Installed Building (IBP) Looks Promising: Invest in the Stock

Installed Building Products, Inc. IBP is poised to gain from the strong end-market demand and proficient acquisition strategies. Also, its national scale and diverse product categories and end markets are added to the positives.

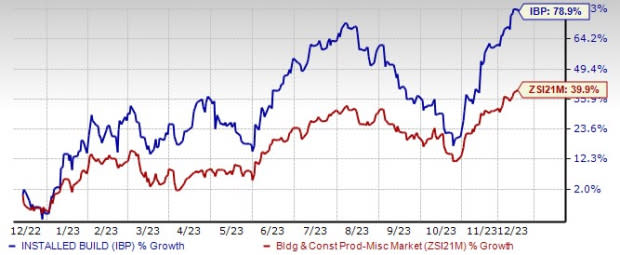

Shares of this residential insulation installer have gained 78.9% over the past year compared with the Zacks Building Products - Miscellaneous industry’s 39.9% rise. Also, the 2024 earnings per share estimates for this Zacks Rank #2 (Buy) company have moved 2% upward over the past 30 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term. The estimated figure indicates 6% year-over-year growth for 2024.

We believe that IBP offers a sound investment opportunity, as evidenced by its VGM Score of A. Our research shows that stocks with a VGM Score of A or B, along with Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities to investors.

Image Source: Zacks Investment Research

Let us delve deeper into other factors that make this stock a profitable pick.

What Makes the Stock an Attractive Pick?

Inorganic Moves: Acquisitions are an important part of Installed Building Products’ growth strategy. This led to the diversification of its geographies, end markets and products. The company maintains a robust pipeline of acquisition candidates that considers the geographic expansion in the core residential insulation end market and acquisition opportunities that continue end-market and end-product diversification strategies.

Recently, IBP strengthened its market presence with the acquisition of Combee Insulation Company, Inc., Combee Foam Products, Inc., and Air Tight Diagnostics, LLC. This move, in line with IBP's growth strategy, significantly expands its footprint in Central Florida, catering to single-family, multifamily, and commercial customers. IBP's 2023 acquisition spree, totaling around $75 million in annual revenues, showcases its commitment to sustained growth.

Higher Return on Equity (ROE): Installed Building Products’ trailing 12-month ROE is indicative of its growth potential. ROE for the trailing 12 months is 49.8%, much higher than the industry’s 11.2%, reflecting the company’s efficient usage of shareholders’ funds.

Higher Market Demand: The company has been capitalizing on the strong end-market demand and the continued success of local branches, which prudently align selling prices with the value IBP offers its customers. Although interest rates continue to increase from historically low levels, the company remains optimistic, given the strong demand for installation services. IBP has been gaining from the continued benefits of its product, end-market and geographic diversification strategies, as softer single-family sales were partially offset by the continuation of robust sales growth in its multi-family end market.

Other Top-Ranked Construction Stocks Hogging in the Limelight

EMCOR Group, Inc. EME currently sports a Zacks Rank of 1. Shares of the company have risen 23.3% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 25%, on average. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 12% and 52.8%, respectively, from the previous year’s reported levels.

Acuity Brands, Inc. AYI currently carries a Zacks Rank of 2. AYI delivered a trailing four-quarter earnings surprise of 12%, on average.

The stock has gained 13.6% in the past six months. The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and EPS indicates a decline of 3% and 4.7%, respectively, from a year ago.

Armstrong World Industries AWI currently carries a Zacks Rank #2. AWI delivered a trailing four-quarter earnings surprise of 7.9%, on average.

Shares of the company have gained 36.1% in the past six months. The Zacks Consensus Estimate for AWI’s 2023 sales and EPS indicates growth of 4.7% and 8.2%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report