Inspira (IINN) Expands in Life Support Space With New Deal

Inspira Technologies OXY IINN has announced a partnership with Ennocure MedTech, a player in the field of bio-electronic wound dressing. This collaboration aims to integrate bio-electronic technology into Inspira's INSPIRA ART, a cutting-edge approach to oxygenating blood directly to replace traditional mechanical ventilation.

Financial terms of the deal have not been disclosed.

Addressing Unmet Needs of Bloodstream Infection Care

This collaboration particularly aims to address a persistent global healthcare challenge, with an estimated 250,000 bloodstream infections linked to intravenous lines annually. These infections not only result in prolonged hospital stays but also increase healthcare costs significantly.

Inspira's plan is to incorporate Ennocure's bio-electronic technology into its INSPIRA ART, creating a preventive approach to reduce complications and combat bloodstream infections.

Strategic Implications

According to Inspira, the integration of its technology to oxygenate blood combined with Ennocure's infection prevention solutions will help the company improve patient outcomes in ICUs. This will, therefore, pave the way for safer and more effective life support treatments.

Image Source: Zacks Investment Research

Market Prospects

Going by a Data Bridge Market Research report, the global life support equipment market, valued at $4.25 billion in 2022, is projected to reach $6.96 billion by 2030, at a CAGR of 7.20%. Dominated by hospitals, the market's growth will be fueled by technological advancements, increasing healthcare expenditure and a rise in chronic diseases. Factors such as continuous innovation, improving healthcare infrastructure, and strategic collaborations are likely to further expand opportunities in this vital healthcare sector.

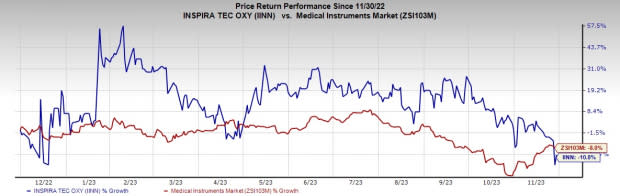

Share Price Performance

Over the past year, shares of IINN have lost 10.8% compared with the industry’s 8% decline.

Zacks Rank and Key Picks

Inspira currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares have plunged 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 for 2023 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it came up with an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have lost 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Inspira Technologies OXY B.H.N. Ltd. (IINN) : Free Stock Analysis Report