Insmed (INSM): A Hidden Gem or Just Modestly Undervalued?

Insmed Inc (NASDAQ:INSM) has been making waves in the stock market with a daily gain of 16.48% and a 3-month gain of 35.77%. However, the company also reported a Loss Per Share of 5.25. This raises the question: Is the stock just modestly undervalued?

In this article, we will delve into the valuation analysis of Insmed (NASDAQ:INSM), providing you with insights to make informed investment decisions. So, let's get started.

Company Overview

Insmed Inc is a global biopharmaceutical company dedicated to transforming the lives of patients with serious and rare diseases. The company's first commercial product is ARIKAYCE, approved in the US for the treatment of Mycobacterium Avium Complex (MAC) lung disease. Insmed's clinical pipeline includes Brensocatib and INS1009, promising treatments for non-cystic fibrosis bronchiectasis and pulmonary arterial hypertension respectively.

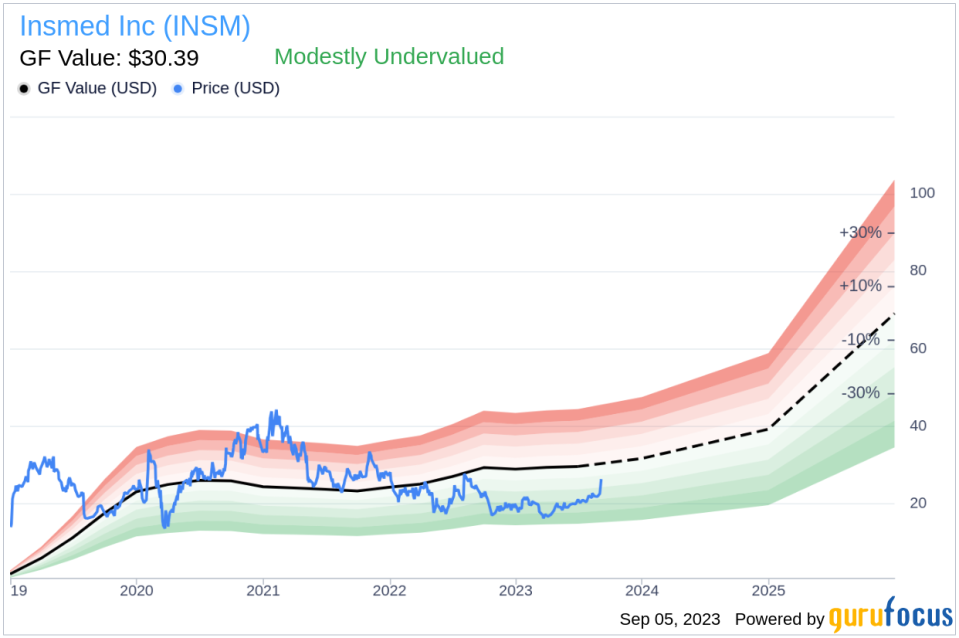

With a stock price of $26.37, the company has a market cap of $3.80 billion. However, the GF Value, an estimation of its fair value, is $30.39. This discrepancy suggests that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value represents the intrinsic value of a stock based on a unique method. It's calculated considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates.

Insmed (NASDAQ:INSM) appears to be modestly undervalued based on the GF Value. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

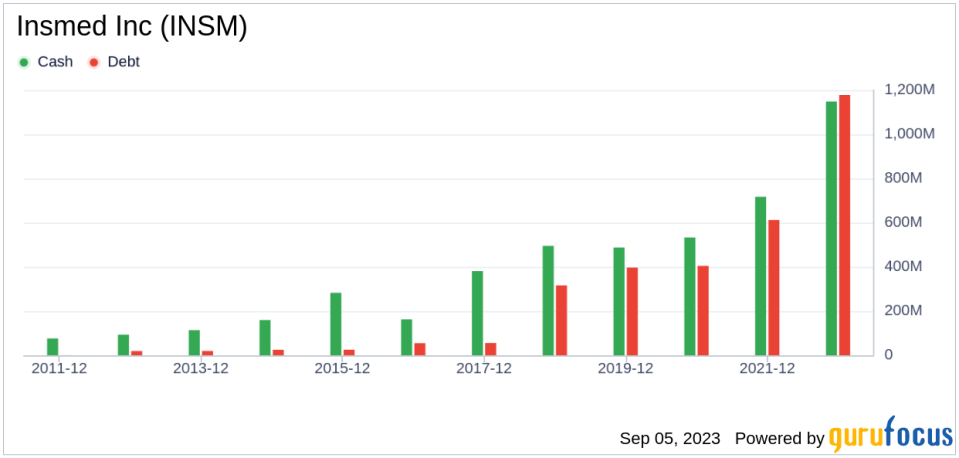

Investing in companies with poor financial strength can lead to a higher risk of permanent loss of capital. Insmed's cash-to-debt ratio of 0.77 is worse than 82.28% of companies in the Biotechnology industry, indicating poor financial strength.

