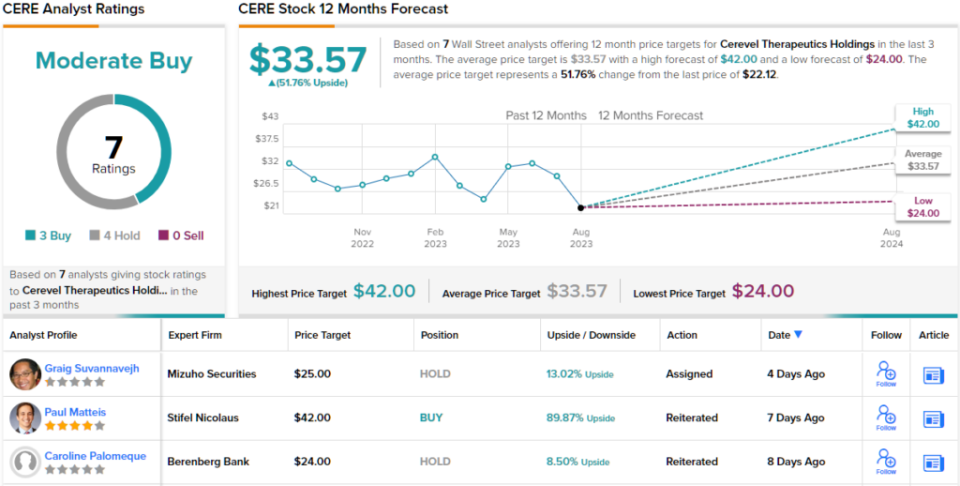

Overall, CERE stock has 7 recent analyst reviews, including 3 Buys and 4 Holds, for a Moderate Buy consensus rating. The average price target, $33.57, implies a 53% upside from the current trading price of $21.93. (See CERE stock forecast)

Zebra Technologies (ZBRA)

We’ll change gears now, and look at Zebra Technologies, a tech firm with a niche in the retail sector. Zebra provides a set of vital tools to facilitate modern retail sales, offering its customers a line of products for pricing, marking, tracing, and tracking merchandise. The company is best known for making barcodes, RFID tags, scanners, and printers; in short, all the tools that retailers needs to keep their inventory and logistics chains up to date.

Zebra started out back in 1969, building electromechanical devices, and switched to labeling and ticketing in 1982. It added RFID tagging and tracking in 2004 and hasn’t looked back since. However, this month has witnessed a sharp decline in the stock, with a loss of 15%.

The share price decline came after Zebra released its 2Q23 earnings report. At the top line, the company reported $1.214 billion in revenue, down over 14% year-over-year and missing the forecast by almost $100 million. The non-GAAP EPS of $3.29 per share was 1 cent ahead of the estimates but was down from $4.61 in the year-ago quarter. Investors were spooked by the results, and the stock tumbled in the aftermath.

The dip in Zebra’s shares appears to have had little impact on a number of company insiders who engaged in recent purchases. Among them is Anders Gustafson, the Executive Chair, who invested about $1 million to acquire 4,100 shares. Additionally, both the CEO, Bill Burns, and the Director, Richard Keyser, bought 1,000 shares each for around $250,000.

Covering ZBRA shares for Stephens, analyst Tommy Moll notes the drop in share price this month but sees it as a buying opportunity. In his view, the company’s hard times are likely at or near the bottom, and investors can expect better performance heading into next year.

“Leading into earnings, ZBRA shares climbed higher likely on the idea that 2023 earnings would prove a trough, despite negative read throughs and channel checks late in the quarter. On earnings day, ZBRA reported a significant guidance cut on (1) end market demand softening and (2) channel de-stocking… Looking ahead, we anticipate positive catalysts from revenue bottoming 3Q23, and then with visibility to a return to year-over-year revenue growth 2H24, which could come over the next couple quarters. In the meantime, we anticipate shares to move higher modestly as incremental investors contemplate an attractive entry point,” Moll wrote.

Putting some numbers to this stance, Moll gives a $350 price target on the stock, indicating confidence in a 33% upside on the one-year horizon. His rating here is Overweight (i.e. Buy). (To watch Moll’s track record, click here)

Looking at the consensus breakdown, 6 Buys and 2 Holds have been issued in the last three months. Therefore, ZBRA gets a Strong Buy consensus rating. Based on the $299 average price target, shares could surge 14% in the next year. (See ZBRA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.