Insights into Sino Biopharmaceutical Ltd's Dividend Performance

An In-depth Analysis of the Company's Dividend History, Yield, Growth, and Sustainability

Sino Biopharmaceutical Ltd (SBHMY) has recently announced a dividend of $0.05 per share, payable on November 13, 2023. The ex-dividend date is set for October 4, 2023. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. This article, utilizing data from GuruFocus, offers an in-depth analysis of Sino Biopharmaceutical Ltd's dividend performance and its sustainability.

About Sino Biopharmaceutical Ltd

Warning! GuruFocus has detected 6 Warning Sign with SBHMY. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

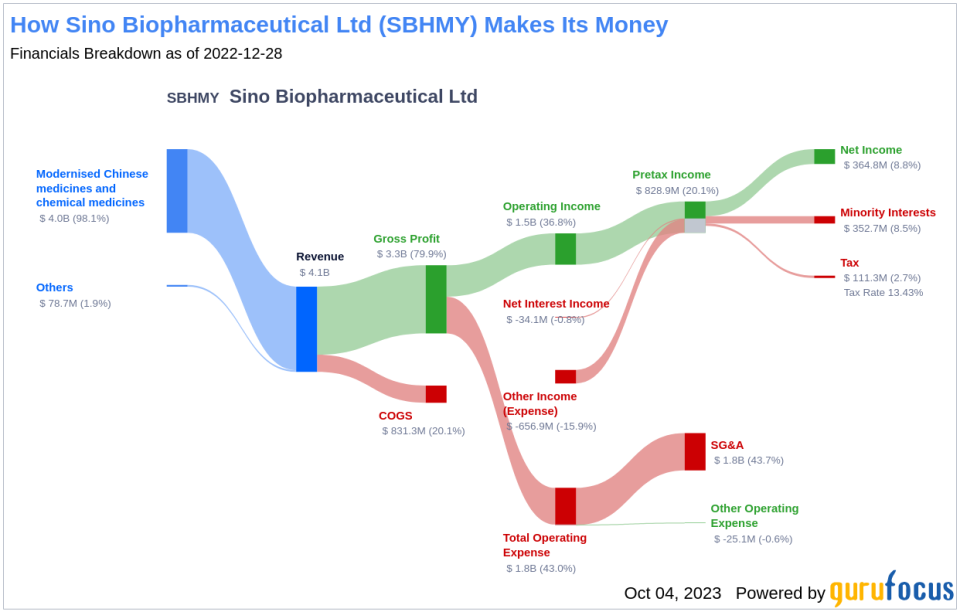

Sino Biopharmaceutical Ltd, one of China's largest drug manufacturers, generated a revenue of CNY 27 billion in 2021. The company's primary therapeutic areas include oncology, hepatitis, cardio-cerebral, and respiratory medicines. Despite facing severe price reductions for some key drugs, Sino Biopharmaceutical Ltd maintains a rich pipeline of early-to-market generics and biosimilars, particularly in oncology and respiratory treatments.

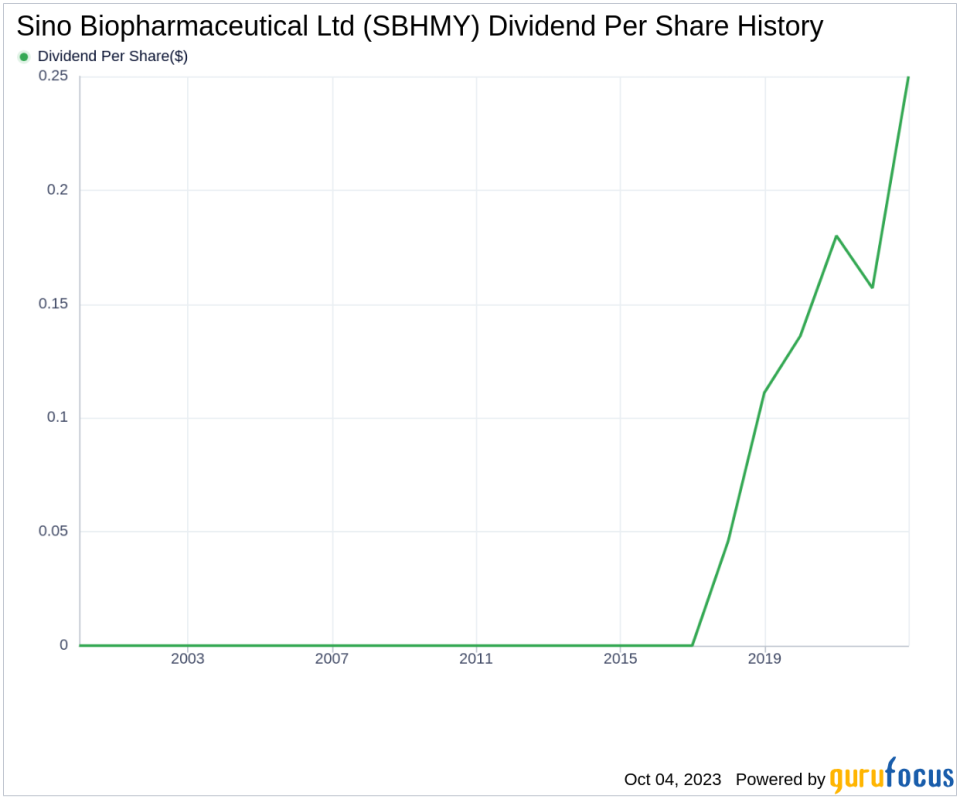

Sino Biopharmaceutical Ltd's Dividend History

Since 2017, Sino Biopharmaceutical Ltd has maintained a consistent dividend payment record, with dividends currently distributed on a quarterly basis. The chart below illustrates the annual Dividends Per Share for tracking historical trends.

