Institutional Venture Management XIII, LLC Trims Stake in The Honest Co Inc

Overview of Institutional Venture Management XIII, LLC (Trades, Portfolio)'s Recent Trade

In a notable move within the investment community, Institutional Venture Management XIII, LLC (Trades, Portfolio) has reduced its holdings in The Honest Co Inc (NASDAQ:HNST). This transaction, which took place on November 16, 2023, saw the firm decrease its stake in the company, signaling a shift in its investment strategy regarding this particular stock. The Honest Co Inc, known for its eco-friendly products, has been a part of Institutional Venture Management XIII, LLC (Trades, Portfolio)'s portfolio, and this reduction marks a change in the firm's position.

Details of the Transaction

The trade involved Institutional Venture Management XIII, LLC (Trades, Portfolio) selling off 361,034 shares of The Honest Co Inc, which resulted in a -3.68% change in the firm's holdings. This adjustment had a -1% impact on the portfolio, with the shares being traded at a price of $1.50 each. After the transaction, Institutional Venture Management XIII, LLC (Trades, Portfolio) still holds 9,441,149 shares of The Honest Co Inc, which constitutes 26.41% of its portfolio and 9.89% of the company's outstanding shares.

Profile of Institutional Venture Management XIII, LLC (Trades, Portfolio)

Institutional Venture Management XIII, LLC (Trades, Portfolio), based in Menlo Park, California, operates with a distinct investment philosophy. With a portfolio that includes top holdings such as LegalZoom.com Inc (NASDAQ:LZ), The Honest Co Inc (NASDAQ:HNST), and Inspirato Inc (NASDAQ:ISPO), the firm has a significant presence in the Industrials and Consumer Defensive sectors. The firm's equity stands at $54 million, reflecting its substantial investment activities and market influence.

Introduction to The Honest Co Inc

The Honest Co Inc, with the stock symbol HNST, is a USA-based company that went public on May 5, 2021. It operates as a digitally-native consumer products company, focusing on creating eco-friendly products for a broad consumer base. The company's offerings are spread across three main segments: Diapers and Wipes, Household and Wellness, and Skin and Personal Care, with the majority of its revenue stemming from the Diapers and Wipes segment. Despite being a relatively new entrant to the market, The Honest Co Inc has established a significant presence in the United States.

Financial and Market Analysis of The Honest Co Inc

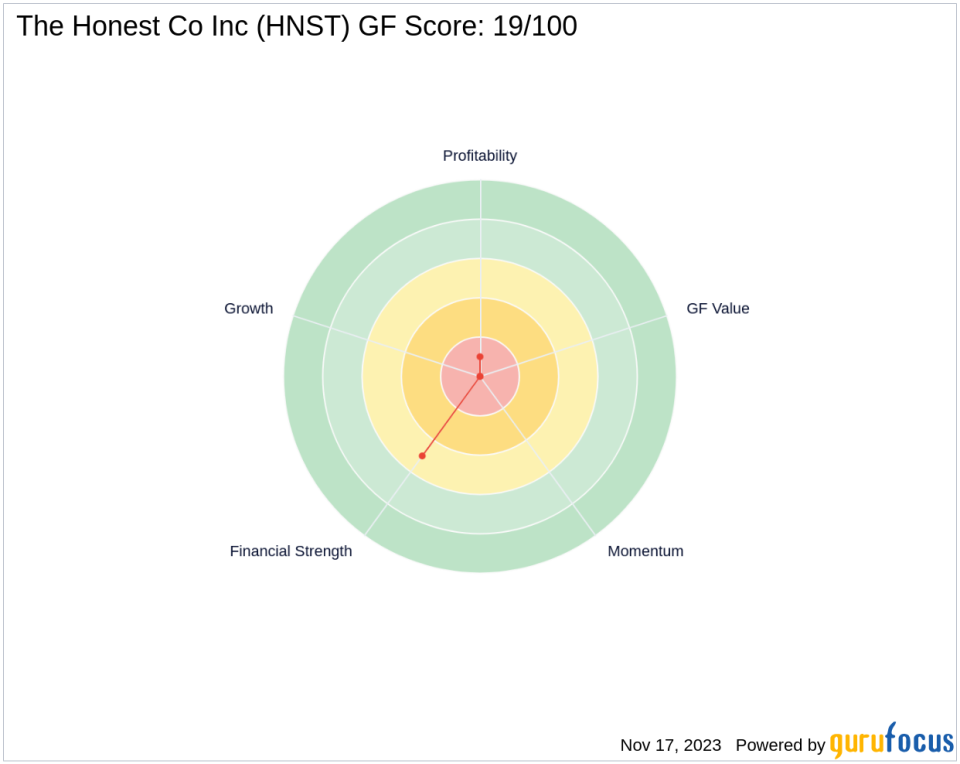

The Honest Co Inc currently has a market capitalization of $135.566 million, with a stock price of $1.42. The company's performance metrics present a challenging picture, with a PE Percentage of 0.00, indicating that it is operating at a loss. The GF Score stands at 19/100, suggesting a low potential for future performance. The stock's ranks in areas such as Profitability, Growth, and Momentum are also less than ideal, reflecting the company's current challenges.

Performance Indicators and Fundamental Health

Since its IPO, The Honest Co Inc's stock has declined by -93.31%, with a year-to-date drop of -51.37%. The company's fundamental health, as indicated by its balance sheet and a cash to debt ratio of 0.73, shows some resilience. However, the Piotroski F-Score of 3 and an Altman Z score of -0.87 raise concerns about the company's financial stability and operating efficiency.

Market Reaction and Future Outlook

The market's reaction to The Honest Co Inc has been tepid, with RSI indicators showing moderate momentum. The stock's future performance potential, based on the GF Score and other financial metrics, remains uncertain. Investors and analysts will be closely monitoring the company's ability to turn around its performance and deliver on its growth potential.

Transaction Analysis and Impact

The recent reduction by Institutional Venture Management XIII, LLC (Trades, Portfolio) in its stake in The Honest Co Inc has likely been influenced by the company's underwhelming financial and market performance indicators. This move could signal a lack of confidence in the stock's short-term growth prospects or a strategic reallocation of the firm's assets. For The Honest Co Inc, this transaction may prompt a reevaluation of its business strategies to improve its standing in the market and attract further investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.