Insurance Stocks' Q3 Earnings Due on Nov 1: AFL, MET & More

Insurance industry stocks in the third quarter are expected to have benefited from strong retention, accelerated digitalization, interest rate hikes and reinsurance agreements. Furthermore, favorable renewals and organic business growth are likely to boost September-quarter results of companies like Aflac Incorporated AFL, MetLife, Inc. MET, American International Group, Inc. AIG, The Allstate Corporation ALL and Prudential Financial, Inc. PRU, which are set to announce quarterly numbers on Nov 2. However, potential hindrances might have arisen in the form of rising expenses and a challenging catastrophe environment.

The insurance space belongs to the Finance sector (one of the 16 broad Zacks sectors within the Zacks Industry classification), overall earnings of which are projected to increase 12.3% from the year-ago quarter’s reported figure. Revenues are expected to inch up 2.8%, as indicated by our latest Earnings Preview. The upward estimate for earnings is likely to have been supported by increased earned premiums, partially offset by higher expenses and catastrophe losses stemming from wind, hail and devastating wildfire events.

Let’s delve deeper and look at the key factors that are likely to have impacted the insurance stocks during the quarter under review.

Factors Setting the Tone for Insurance Stocks’ Q3 Results

Insurance companies with exposure to the property and casualty business segment are expected to have incurred losses due to severe convective storms in the United States and Italy, as well as catastrophe losses resulting from the Maui wildfire. AON predicts that global insured losses from natural disasters will reach $88 billion by the third quarter-end. However, insurers may have mitigated the impact of these catastrophe losses and protected their underwriting results through favorable reserve development.

Amid an active catastrophe environment, the insurance industry sees faster policy renewals, enabling insurers to raise rates for efficient claims processing. Enhanced pricing, exposure growth and client retention are likely to have boosted third-quarter premium generation. Diversified portfolios aimed at risk reduction further aided premium growth.

During the third quarter, increased business activities are expected to have driven heightened demand for insurance products. Insurers may have capitalized on this by diversifying and redesigning their offerings, resulting in revenue growth. Additionally, the pandemic's onset may have sustained growing awareness, further supporting insurance businesses.

Increased global travel is anticipated to have driven higher auto insurance premiums. Elevated economic activities are likely to have benefited commercial and group insurance businesses in the third quarter. Companies with interest rate-sensitive products and investments are expected to have benefited from the high interest rate environment supporting investment income.

Insurance companies are expected to have gained from improved operating efficiency in the third quarter, primarily due to accelerated digitalization and the influence of insurtech. Cutting-edge technologies, including artificial intelligence, blockchain, advanced analytics, cloud computing, telematics, and robotic process automation, have facilitated streamlined operations and cost reduction. These advancements are likely to have bolstered the margins of insurance companies during the quarter.

Insurance Providers Reporting on Nov 1

Against the backdrop discussed above, let’s find out how the following five companies are placed ahead of their third-quarter earnings release tomorrow.

Our proprietary model clearly indicates that a company needs to have the right combination of two key elements — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

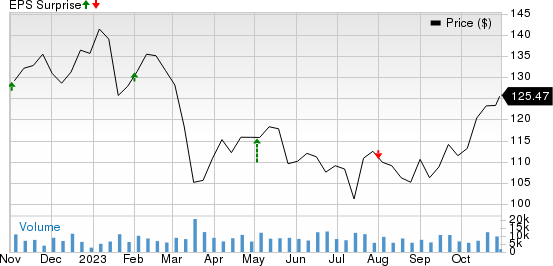

Aflac: The Zacks Consensus Estimate for adjusted revenues in Aflac U.S. indicates a 3.8% jump from the year-ago period’s actuals. The consensus mark for the segment’s pre-tax adjusted earnings indicates 4.1% year-over-year growth. However, the Zacks Consensus Estimate for Aflac’s total net earned premiums suggests a decline of 6.8% from the prior-year quarter due to weaker Japan operations.

The Zacks Consensus Estimate for the third-quarter earnings and top line stands at $1.44 per share and $4.5 billion, respectively, indicating an earnings increase of 17.1% but a revenue decline of 7.4% from the corresponding year-ago quarter’s actuals. As far as earnings surprises are concerned, Aflac’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average being 7.8%. (Read more: Can Aflac's Q3 Earnings Beat on Lower Benefits & Expenses?)