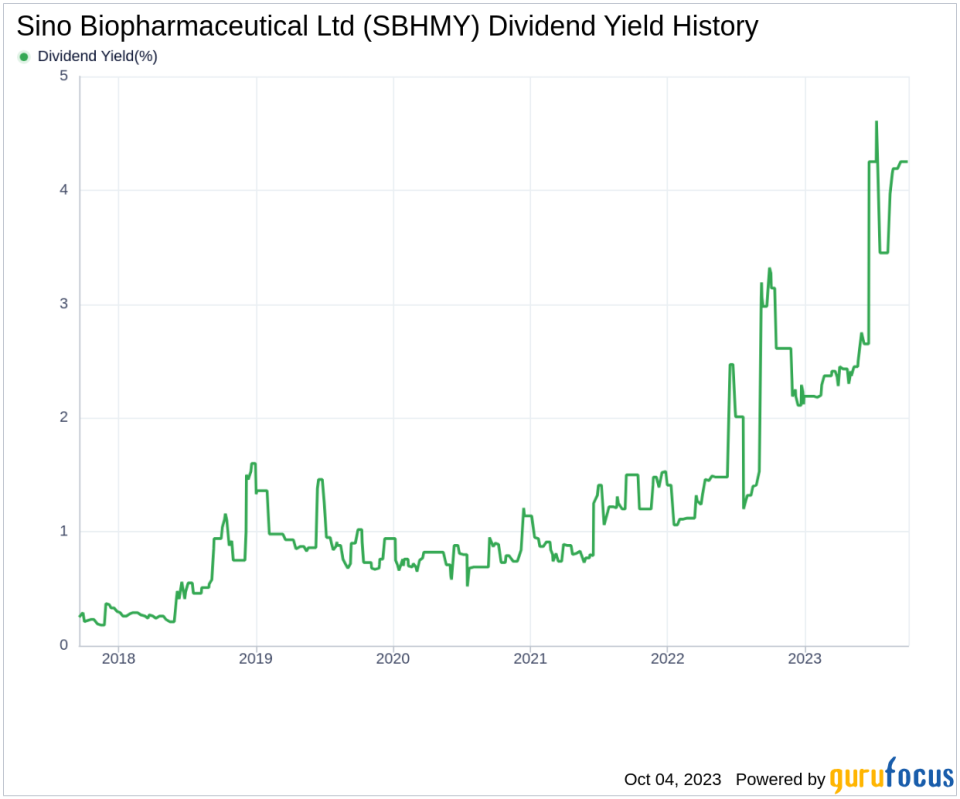

Dividend Yield and Growth of Sino Biopharmaceutical Ltd

As of today, Sino Biopharmaceutical Ltd has a 12-month trailing dividend yield of 4.24% and a 12-month forward dividend yield of 4.95%. This indicates an expectation of increased dividend payments over the next 12 months. The company's dividend yield of 4.24% is near a 10-year high, outperforming 87.14% of global competitors in the Biotechnology industry, making it an attractive proposition for income investors.

Over the past three years, Sino Biopharmaceutical Ltd's annual dividend growth rate was 34.30%. Extended to a five-year horizon, this rate decreased to 17.80% per year. However, over the past decade, the company's annual dividends per share growth rate stands at an impressive 19.80%. Based on the company's dividend yield and five-year growth rate, the 5-year yield on cost of Sino Biopharmaceutical Ltd stock as of today is approximately 9.62%.

Evaluating Dividend Sustainability

The sustainability of the dividend is evaluated by examining the company's payout ratio. The dividend payout ratio indicates the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, Sino Biopharmaceutical Ltd's dividend payout ratio is 1.12, which may suggest that the company's dividend may not be sustainable.

Sino Biopharmaceutical Ltd's profitability rank of 9 out of 10, as of June 30, 2023, suggests good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Future Growth Prospects

Sino Biopharmaceutical Ltd's growth rank of 9 out of 10 suggests a good growth trajectory relative to its competitors. However, the company's 3-year EPS growth rate and 5-year EBITDA growth rate underperform approximately 61.46% and 59.37% of global competitors, respectively. Despite this, the company's revenue has increased by approximately 5.60% per year on average, outperforming around 51.9% of global competitors.

Final Thoughts

While Sino Biopharmaceutical Ltd's dividend yield and growth rate are noteworthy, the sustainability of its dividend is a concern due to its high payout ratio. However, with strong profitability and a robust growth trajectory, the company may continue to be a viable investment option for income-focused investors. As always, potential investors should conduct thorough research and consider multiple factors before making an investment decision.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.