Insteel Industries Inc (IIIN) Faces Headwinds in Q1 2024 with Net Earnings and Sales Decline

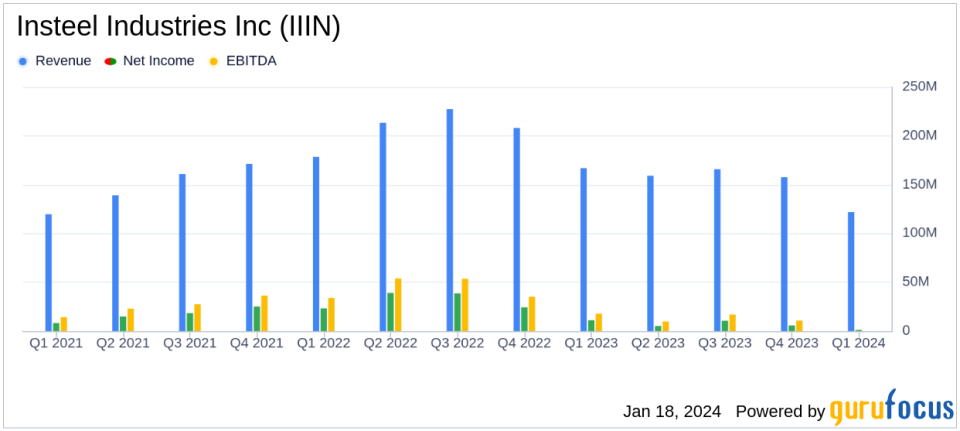

Net Earnings: Decreased to $1.1 million, or $0.06 per share, compared to $11.1 million, or $0.57 per share in Q1 2023.

Net Sales: Dropped by 27.1% to $121.7 million from $166.9 million in the prior year quarter.

Gross Margin: Narrowed to 5.2% from 10.7% in the prior year quarter.

Capital Expenditures: Increased to $12.3 million from $8.2 million in the prior year quarter.

Cash and Cash Equivalents: Ended the quarter with $85.6 million, a decrease from $125.7 million at the end of the previous fiscal year.

Dividends: Paid a special cash dividend of $2.50 per share and a regular quarterly dividend of $0.03 per share.

On January 18, 2024, Insteel Industries Inc (NYSE:IIIN) released its 8-K filing, reporting the financial results for the first quarter of fiscal 2024 ended December 30, 2023. The company, which is the largest manufacturer of steel wire reinforcing products for concrete construction applications in the United States, faced significant headwinds during the quarter.

Insteel Industries Inc (NYSE:IIIN) reported a notable decrease in net earnings to $1.1 million, or $0.06 per share, from $11.1 million, or $0.57 per share, in the same period a year ago. This decline was partly due to a $3.3 million gain on the sale of property, plant, and equipment included in the prior year's earnings. The company's performance was adversely affected by the narrowing of spreads between selling prices and raw material costs, as well as increased unit manufacturing costs due to lower production levels.

Net sales saw a significant reduction, falling 27.1% to $121.7 million from $166.9 million in the prior year quarter, primarily driven by a decrease in average selling prices. Shipment volume remained essentially unchanged, indicating that the sales decline was not due to a reduction in the quantity of goods sold but rather price pressures. The company's gross margin also suffered, narrowing to 5.2% from 10.7% in the prior year quarter, further reflecting the impact of reduced selling prices and higher operating costs.

Financial Position and Capital Allocation

Despite the challenges faced in the first quarter, Insteel Industries Inc (NYSE:IIIN) generated $21.8 million of cash from operating activities, although this was a decrease from $33.0 million in the prior year. The reduction in receivables and inventories provided $16.3 million in working capital during the current quarter. Capital expenditures for the quarter increased to $12.3 million from $8.2 million in the prior year quarter, with the company planning to invest up to approximately $30.0 million for the fiscal year 2024, focusing on modernizing facilities and advancing growth initiatives.

The company also returned value to shareholders by paying a special cash dividend totaling $48.6 million, or $2.50 per share, in addition to its regular quarterly cash dividend of $0.03 per share. At the end of the quarter, Insteel had $85.6 million in cash and cash equivalents and no borrowings outstanding on its $100.0 million revolving credit facility.

Outlook and Management Commentary

Despite the difficult first quarter, H.O. Woltz III, Insteels President and CEO, expressed optimism about the remainder of fiscal 2024.

With pricing turning upward and inventory liquidations substantially complete, we believe that we are past some of the headwinds that adversely affected results during 2023 and the first quarter of 2024,"

Woltz commented. He also highlighted positive customer sentiment and an improving macroeconomic outlook, including potential increased demand from the Infrastructure Investment and Jobs Act.

Insteel Industries Inc (NYSE:IIIN) remains focused on navigating market conditions, strengthening its leadership positions, and optimizing operations for long-term success. The company will hold a conference call to discuss its first quarter financial results and provide further insights into its performance and strategies.

For value investors and potential GuruFocus.com members, Insteel Industries Inc (NYSE:IIIN) presents a case of resilience amidst market challenges, with a strong focus on capital allocation and strategic investments poised to capitalize on future market improvements.

Explore the complete 8-K earnings release (here) from Insteel Industries Inc for further details.

This article first appeared on GuruFocus.