Profitability and Growth

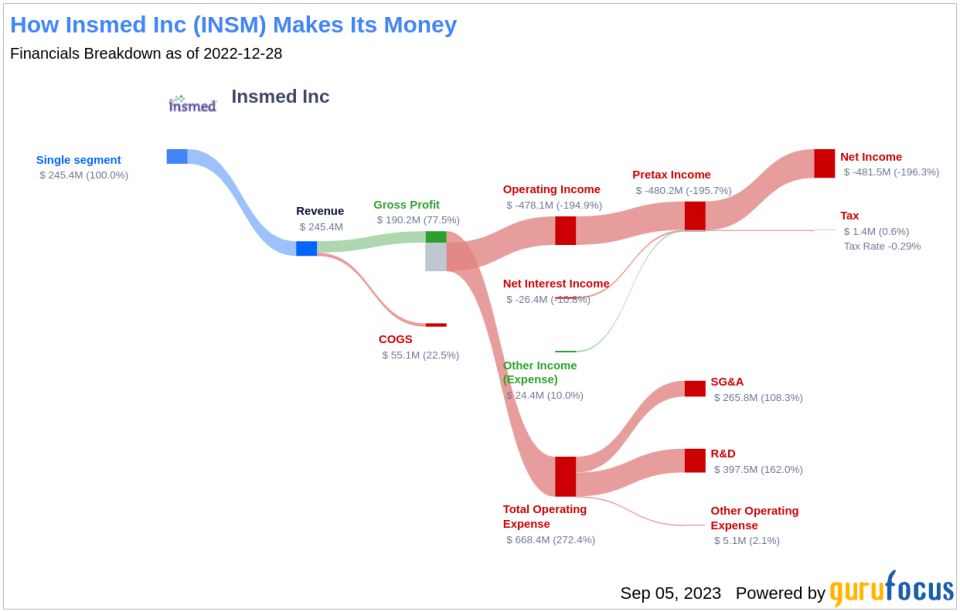

Profitable companies are generally safer investments. However, Insmed's profitability is poor, with an operating margin of -243.22%. The company's growth also ranks worse than 69.27% of companies in the Biotechnology industry.

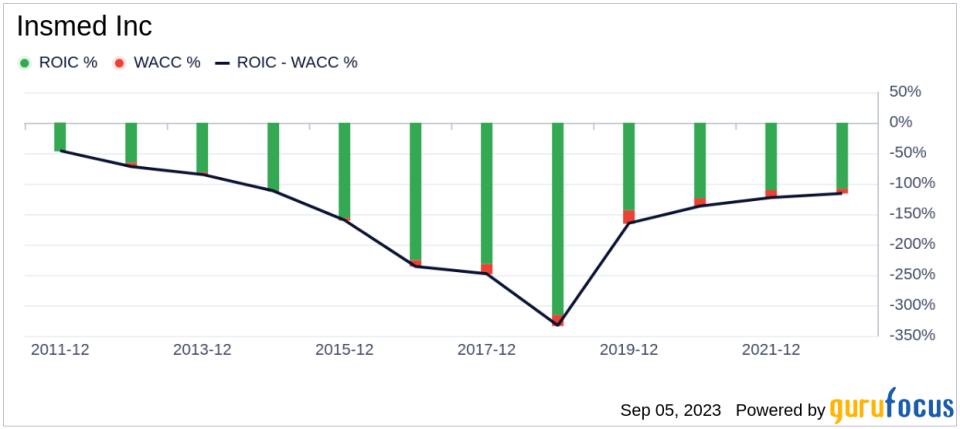

ROIC vs WACC

Insmed's return on invested capital (ROIC) of -155.03 is significantly lower than its weighted average cost of capital (WACC) of 5.59, indicating the company may not be creating value for its shareholders.

Conclusion

While Insmed (NASDAQ:INSM) appears to be modestly undervalued, it's crucial to consider its poor financial condition and profitability, as well as its below-average growth. For further details on Insmed's financials, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.