Insufficient Growth At Agora, Inc. (NASDAQ:API) Hampers Share Price

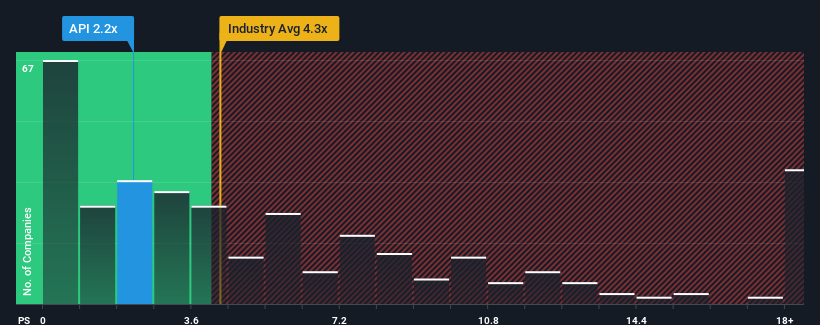

With a price-to-sales (or "P/S") ratio of 2.2x Agora, Inc. (NASDAQ:API) may be sending bullish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios greater than 4.3x and even P/S higher than 9x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Agora

How Agora Has Been Performing

While the industry has experienced revenue growth lately, Agora's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Agora's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Agora's Revenue Growth Trending?

In order to justify its P/S ratio, Agora would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. Even so, admirably revenue has lifted 149% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 13% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Agora's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Agora's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Agora that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here