Insiders Pour $1 Million-Plus Each Into These 2 Stocks — Here’s Why You Might Want to Follow Their Footsteps

For the retail investor, insider trades are one of the best indicators of a stock’s potential future performance. The insiders, of course, are far more benign than the connotations of the name. They are corporate officers, residents of the C-suite, or members of the Board. Their positions give them a close-up view of a company’s inner workings, and that view guides them when they trade their own firms’ shares.

The corporate insiders’ knowledge gives them an advantage in their trading, providing an edge over other traders in the same stocks. To maintain a level playing field, regulators require insiders to publish their trades, allowing the trading public to follow these transactions. The key point to remember is that insiders typically only buy their own stocks when they are certain the price will go up.

We’ve used the Insiders’ Hot Stocks tool to get the lowdown on a pair of stocks that some insiders have splashed out at least $1 million on. The insiders are cautious in their trading activities, and their purchases of such substantial value demonstrate a clear willingness to take significant risks. These are the trades that retail investors should scrutinize closely.

Now, let’s take a closer look at these trades and what the analysts have to say. This will help us understand why following their footsteps could be a smart move.

Oneok, Inc. (OKE)

Let’s begin with Oneok, a prominent midstream company specializing in natural gas. Oneok owns one of the top-rated natural gas liquids systems in the US, and its network connects the Permian, Mid-Continent, and Rocky Mountain regions with important market centers. Oneok’s network includes an array of natural gas gathering, processing, storage, and transport assets, making the company a leading provider of midstream services.

This past May, Oneok made an important move to expand its network, with the announcement of its agreement to acquire Magellan Midstream Partners. The move will make Magellan a fully-owned subsidiary of Oneok, and give Oneok a presence on the Gulf Coast. The combined asset net work will include more than 25,000 miles of pipeline. The acquisition transaction is valued at $18.8 billion in cash and stock, and is expected to close during 3Q23.

Heading toward that transaction closing, we can look at Oneok’s most recent quarterly report, for a snapshot of how the company stands. Revenues for 1Q23 came in at $4.52 billion, falling almost 17% y/y and missing the forecast by $827 million. Earnings, however, beat the forecast; the EPS figure of $2.34 was 5 cents better than had been anticipated.

Better-than-expected earnings helped prop up a solid dividend, which Oneok declared at 95.5 cents per common share back in April, and paid out in May. At the current rate the dividend payment annualizes to $3.82 per share, and gives a yield of 6.3%, contributing significantly to the stock’s return value.

Turning to the insider activity, we find that the company’s President and CEO Pierce Norton recently bought 24,607 shares of OKE, for which he spent $1.5 million. It was by far the largest transaction conducted recently by a Oneok insider.

All of this has caught the attention of Stifel analyst Selman Akyol, who is impressed by Oneok’s acquisition activity and its ability to emulate larger midstream firms.

“We view the acquisition of Magellan as providing ONEOK with increased scale and diversity of assets while maintaining its Gulf Coast and Mid-Con concentric footprint. This will clearly make OKE more on par with Enterprise Products or Energy Transfer in terms of diversity across the carbon chain. Equally important, it provides OKE with immediate synergies totaling $200 million and potentially a runaway to harvest total synergies over $400 million over the next several years. OKE has had a desire to be able to export NGLs and we believe either through additional assets or potentially repurposing assets OKE may be much closer to achieving that given Magellan’s access to the water,” Akyol opined.

These comments support the analyst’s Buy rating, while his $76 price target suggests that OKE will appreciate ~25% in the coming months. (To watch Akyol’s track record, click here)

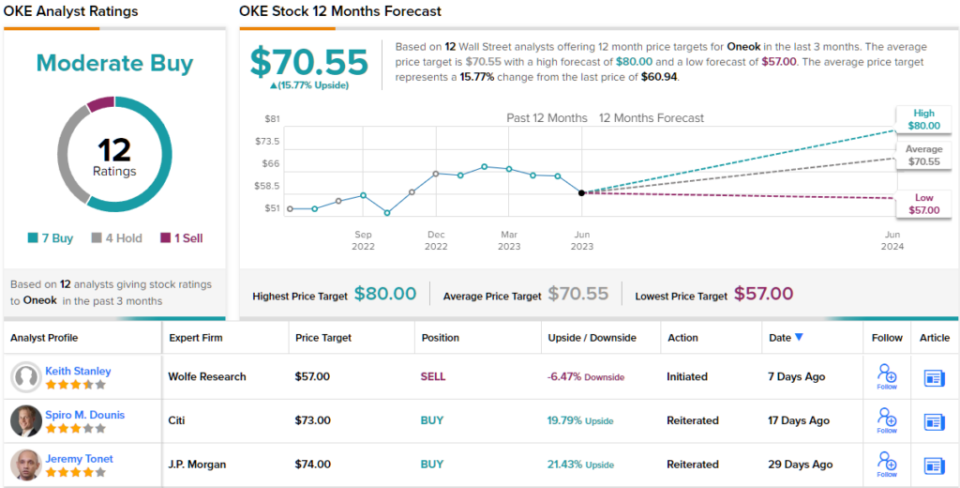

Overall, OKE has a Moderate Buy consensus rating, based on 12 recent analyst reviews with a breakdown of 7 Buys, 4 Holds, and 1 Sell. The stock is currently trading at $60.94 and its average price target of $70.55 implies room for ~16% growth going forward. (See Oneok stock forecast)

The Children’s Place (PLCE)

Now we’ll shift gears and move from the energy industry to the realm of children’s retail, where we’ll explore the prominent player, Children’s Place.

