Insight Enterprises Inc (NSIT) Achieves Record Gross Margin Amidst Sales Decline

Gross Margin Expansion: Gross margin reached a record 19.5% in Q4, up 270 basis points year over year.

Net Sales: Q4 net sales declined by 11% year over year, while full-year sales saw a 12% decrease.

Operational Earnings Growth: Earnings from operations rose by 16% in Q4 and 1% for the full year.

Earnings Per Share: Q4 diluted EPS increased by 14% to $2.42, with full-year adjusted diluted EPS up 6% to a record $9.69.

Cash Flow: Operating activities generated $205.8 million in Q4 and $619.5 million for the full year.

Cloud and Services Performance: Cloud gross profit surged by 43% in Q4, contributing to the overall gross profit growth.

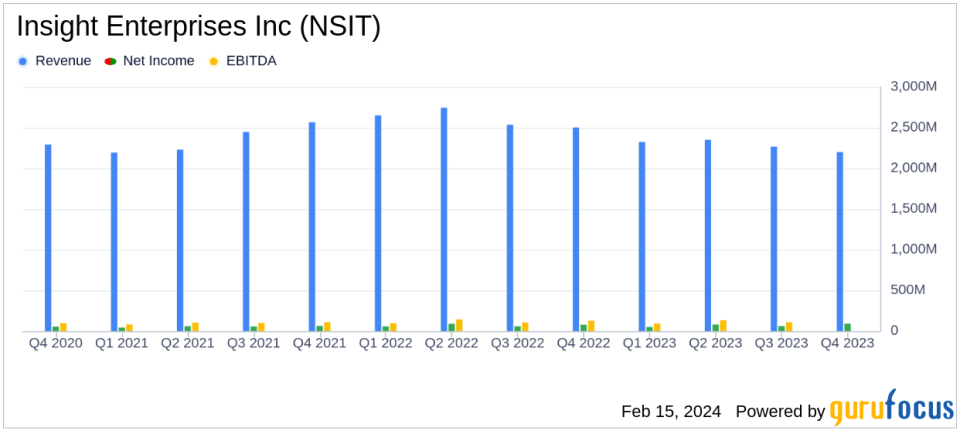

On February 15, 2024, Insight Enterprises Inc (NASDAQ:NSIT), a Fortune 500 global IT provider, released its 8-K filing, reporting its fourth quarter and full year results for the period ended December 31, 2023. Despite a challenging market environment, the company achieved record gross margins and demonstrated strong operational performance.

Insight Enterprises Inc operates across North America, EMEA, and APAC, with the North America segment being the largest revenue contributor. The company specializes in digital innovation, cloud/data center transformation, connected workforce, and supply chain optimization solutions and services.

Financial Performance and Challenges

The company faced a decline in net sales, which decreased by 11% in the fourth quarter and 12% for the full year compared to the previous year. This was primarily due to a decrease in hardware gross profit, which was offset by significant growth in cloud and services gross profit. The resilience in gross profit, which grew by 4% in Q4 and 2% for the full year, is particularly noteworthy as it contributed to the record gross margin of 19.5% in Q4 and 18.2% for the full year.

Insight Enterprises Inc's earnings from operations increased by 16% to $131.9 million in Q4 and by 1% to $419.8 million for the full year. Adjusted earnings from operations also saw a rise of 16% in Q4 and 5% for the full year. Diluted earnings per share (EPS) for Q4 increased by 14% to $2.42, although there was a slight decrease of 1% for the full year. Adjusted diluted EPS, however, reached a record $2.98 in Q4, up 18% year over year, and $9.69 for the full year, up 6%.

In the fourth quarter, we achieved gross profit growth of 4% and impressive adjusted diluted earnings per share growth of 18%, strengthened by acquisitions we made in the second half of the year," stated Joyce Mullen, President and Chief Executive Officer. "We continued to see strength in cloud and services gross profit, which offset a decline in gross profit from hardware," Mullen stated.

Key Financial Metrics

Insight Enterprises Inc's financial achievements are significant in the context of the hardware industry, which has been facing headwinds due to global supply chain issues and shifting technology demands. The company's ability to grow its gross profit and expand its gross margin in such an environment is indicative of its strong operational efficiency and strategic focus on high-margin service offerings.

Important metrics from the financial statements include the following:

Net sales in North America decreased by 14% to $1.8 billion in Q4.

Services net sales increased by 6% year over year in Q4.

Cloud gross profit grew by 43% year over year in Q4.

Cash flows from operating activities were robust at $205.8 million for Q4.

These metrics are crucial as they reflect the company's revenue generation capabilities, profitability from core operations, and cash flow health, which are all key considerations for value investors.

Looking Ahead

For the full year 2024, Insight Enterprises Inc expects adjusted diluted earnings per share to be between $10.50 and $10.80. The company anticipates gross profit growth in the mid to high teens and a gross margin of approximately 19%. However, operating expenses are expected to grow at a higher rate than gross profit.

The company's performance analysis suggests that while facing sales headwinds, Insight Enterprises Inc has managed to pivot effectively towards more profitable segments, such as cloud services. The record gross margins and strong cash flows highlight the company's resilience and adaptability in a rapidly evolving industry.

Insight Enterprises Inc's strategic shifts and operational focus have positioned it well to navigate future challenges and capitalize on growth opportunities within the IT solutions sector.

For more detailed information and analysis on Insight Enterprises Inc's financial performance, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Insight Enterprises Inc for further details.

This article first appeared on GuruFocus.