Insperity (NSP) Benefits From Its Presence in PEO Industry

Insperity, Inc. NSP gains from an increase in the average number of worksite employees paid per month. The strong liquidity position bodes well for the company. The increasing expenses are pressuring the bottom line.

Insperity, Inc. reported solid first-quarter 2023 results, wherein earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 22 cents from non-recurring items) of $2.67 per share outpaced the consensus estimate by 7.7% and rose more than 34.2% year over year. Revenues of $1.77 billion surpassed the consensus mark by 0.8%. Revenues increased 12.2% year over year. The upside was backed by an increase in the paid average number of worksite employees (WSEE). The average number of WSEEs paid per month was 306,691, which increased 10.1% year over year.

Current Situation of Insperity

Insperity gains from the growing professional employer organization (“PEO”) industry. The industry currently grows on the back of the increased need of providing employee benefits, increased costs related to workers’ compensation insurance coverage, workplace safety programs, employee-related complaints and litigation, complex regulation of payroll and payroll tax among other things.

The company’s continuous efforts to reward its shareholders are praiseworthy. During 2022 and 2021, the company repurchased 770,000 shares and 716,000 shares for $73 million and $69.7 million, respectively, and paid out dividends totaling $77 million and $144.2 million.

Insperity’s current ratio at the end of first-quarter 2023 was pegged at 1.17, higher than the current ratio of 1.11 reported at the end of the prior-year quarter. This figure indicates that the company might not face any difficulties in meeting its short-term debt obligations.

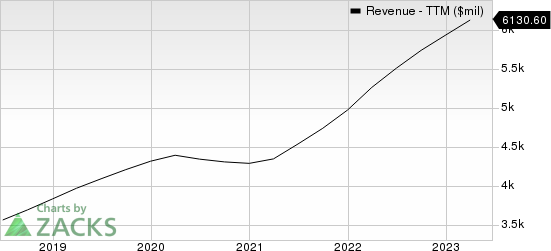

Insperity, Inc. Revenue (TTM)

Insperity, Inc. revenue-ttm | Insperity, Inc. Quote

The increasing expenses dented the bottom line. Higher expenses can be associated with the rising investment in growth, technology and product and service offerings. During 2022, adjusted operating expenses of $760.99 million increased 17.7% year over year.

Zacks Rank and Stocks to Consider

NSP currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can also consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 2.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently sports a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Insperity, Inc. (NSP) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report