Insiders Pour Millions Into These 3 Buy-Rated Stocks — Here’s Why You Might Want to Ride Their Coattails

With New Year’s right around the corner, it’s a convenient time for investors to start rearranging their stock portfolios. There’s no trick to this, just the steady work of reading the market signals and adjusting holdings accordingly, to try to set up a profitable investment package that will work in next year’s market conditions.

One of the clearest signals out there comes from the corporate insiders. These are the company officers – the C-suite residents and Board members whose positions give them both detailed knowledge of their companies’ prospects and accountability to shareholders for bringing in positive results. This combination makes their own stock trades highly informative for the retail investor; the insiders may sell shares for many reasons, but they’ll only buy for one: they believe those shares are going to go up.

And when insiders start pouring their own millions into their stocks, investors should pay close attention – and maybe even hop on their coattails to ride along.

We can use the data tools at TipRanks, particularly the Insiders’ Hot Stocks tool, to follow these trades. A brief look at the data shows that Wall Street gives 3 of these stocks Buy-ratings with considerable upside potential. Now, let’s take a deeper dive into these insider favorites.

Don’t miss

‘We Are Bullish on Cybersecurity’: Susquehanna Recommends 3 Stocks to Consider

Jefferies Says Solar Stocks Offer a Positive Risk-Reward — Here Are 2 Names to Take Advantage

Bank of America Pounds the Table on These 3 Buy-Rated Stocks

Cibus (CBUS)

We’ll start in the agricultural world, where millions can ride on finding the right seed, or producing the right fruit – and then being able to replicate it again, and again, and again, reliably, to meet the food needs of the world’s population. If that sounds a bit dramatic, what it comes down to is the collective wisdom of the world’s farmers, backed up by cutting-edge agricultural technologies, planting and cultivating to find the perfect crops.

This is where Cibus fits, right into the category of cutting-edge agricultural technologies. The company works on the science side of agriculture, using gene editing technology to create the perfect plant traits – traits that can then be spliced into seeds and put into cultivation. Cibus is not a seed company; rather, it’s a genetics company, that works with the seed producers to develop precisely the right plant traits, in a predictable way, at greater speed and efficiency than traditional plant breeding methods.

Operating as a technology company, Cibus develops new genes and then licenses those genetic traits to seed companies, who pay royalties on the final seed sales. Cibus targets productivity traits that are designed to increase crop yields while lowering the input costs of chemicals and fertilizers – with the end goal of making large-scale farming both more sustainable and more profitable for everyone involved, while continuing to generate the crop volumes that the world depends on. Among the traits that Cibus is working to promote are seed pod shatter resistance, disease resistance, and efficiency in nutrient use.

In its last quarterly update, from 3Q23, Cibus gave updates on its continued efforts at trait development for several crops in various regions. These included field trials for the PSR trait in canola, a vital oil seed crop, and for the HT1 and HT3 traits in rice. The company also started field trials for its PSR trait in winter oilseed rape (WOSR) in the UK, and reported continued progress in its soybean single cell operating system, which is expected to come online in 2024.

Cibus has been transitioning from an R&D company to a commercial company, and on the insider trading front, it’s clear CEO Rory Riggs is confident in its success. He recently bought 517,107 CBUS shares, with the purchase now worth almost $8.69 million.

Canaccord Genuity analyst Bobby Burleson also takes an upbeat stance on the company, believing it is making the right moves in anticipation of lift off. Burleson writes, “We continue to see CBUS well positioned in the gene-edited crop trait market given the company’s traction with leading germplasm partners and substantial progress already made by CBUS on several traits across multiple crops including canola, rice, and soybean, among others, with the caveat that the cash runway needs to be addressed to execute its plan for 2024 and beyond. CBUS recently announced headcount reductions and a realignment in part to extend this runway.”

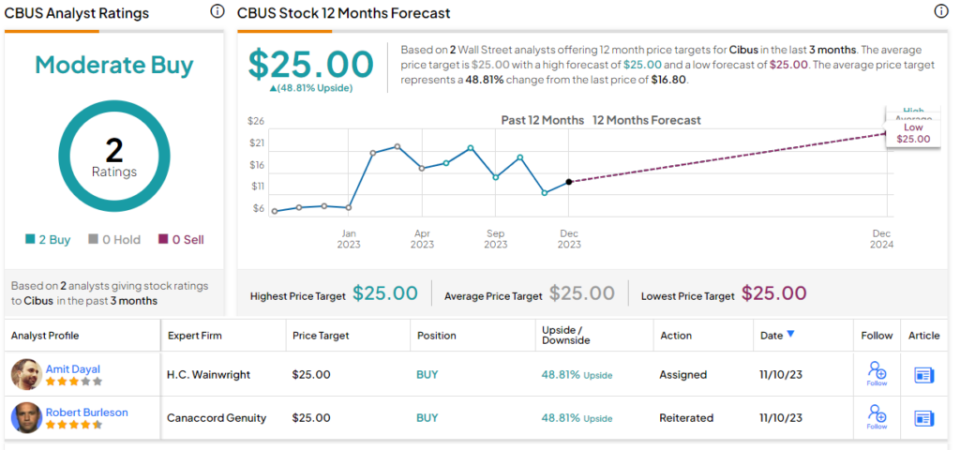

Burleson complemented his stance with a Buy rating on the shares, and a $25 price target that implies a one-year upside of 49%. (To watch Burleson’s track record, click here)

Overall, Cibus’ Moderate Buy consensus rating is based on just 2 recent analyst reviews – but they are both positive. The stock is trading for $16.80, and its average price target matches the Canaccord view. (See Cibus stock forecast)

RumbleON (RMBL)

Next up is RumbleON, an automotive-related company operating in the sales niche. Specifically, RumbleON connects buyers and dealers in the world of recreational sporting vehicles. The company has a particular focus on motorcycles – hence its name – but it will facilitate transactions in all sorts of pre-owned powersports vehicles.