Notably, Children’s Place holds the position of being the largest children’s apparel retailer in the North American market. The company designs its own clothing lines for children from birth through toddlerhood to school age, and it contracts out the manufacturing of these designs. Additionally, the company controls both the retail and wholesale marketing and sales.

Children’s Place sells its merchandise under several brand names, including the well-known eponymous Children’s Place label, Baby Place, and Gymboree, among others. At the end of the company’s first quarter – the end of this past April – Children’s Place was operating 599 stores across the US, including Puerto Rico, and Canada. On the international side, the company had five international franchise partners, controlling 212 distribution points in 15 countries.

The economic turmoil of the past several years has been hard on Children’s Place, and the company’s stock is down 28% since the beginning of this year. Recent weeks have been better, however, and PLCE has joined the overall bullish trend – the stock has gained 81% from its June 1 trough.

Turning to the financial results, we find that Children’s Place last report, for Q1 of fiscal 2023, ending on April 29, showed a top-line revenue figure of $321.64 million. This was down 11% year-over-year, and missed the estimates by $16.82 million. At the bottom line, earnings also missed the forecast, with the non-GAAP EPS of -$2.00 coming in 22 cents below expectations. The EPS figure was a poor comparison to the $1.05 EPS profit reported in 1Q22.

Despite the financial misses, the CEO of Children’s Place, Jane Elfers, purchased 43,000 shares of the stock early this month. This was a significant insider buy, for which Elfers laid out $1.019 million. Her stake in the company now totals more than $8.8 million.

She is not the only bull here, either. Jeff Lick, covering PLCE for B. Riley, sees Children’s Place as an undervalued growth opportunity, and recommends that investors buy in now. In his words, “We continue to like the fundamental, transformational story of PLCE. From a stock set-up perspective, we’d be remiss if we didn’t highlight the notion that it appears to us PLCE now has four consecutive quarters of low expectations, potentially explosive upside catalysts and seemingly easy compares.”

“We do not mean to dismiss the effects that the current and prolonged economic headwinds can and has had on PLCE’s financial results. In our view, the company-specific, transformative elements to the PLCE story in conjunction with its proven cash flow generation and low valuation based on our 2024 estimates represent simply too meaningful of an outsized return potential together with a reasonable level of downside protection to pass up,” the analyst added.

In addition to his Buy rating on the shares, Lick gives PLCE a $43 price target, implying a one-year gain of 64%. (To watch Lick’s track record, click here)

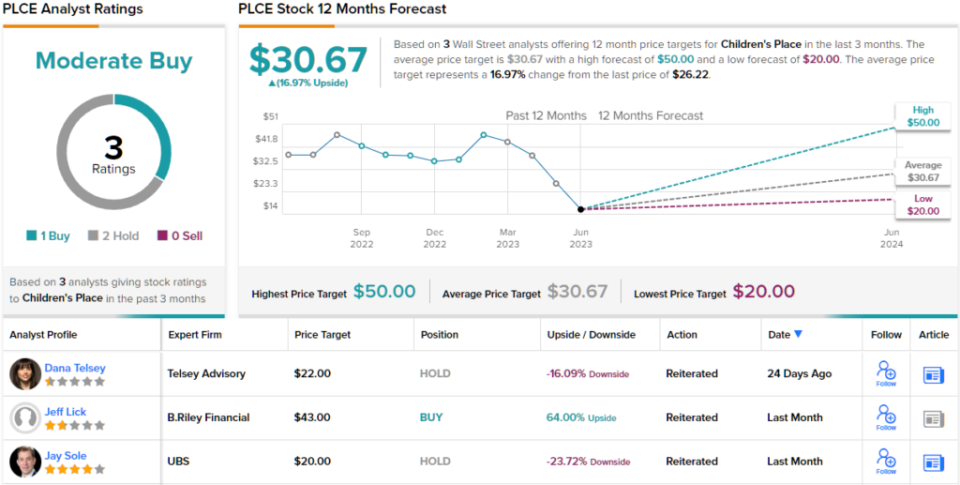

Overall, Children’s Place stock gets a Moderate Buy rating from the analyst consensus, based on 3 recent reviews that include 1 Buy to 2 Holds. The stock is selling for $26.22 and its average target price, at $30.67, suggests it will gain ~17% in the next 12 months. (See PLCE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.