Installed Building Products Inc Reports Record Q4 and Fiscal Year 2023 Results

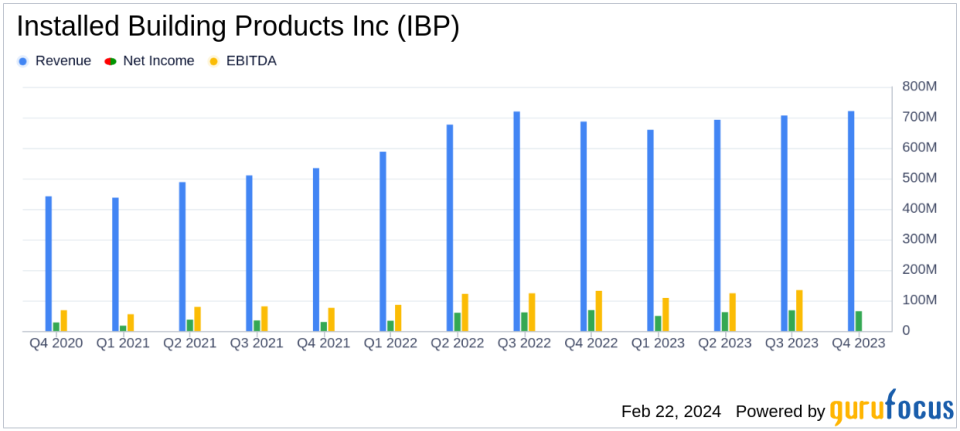

Net Revenue: Increased by 5.0% to a record $720.7 million in Q4 2023.

Net Income: Reported at $64.9 million, translating to $2.29 per diluted share.

Adjusted EBITDA: Rose to $128.3 million, showcasing operational efficiency.

Dividends: Declared Q4 dividend of $0.33 per share; increased regular quarterly cash dividend by 6% to $0.35 per share for Q1 2024.

Share Repurchases: Repurchased 42,486 shares; authorized a new $300 million stock repurchase program.

Acquisitions: Completed eight acquisitions in 2023, adding approximately $75 million in annual revenue.

Liquidity: Strong position with $386.5 million in cash and cash equivalents as of December 31, 2023.

Installed Building Products Inc (NYSE:IBP) released its 8-K filing on February 22, 2024, detailing a robust financial performance for the fourth quarter and the fiscal year ended December 31, 2023. The company, a leading installer of insulation and complementary building products in the residential new construction market, has demonstrated resilience and strategic growth despite market headwinds.

Financial Performance Highlights

IBP's net revenue for Q4 2023 reached a record high of $720.7 million, a 5.0% increase from the previous year, driven by growth in multi-family and commercial sales, including contributions from recent acquisitions. This growth helped offset softer single-family sales. The company's net income stood at $64.9 million, or $2.29 per diluted share, with adjusted net income climbing to $77.3 million, or $2.72 per diluted share, marking an 11.9% increase in adjusted earnings per share.

For the full fiscal year 2023, IBP reported record net revenue of $2.8 billion, up 4.1% from 2022. The company's net income for the year was $243.7 million, or $8.61 per diluted share, with an adjusted net income of $290.8 million, or $10.27 per diluted share. These results reflect IBP's ability to navigate a challenging market environment effectively.

Strategic Developments and Capital Allocation

IBP's Chairman and Chief Executive Officer, Jeff Edwards, highlighted the company's strategic investments and shareholder returns. In 2023, IBP invested approximately $60 million in acquisitions and returned nearly $70 million to shareholders through dividends and share repurchases. Edwards emphasized the company's strong liquidity position and commitment to pursuing accretive acquisitions as a top priority within its capital allocation strategy.

"IBP improved both sales and profitability in the fourth quarter, helping the Company achieve another year of record financial results including record revenue, net income, and adjusted EBITDA. I am proud of IBPs performance in 2023, as healthy sales in our multi-family and commercial end-markets offset softer single-family sales throughout the year," stated Jeff Edwards.

Looking ahead, Edwards expressed confidence in the resilience of the residential housing construction activity and the continued demand for IBP's services in 2024.

Operational Efficiency and Market Adaptation

IBP's operational efficiency is evident in its improved gross profit, which rose 13.0% to $245.7 million in Q4 2023, with gross profit margins increasing to 34.1% from 31.7% in the prior year period. Adjusted EBITDA margins also expanded, reflecting the company's ability to optimize value and manage costs effectively.

The company's balance sheet remains strong, with $386.5 million in cash and cash equivalents. Net cash provided by operating activities for the full year was $340.2 million, up from $277.9 million in the prior year, underscoring IBP's solid cash flow generation capabilities.

Conclusion

Installed Building Products Inc's record performance in Q4 and the fiscal year 2023 showcases the company's strategic growth initiatives and operational excellence. With a robust balance sheet, disciplined capital allocation, and a positive outlook for the construction industry, IBP is well-positioned to continue delivering value to its shareholders and customers.

For more detailed information on Installed Building Products Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Installed Building Products Inc for further details.

This article first appeared on GuruFocus.