RumbleON boasts that it is the largest retailer of new and used powersports vehicles in the North American market. The company deals in most of the brands out there – customers can find Harley Davidson and Indian motorcycles, as well as Polaris vehicles. For fans of international motorsports, relevant labels include Ducati, Triumph, BMW, Honda, and Yamaha.

RumbleON offers a seamless online process for both buyers and sellers, and guarantees that customers will find the ride they are looking for. The company’s $575.4 million acquisition of RideNow, completed two years ago as the country as a whole was emerging from the COVID lockdown era, brought RumbleON a network of 50+ locations around the country, where customers can shop for new vehicles, or pick up vehicles bought online.

A look at the insider trades on RMBL brings us to William Coulter, a member of the Board of Directors and a 10% owner of the company. This month, Coulter made a bulk purchase of 860,882 shares of the stock, now worth over $7.34 million. Coulter now holds over $50 million worth of RumbleON stock.

Getting to the company’s recent financial figures, we find that RumbleON saw a total of $338.1 million in revenue for 3Q23. This was down 11.7% from Q2, a decline management described as ‘driven by seasonal trends.’ The Q3 revenue missed the forecast by $16.85 million.

At the company’s bottom line, earnings came out to a net loss of 71 cents per diluted share, in non-GAAP terms. This figure was based on a total adjusted net loss of $11.9 million; the EPS missed expectations by 35 cents per share.

Nevertheless, despite its earnings miss, B. Riley analyst Eric Wold takes the view that with a $100 million equity rights offering now completed, the company’s potential growth drivers are not being fully appreciated. He writes, “With our view that underlying demand trends and powersports vehicle GPUs have stabilized recently and the reduction in debt from this offering and non-core asset sales will boost FCF generation through lower interest expense, we believe the impressive subscription level demonstrates that the current valuation may not accurately reflect those growth drivers—especially within an externally-acquisitive environment.”

Looking ahead, Wold adds his view of the stock’s likely path forward: “We are adjusting our model for the equity rights offering and remain optimistic that management will be able to utilize nearly half of the proceeds to fuel accretive dealership acquisitions in the quarters ahead. We previously noted our belief that RMBL shares were artificially trading at this level due to the overhang from the equity rights offering and would not be surprised if they moved higher toward a more appropriate valuation.”

Together, these comments back up Wold’s Buy rating on the shares, and his $11 price target shows his confidence in a 29% potential upside in the next 12 months. (To watch Wold’s track record, click here)

RumbleON has earned a unanimously positive Strong Buy consensus rating from the Street, based on 3 recent analyst reviews. The stock is trading for $8.53 and its $10.50 average price target implies a potential gain of 23% by this time next year. (See RumbleON stock forecast)

Ford Motor (F)

Last up is a storied name in the automotive industry, Ford Motor. Long synonymous with Detroit’s ‘Motor City’ image, Ford is actually based in nearby Dearborn. Founder Henry Ford introduced the first automotive assembly lines in 1913, at his Highland Park factory – streamlining production of his famous Model T and changing forever the way that heavy industry operates. Today, Ford is best known for its popular and famous F-series of light- and heavy-duty pickup trucks, which have consistently been the best-selling trucks in the US for over 40 years.

Ford continues to innovate, working to improve existing vehicles, introduce new features, and create new driving systems. The company has made a solid commitment to putting more electric vehicles on the road, and is developing new driver assistance and connected vehicle systems that promise to change the way we control and operate our vehicles.

However, when we look at Ford’s last quarterly earnings results, we find the auto giant missed expectations on both the top-and bottom-line. The company generated $41.18 billion in revenue, up 10% y/y, but falling shy of the forecast by $1.33 billion. The company’s bottom-line adj. earnings reached 39 cents per share, coming in 7 cents worse than had been anticipated.

Meanwhile, the most recent insider trade on Ford stock came from the company’s Chief EV, Digital & Design officer, Doug Field. Field recently spent just over $2 million to buy 182,000 shares and his full stake in the company is currently worth ~$8.60 million.

For Bank of America’s 5-star analyst John Murphy, the company’s long-term plans are net positives, and he writes of the automaker, “Ford is aggressively repositioning its business model by leveraging the combined strength of its Ford Blue and Ford Pro businesses to fund its growing Model e business along with vital connected technology. We believe the company has a long way to go, but combined with a strong near-term product cadence (especially Super Duty) we expect management will likely make great strides.”

Murphy goes on to rate F as a Buy, and his $19 price target suggests a strong 58% gain lying ahead for the stock next year. (To watch Murphy’s track record, click here)

Zooming out, we see that Ford Motor has picked up 14 recent analyst reviews, with a breakdown of 6 Buys and Holds, each, and 2 Sells giving the stock its Moderate Buy consensus rating. Shares are currently trading for $12.02 and the stock’s $13.15 average target price points toward a 9.5% upside on the one-year horizon. (See Ford stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.