Inspire Medical (INSP) Hits 52-Week High: What's Aiding It?

Shares of Inspire Medical Systems, Inc. INSP scaled a new 52-week high of $323.23 on Jun 23, 2023, before closing the session at $315.08.

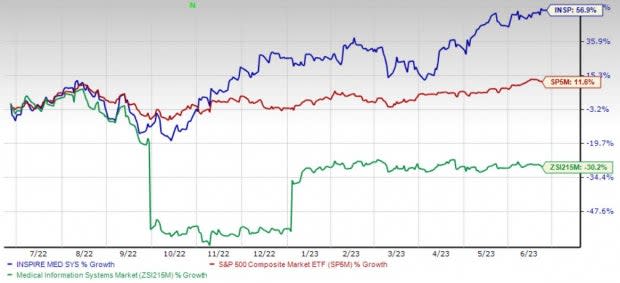

Over the past year, this Zacks Rank #3 (Hold) stock has gained 56.8% against the 30.3% decline of the industry. The S&P 500 has witnessed 11.5% growth in the said time frame.

The company’s projected earnings per share growth rate of 26.1% compares with the industry’s growth projection of 17.1%. Inspire Medical’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 43.3%.

Image Source: Zacks Investment Research

Inspire Medical is witnessing an upward trend in its stock price, prompted by its global presence. The optimism led by a solid first-quarter 2023 performance and receipt of a few regulatory approvals are expected to contribute further. However, threats from stiff competition and overdependence on Inspire System persist.

Let’s delve deeper.

Key Growth Drivers

Global Presence: Investors are upbeat about Inspire Medical’s solid revenues from its two geographic regions, the United States and outside of the United States. In the first quarter of 2023, U.S. revenues and revenues from outside the United States reflected an increase of 87% and 15%, respectively, from the year-ago quarter on a reported basis.

During the quarter, Inspire Medical activated 68 new U.S. centers, thus bringing the total to 973 U.S. medical centers providing Inspire therapy. The company also created 17 new U.S. sales territories in the quarter, bringing the total to 242 U.S. sales territories.

Regulatory Approvals: Investors are optimistic about Inspire Medical’s receipt of a slew of FDA approvals over the past few months. This month, the company received the FDA’s approval on an expanded indication. The update includes an increase on the upper limit of the Apnea Hypopnea Index to 100 events per hour from 65 and raises the Body Mass Index warning in the labeling to 40 from 32.

In March, the company received the FDA’s approval to offer Inspire therapy to pediatric patients with Down syndrome.

Strong Q1 Results: Inspire Medical’s impressive first-quarter 2023 results buoy optimism. The company saw a robust improvement in its top line and strength in year-over-year geographic results. Management’s expectations of activating more U.S. medical centers and adding new U.S. sales territories during each quarter of 2023 also raise optimism about the stock.

Downsides

Overdependence on Inspire System: Sales of Inspire Medical’s Inspire system accounts for primarily all its revenues. Management expects that sales of the Inspire systems will continue to account for the substantial majority of the company’s revenues going forward. Inspire Medical’s ability to execute its growth strategy and become profitable will, therefore, depend upon the adoption of the Inspire therapy by patients, physicians and sleep centers, among others, to treat moderate to severe obstructive sleep apnea (OSA) in patients who cannot use or get consistent benefit from continuous positive airway pressure.

Stiff Competition: The medical technology industry is highly competitive, subject to change and significantly affected by new product introductions and other activities of industry participants. Inspire Medical’s competitors have historically dedicated and will continue to dedicate significant resources to promote their products or develop new products or methods to treat moderate to severe OSA.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 13.9% compared with the industry’s 9.3% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 49.7% compared with the industry’s 15.8% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 42.7% against the industry’s 23.8% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report