Institutional Venture Management XIV, LLC Reduces Stake in Oportun Financial Corp

In a recent transaction, Institutional Venture Management XIV, LLC has reduced its holdings in Oportun Financial Corp (NASDAQ:OPRT). This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications of this move.

Details of the Transaction

The transaction took place on September 5, 2023, with the firm reducing its stake by 50,000 shares. This move had a -0.22% impact on the firm's portfolio. The shares were traded at a price of $7.31 each, leaving the firm with a total of 3,358,691 shares in Oportun Financial Corp. This represents 14.82% of the firm's portfolio and 9.87% of the total shares of OPRT.

Profile of Institutional Venture Management XIV, LLC

Institutional Venture Management XIV, LLC, located at 3000 Sand Hill Road, Menlo Park, CA, is a firm that currently holds three stocks in its portfolio. Its top holdings include Oportun Financial Corp (NASDAQ:OPRT), ZipRecruiter Inc (NYSE:ZIP), and Nerdwallet Inc (NASDAQ:NRDS). The firm's total equity stands at $166 million, with its top sectors being Industrials and Financial Services.

Overview of Oportun Financial Corp

Oportun Financial Corp (NASDAQ:OPRT), based in the USA, is a financial services provider that caters to individuals with limited or no credit history. The company, which went public on September 26, 2019, offers personal and auto loans among other services. As of the date of this article, the company's market cap stands at $254.993 million.

Performance of Oportun Financial Corp

Currently, the stock price of OPRT is $7.49, which is fairly valued according to the GF-Score. Since the transaction, the stock price has increased by 2.46%. However, since its IPO, the stock price has decreased by 52.29%. The year-to-date price change stands at 32.8%.

Financial Health and Profitability of Oportun Financial Corp

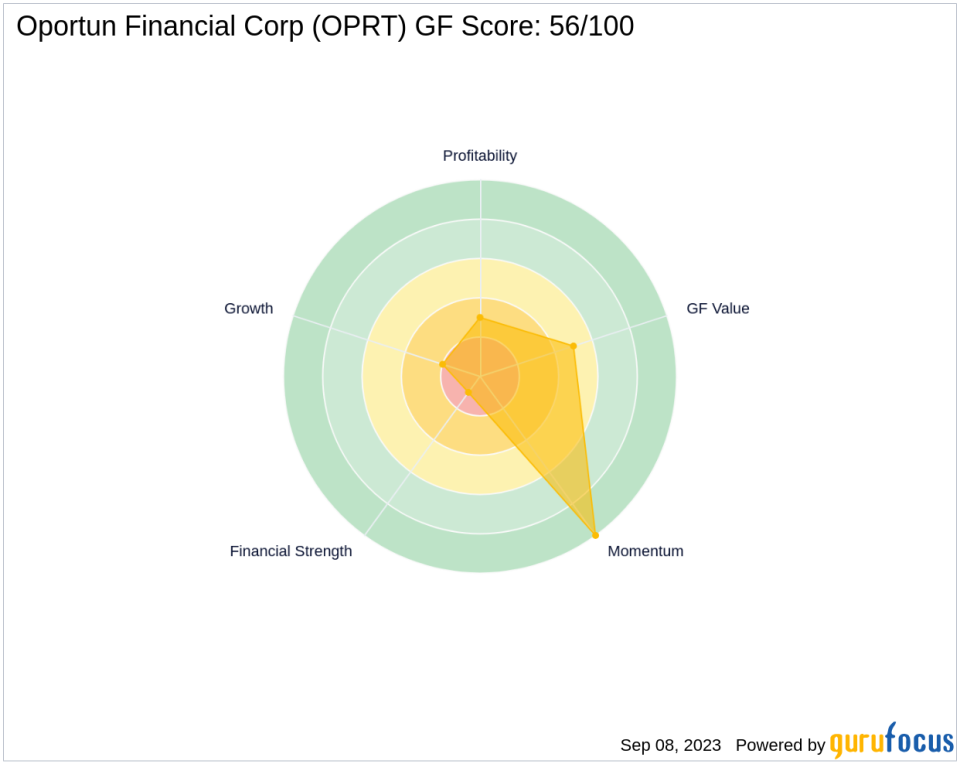

Oportun Financial Corp has a GF-Score of 56/100, indicating a poor future performance potential. The company's financial strength is ranked 1/10, while its profitability rank is 3/10. The company's growth rank is 2/10, its GF Value Rank is 5/10, and its momentum rank is 10/10.

Conclusion

In conclusion, Institutional Venture Management XIV, LLC's decision to reduce its stake in Oportun Financial Corp could have significant implications for both the firm and the traded company. Despite the decrease in holdings, OPRT remains a significant part of the firm's portfolio. On the other hand, Oportun Financial Corp's performance and financial health indicate a challenging path ahead. Investors should keep a close eye on these developments and make informed decisions accordingly.

This article first appeared on GuruFocus.