Aflac Incorporated Price and EPS Surprise

Aflac Incorporated price-eps-surprise | Aflac Incorporated Quote

Our proven model predicts a likely earnings beat for AFL this time around. This is because the stock has an Earnings ESP of +0.62% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

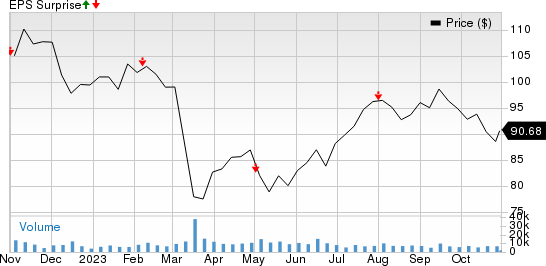

MetLife: The Zacks Consensus Estimate for MetLife’s premiums indicates a decline of 37.4% from the prior-year quarter. The consensus mark for adjusted retirement and income solutions revenues predicts a 64.4% year-over-year plunge. However, the Zacks Consensus Estimate for MET’s U.S. business’ adjusted earnings suggests an increase of 19.2% from the prior-year quarter’s reading. Also, the consensus mark for adjusted earnings in Latin America indicates a 16.7% jump from the year-ago period’s actuals.

The Zacks Consensus Estimate for the third-quarter earnings and top line stands at $1.99 per share and $17.9 billion, respectively, indicating an earnings increase of 64.5% but a revenue decrease of 24.3% from the corresponding year-ago quarter’s actuals. As far as earnings surprises are concerned, MetLife’s earnings beat the Zacks Consensus Estimate in two of the last four quarters and missed twice, the average negative surprise being 5.3%. (Read more: Will Lower Premiums Hurt MetLife's Q3 Earnings?)

MetLife, Inc. Price and EPS Surprise

MetLife, Inc. price-eps-surprise | MetLife, Inc. Quote

Our proven model doesn’t conclusively predict an earnings beat for MetLife this time around. This is because the stock has an Earnings ESP of -0.51% and a Zacks Rank #3.

AIG: This leading multiline insurer’s third-quarter revenues are likely to have been supported by better net premiums earned in General Insurance. The consensus mark for the metric suggests a year-over-year increase of almost 4%. Improved retention, new business and continued growth in the insurance premium rate are likely to aid its results. Also, AIG’s Q3 earnings are expected to have gained from increased net investment income.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top line is pegged at $1.55 per share and $12.6 billion, respectively, indicating an earnings increase of 134.9% and a revenue jump of 11.4% from the corresponding year-ago quarter’s readings. As far as earnings surprises are concerned, AIG’s bottom line beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 13.5%. (Read more: Can AIG Q3 Earnings Beat on Strong General Insurance Growth?)

American International Group, Inc. Price and EPS Surprise

American International Group, Inc. price-eps-surprise | American International Group, Inc. Quote

Our proven model predicts a likely earnings beat for AIG this time around. This is because the stock has an Earnings ESP of +4.02% and a Zacks Rank #2.

The Allstate Corporation: This leading property-casualty insurer’s third-quarter revenues are expected to have been supported by better premiums. The consensus mark for net premiums earned from Property-Liability and Protection Services segments suggests year-over-year increases of 10.1% and 14.9%, respectively. Prudent rate increases and strong policy retention rates are likely to aid its results. However, Allstate’s Q3 earnings may have taken a hit from pre-tax catastrophe losses of $1.18 billion in the third quarter. Also, the homeowners business’ underwriting results are likely to have suffered from increasing loss costs.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top line is pegged at 39 cents per share and $14.7 billion, respectively, indicating an earnings improvement of 125% and a revenue increase of 14.7% from the corresponding year-ago quarter’s readings. As far as earnings surprises are concerned, ALL’s bottom line beat the Zacks Consensus Estimate in three of the last four quarters, missing the mark once, the average surprise being 4.7%.

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

Allstate has an Earnings ESP of -53.74% and a Zacks Rank of 3.

Prudential Financial: Prudential Financial's international operations are expected to see a favorable impact from annual assumption updates and other refinements. Similarly, the U.S. business is likely to benefit from higher spread income and improved underwriting, contributing positively to its performance. The consensus estimate for U.S. business’ adjusted operating income before taxes indicates 91.3% year-over-year growth. However, the consensus mark for total premiums indicates a 59.9% decline in the third quarter from the year-ago period’s finals.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top line stands at $3.16 per share and $12.9 billion, respectively, indicating an earnings increase of 48.4% but a revenue decline of 40.3% from the respective year-earlier quarter’s readings. As far as earnings surprises are concerned, PRU’s bottom line missed the Zacks Consensus Estimate in all the last four quarters, the average negative surprise being 6.2%.

Prudential Financial, Inc. Price and EPS Surprise

Prudential Financial, Inc. price-eps-surprise | Prudential Financial, Inc. Quote

Prudential Financial has an Earnings ESP of -0.45% and is a Zacks #3 Ranked stock.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report