Installed Building (IBP) Acquires Interior 2000 & R-Pro

Installed Building Products, Inc. IBP has solidified its standing as an industry-leading installer of insulation and complementary building products with two recent strategic acquisitions. The company welcomed Interior 2000 Products, LLC and R-Pro Select, LLC into its portfolio, fortifying its market presence and revenue streams.

Interior 2000 Products, LLC, based in Richmond, VA, brings to IBP a wealth of experience dating back to 1999. The company specializes in installing showers, shelving, mirror products, and fireplaces in both residential and commercial construction projects throughout the greater Richmond area. This acquisition not only enhances IBP's footprint in this key market but also injects nearly $6 million in annual revenues into the company's coffers. Moreover, it seamlessly complements IBP's existing residential insulation installation branch.

On Aug 6, IBP completed the acquisition of R-Pro Select, LLC, headquartered in Fletcher, NC. R-Pro is a recognized installer of fiberglass, spray foam, cellulose insulation, and fireplaces, catering primarily to residential customers in Asheville, Hendersonville, and the surrounding communities of Western North Carolina. This strategic move further strengthens IBP's presence in the Western North Carolina region, opening up exciting growth opportunities.

Acquisitions: A Major Growth Driver

These acquisitions are part of IBP's overarching growth strategy, which hinges on strategic expansion through acquisitions. So far this year, IBP has added more than $55 million in annual revenues to its portfolio through these buyouts. These acquisitions underscore IBP's commitment to diversifying its offerings and extending its reach across multiple geographies, products, and end markets. It expects to acquire at least $100 million of revenues for 2023.

With a robust pipeline of opportunities on the horizon, IBP is well-positioned to continue its upward trajectory in the coming years. As the company deepens its roots in key markets and broadens its product offerings, shareholders can look forward to a promising future with Installed Building Products.

The diverse end-market mix has provided crucial support for IBP’s sales performance in the second quarter of 2023. Although it saw a decrease in installation projects in the single-family segment compared to the same period last year, it was partially counterbalanced by growth in commercial and multi-family sales.

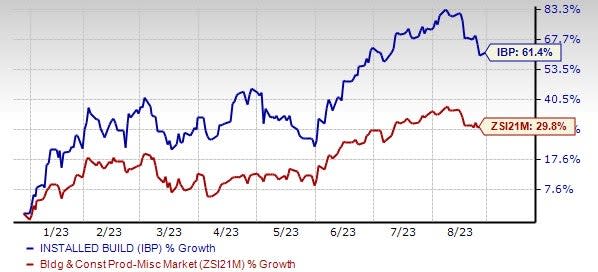

Image Source: Zacks Investment Research

Shares of this residential insulation installer have gained 61.4% year to date (YTD) compared with the Zacks Building Products - Miscellaneous industry’s 29.8% rise. We believe that IBP offers a sound investment opportunity, as evidenced by its VGM Score of A.

Zacks Rank & Key Picks

Currently, IBP carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Zacks Construction sector are:

Sterling Infrastructure, Inc. STRL provides transportation, e-infrastructure and building solutions. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $4.09 per share from $3.52 in the past 30 days.

Shares of STRL have gained 141.4% YTD. STRL’s expected earnings growth rate for 2023 is 29.4% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Willdan Group WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry. Shares of WLDN have gained 36.7% YTD.

Willdan Group presently flaunts a Zacks Rank #1. WLDN’s expected earnings growth rate for 2023 is 50%. The Zacks Consensus Estimate for WLDN’s 2023 earnings has moved north to $1.32 per share from $1.25 in the past 30 days.

Fluor Corporation FLR benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate.

FLR presently sports a Zacks Rank #1. Shares of FLR have lost 0.5% YTD. Nonetheless, its expected earnings growth rate for 2023 is 141.5%. The Zacks Consensus Estimate for FLR’s 2023 earnings has moved north to $1.98 per share from $1.74 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report