Insmed Inc's Meteoric Rise: Unpacking the 34% Surge in Just 3 Months

Insmed Inc (NASDAQ:INSM), a global biopharmaceutical company, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 34.26% over the past quarter, with a 20.96% gain in the past week alone. Currently, the stock is trading at $26.39, with a market cap of $3.79 billion. This impressive performance is worth a closer look.

Stock Performance and Valuation

Insmed's stock has shown a robust upward trend, with its GF Value currently standing at $30.39, compared to $31.08 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The company's current GF Valuation is 'Modestly Undervalued', a significant improvement from its past GF Valuation of 'Possible Value Trap, Think Twice'. This suggests that the stock's recent price surge is backed by its intrinsic value, making it an attractive investment opportunity.

About Insmed Inc

Insmed Inc operates in the biotechnology industry, focusing on transforming the lives of patients with serious and rare diseases. The company's first commercial product, ARIKAYCE, is approved in the US for the treatment of Mycobacterium Avium Complex (MAC) lung disease. Insmed's clinical pipeline includes Brensocatib and INS1009, promising treatments for non-cystic fibrosis bronchiectasis and pulmonary arterial hypertension, respectively.

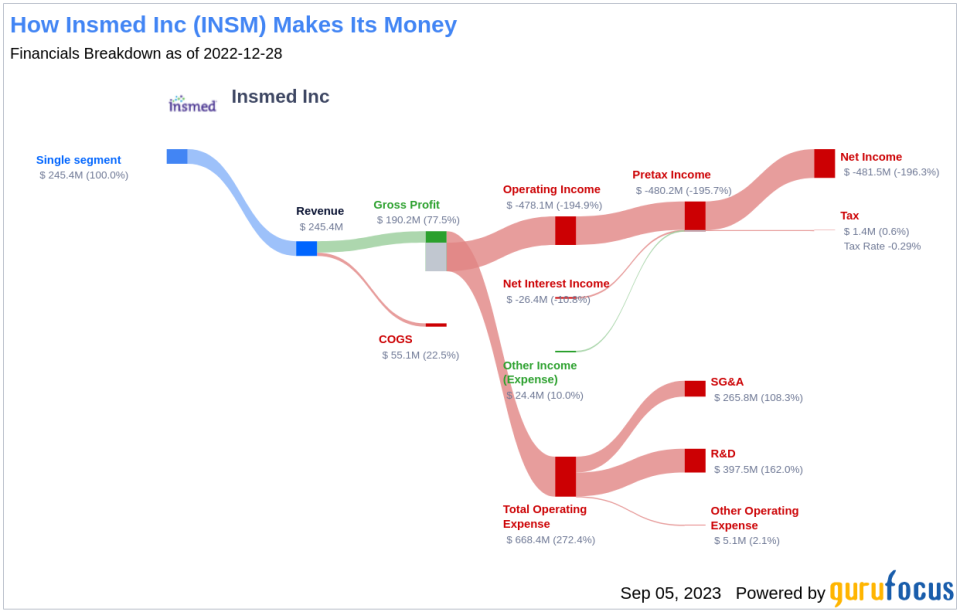

Profitability Analysis

Despite its impressive stock performance, Insmed's Profitability Rank stands at 1/10, indicating relatively low profitability compared to other companies. However, the company's Operating Margin of -243.22% is better than 46.5% of 1028 companies in the industry. Furthermore, its ROA of -52.23% and ROIC of -155.03% are better than 35.11% and 42.76% of companies, respectively. These figures suggest that while Insmed's profitability is low, it is performing relatively well within its industry.

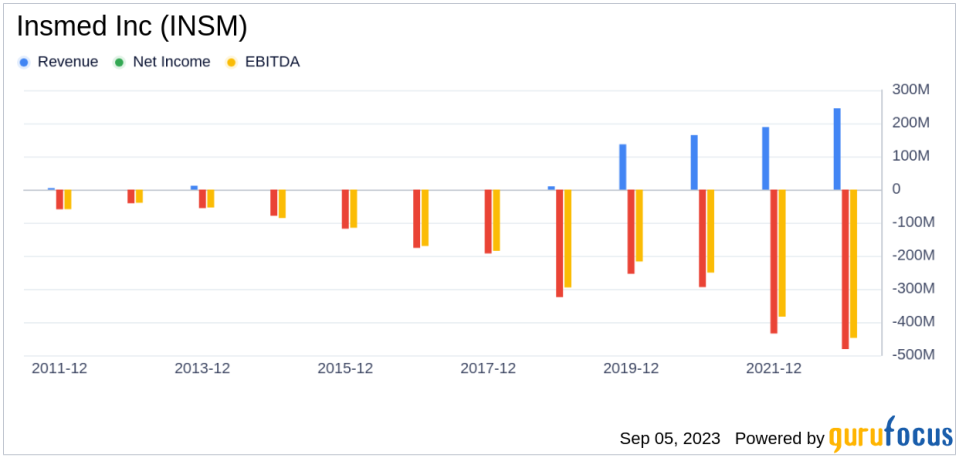

Growth Prospects

Insmed's growth prospects are promising, with a 3-Year Revenue Growth Rate per Share of 7.30%, better than 51.71% of 762 companies. The company's Total Revenue Growth Rate (Future 3Y To 5Y Est) stands at 22.50%, outperforming 78.29% of 129 companies. However, its 3-Year and 5-Year EPS without NRI Growth Rates of -9.10% and -3.70% are better than only 34.69% and 30.05% of companies, respectively. These figures suggest that while Insmed's revenue growth is strong, its earnings growth is lagging.

Major Holders and Competitors

Paul Tudor Jones (Trades, Portfolio) is the top holder of Insmed's stock, holding 39078 shares, accounting for 0.03% of the company's stock. Insmed's main competitors in the biotechnology industry include Denali Therapeutics Inc (NASDAQ:DNLI), Blueprint Medicines Corp (NASDAQ:BPMC), and MoonLake Immunotherapeutics (NASDAQ:MLTX), with market caps of $3.32 billion, $3.03 billion, and $2.81 billion, respectively.

Conclusion

In conclusion, Insmed Inc's stock performance has been impressive over the past three months, backed by its intrinsic value. While the company's profitability is relatively low, it is performing well within its industry. Its strong revenue growth and promising clinical pipeline suggest potential for future growth. However, investors should keep an eye on its earnings growth and competition in the biotechnology industry.

This article first appeared on GuruFocus.