Integer Holdings (ITGR) Hits 52-Week High: What's Aiding It?

Shares of Integer Holdings Corporation ITGR scaled a new 52-week high of $96.55 on Dec 12, before closing the session slightly lower at $94.29.

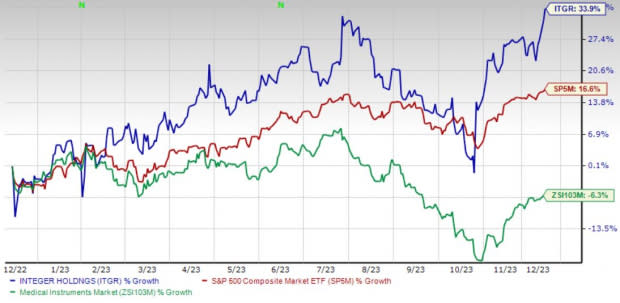

Over the past year, this Zacks Rank #1 (Strong Buy) stock has gained 33.9% against a 6.3% decline of the industry. The S&P 500 has witnessed 16.6% growth in the said time frame.

Over the past five years, the company registered earnings growth of 4.8% compared with the industry’s 4% rise. The company’s long-term expected growth rate of 15.8% compares with the industry’s growth projection of 13.3%. Integer Holdings’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 11.9%.

Image Source: Zacks Investment Research

Integer Holdings is witnessing an upward trend in its stock price, prompted by its research and product development activities. The optimism led by a solid third-quarter 2023 performance and its solid foothold in the broader MedTech space are expected to contribute further. However, dependence on third-party suppliers and global climate change-related troubles continue to concern the company.

Let’s delve deeper.

Key Growth Drivers

Research and Product Development: Investors are optimistic about Integer Holdings’ position as a developer and manufacturer of medical devices and components. The company is focused on developing new products, improving and enhancing existing products and expanding the use of its products in new or tangential applications. In addition to ITGR’s internal technology and capability development efforts aimed at providing its customers with differentiated solutions, the company engages outside research institutions for unique technology projects.

Solid Foothold in the Broader MedTech Space: Investors are optimistic about Integer Holdings’ stable footing in the cardiac, neuromodulation, orthopedics, vascular and advanced surgical markets. Its primary customers include large, multi-national original equipment manufacturers and their affiliated subsidiaries.

ITGR is focused on sales efforts to increase its market penetration in the Cardio & Vascular, Neuromodulation and Non-Medical Electrochem markets. The company is undertaking strategic initiatives to maintain its leadership position in the cardiac rhythm management market.

Strong Q3 Results: Integer Holdings’ robust third-quarter 2023 results raise optimism. The company registered year-over-year top-line and bottom-line performances. The Medical segment recorded robust results owing to strength in the majority of its product lines. The expansion of both margins bodes well.

Downsides

Global Climate Change: Customer, investor and employee expectations relating to environmental, social and governance (ESG) have been rapidly evolving and increasing. Also, government organizations are enhancing or advancing legal and regulatory requirements specific to ESG matters. The heightened stakeholder focus on ESG issues related to ITGR’s business requires the continuous monitoring of various and evolving laws, regulations, standards and expectations and the associated reporting requirements. A failure to adequately meet stakeholders’ expectations may result in non-compliance, loss of business and reduced demand for Integer Holdings’ stock, among others.

Dependence on Third-Party Suppliers: Integer Holdings’ business depends on a continuous supply of raw materials, which may be susceptible to fluctuations due to transportation issues, government regulations and price controls, among others. Significant increases in the cost of raw materials, which cannot be recovered through increases in the prices of the company’s products, could adversely affect its operating results.

Other Key Picks

A few other top-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and DexCom, Inc. DXCM.

DaVita, sporting a Zacks Rank #1, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 45.2% compared with the industry’s 5.3% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 16.5%.

HealthEquity has gained 10.9% against the industry’s 10.8% decline over the past year.

DexCom, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, with an average of 36.4%.

DexCom’s shares have lost 1.9% compared with the industry’s 6.3% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report