Insperity (NSP) Surges 20% in 3 Months: Here's What to Know

Insperity, Inc. NSP shares have gained an impressive 19.8% in the past three months, outperforming the 17.4% rally of the industry it belongs to and the 10.9% rise of the Zacks S&P 500 composite.

What’s Behind the Rally

NSP put on an impressive earnings performance in the past four quarters. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 16%.

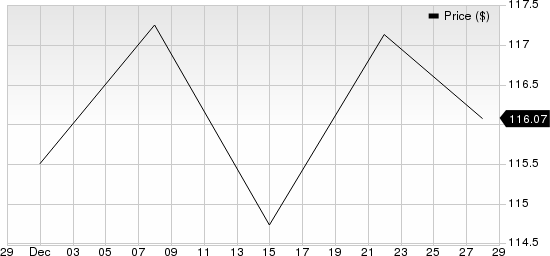

Insperity, Inc. Price

Insperity, Inc. price | Insperity, Inc. Quote

Insperity looks strong on the back of a growing PEO industry, which is currently being driven by the growth of small and medium-sized businesses, increased costs related to workers’ compensation insurance coverage, workplace safety programs, employee-related complaints, and litigation, complex regulation of payroll, payroll tax and employment issues.

Insperity is a comprehensive human resources and business solutions provider, offering a wide range of HR services through PEO services known as Workforce Optimization and Workforce Synchronization solutions. The company's diversified revenue base not only ensures consistent revenue growth but also provides a safeguard against market risks. Its revenues increased 7.8% year over year in the third quarter of 2023.

Commitment to shareholder returns makes NSP a reliable way for investors to compound wealth over the long term. During fiscal 2023, 2022 and 2021, the company paid cash dividends of $76.6 million, $144.2 million and $61.9 million, respectively.

Zacks Rank and Stocks to Consider

Insperity currently carries a Zacks Rank #3 (Hold).

Investors can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank #2. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report