Institutional Venture Management XIII, LLC Adjusts Stake in The Honest Co Inc

Overview of Institutional Venture Management XIII, LLC (Trades, Portfolio)'s Recent Transaction

In a notable move within the investment community, Institutional Venture Management XIII, LLC (Trades, Portfolio) has recently adjusted its holdings in The Honest Co Inc (NASDAQ:HNST). On November 14, 2023, the firm reduced its stake in the company by 672,454 shares, which equates to a 6.42% change in their holdings. This transaction has had a 1.85% impact on their portfolio, with the trade executed at a price of $1.49 per share. Following this transaction, Institutional Venture Management XIII, LLC (Trades, Portfolio) now holds a total of 9,802,183 shares in The Honest Co Inc, representing a 27.47% position in their portfolio and a 10.27% stake in the company.

Profile of Institutional Venture Management XIII, LLC (Trades, Portfolio)

Institutional Venture Management XIII, LLC (Trades, Portfolio), based at 3000 SAND HILL ROAD, MENLO PARK, CA, is a firm with a focused investment philosophy. With a portfolio comprising only three stocks, the firm's top holdings include LegalZoom.com Inc (NASDAQ:LZ), The Honest Co Inc (NASDAQ:HNST), and Inspirato Incorporated (NASDAQ:ISPO). The firm manages an equity portfolio valued at approximately $54 million, with a strong inclination towards the Industrials and Consumer Defensive sectors.

Basic Information on The Honest Co Inc

The Honest Co Inc, trading under the symbol HNST, is a USA-based company that went public on May 5, 2021. It operates as a digitally-native consumer products company, focusing on purpose-driven items designed for a broad consumer base. The company's product offerings span across Diapers and Wipes, Skin and Personal Care, and Household and Wellness, with the majority of its revenue stemming from the Diapers and Wipes segment. The Honest Co Inc has a market capitalization of $147.023 million and a current stock price of $1.54. However, with a PE percentage of 0.00, the company is currently not profitable.

Impact of the Trade on Institutional Venture Management XIII, LLC (Trades, Portfolio)'s Portfolio

The recent reduction in The Honest Co Inc's shares by Institutional Venture Management XIII, LLC (Trades, Portfolio) has led to a significant change in the firm's investment landscape. The trade price of $1.49, when compared to the current stock price, indicates a strategic move by the firm. The transaction has resulted in a 27.47% position in their portfolio, reflecting the firm's continued, albeit reduced, confidence in the stock.

Market Performance of The Honest Co Inc

Since the transaction, The Honest Co Inc's stock has experienced a gain of 3.36%. However, the stock's performance has been underwhelming since its IPO, with a decline of 92.75%, and a year-to-date drop of 47.26%. The stock's price to GF Value ratio stands at 0.44, suggesting that it may be undervalued, but the designation of "Possible Value Trap, Think Twice" by GuruFocus warrants caution.

Financial Health and Valuation Metrics

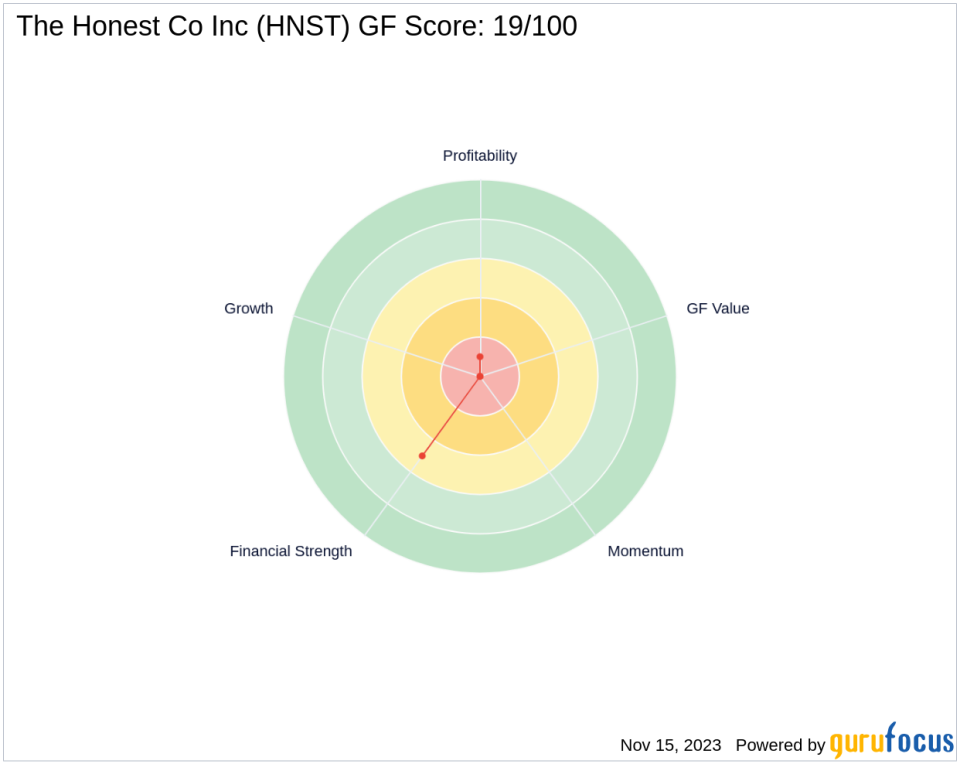

The Honest Co Inc's financial health, as indicated by its GF Score of 19/100, suggests potential challenges in future performance. The company's Financial Strength is rated at 5/10, while its Profitability Rank is notably low at 1/10. The Honest Co Inc's valuation metrics, including GF Value and GF Value Rank, are not applicable due to insufficient data.

Growth and Momentum Indicators

The company's growth metrics, such as a 3-year revenue growth of 8.00%, are overshadowed by a 3-year EBITDA growth of -23.20%. Momentum indicators like the RSI and Momentum Index rankings are also less than ideal, with the stock's RSI 14 Day Rank at 1764 and Momentum Index 6 - 1 Month Rank at 1878.

Sector and Industry Analysis

Institutional Venture Management XIII, LLC (Trades, Portfolio)'s top sectors include Industrials and Consumer Defensive, with The Honest Co Inc positioned within the Consumer Packaged Goods industry. Despite the competitive landscape, the firm's recent transaction suggests a strategic adjustment rather than a complete withdrawal from the stock, indicating a nuanced approach to its investment in The Honest Co Inc.

In conclusion, Institutional Venture Management XIII, LLC (Trades, Portfolio)'s recent trade reflects a significant adjustment in its investment strategy regarding The Honest Co Inc. While the firm maintains a substantial stake in the company, the reduced position and the stock's current market performance and financial health metrics will be critical factors to monitor moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.