Integra Lifesciences Reports Subdued Earnings Amidst Market Stability and Product Resilience

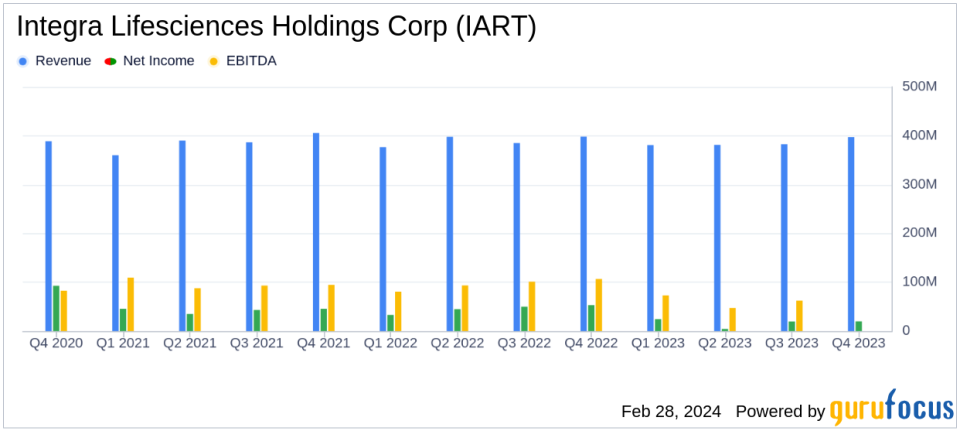

Reported Revenue: $1,541.6 million for full-year 2023, a decrease of 1.0% year-over-year.

Organic Revenue: Flat for full-year 2023 compared to 2022, with a 5.5% increase excluding Boston.

GAAP Earnings Per Share: $0.84 for full-year 2023, down from $2.16 in the previous year.

Adjusted Earnings Per Share: $3.10 for full-year 2023, compared to $3.36 in 2022.

Cash Flow from Operations: $140.0 million for full-year 2023, with capital expenditures of $67.0 million.

2024 Guidance: Revenue expected to be between $1,603 million to $1,618 million, with adjusted earnings per diluted share between $3.15 and $3.25.

On February 28, 2024, Integra Lifesciences Holdings Corp (NASDAQ:IART) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The New Jersey-based medical equipment company, which specializes in products for regenerative therapy, extremity orthopedics, and neurosurgical applications, reported a slight decrease in reported revenues for the full year, while maintaining flat organic revenue growth compared to the previous year.

Performance and Challenges

Integra Lifesciences faced a challenging year with a reported revenue decrease of 1.0% for the full year 2023, amounting to $1,541.6 million. The company's organic revenue remained flat compared to 2022, but showed a 5.5% increase when excluding the impact of the Boston product recall. GAAP earnings per diluted share significantly decreased to $0.84, down from $2.16 in the previous year, reflecting the operational challenges faced by the company.

Despite these challenges, Integra Lifesciences is preparing for growth in 2024, with strategic initiatives such as the relaunch of the Boston portfolio, the integration of the SIA acquisition, and the expansion of its international portfolio. These efforts are crucial for the company's success in the competitive medical devices and instruments industry, where innovation and market expansion are key drivers of growth.

Financial Achievements and Importance

Integra's financial achievements in 2023 include the successful integration of the SIA acquisition and the advancement of its PMA clinical strategy for SurgiMend and DuraSorb. The company also made significant strides in building out its manufacturing capabilities in China and obtained 510(k) clearance for the next generation Aurora Surgiscope. These achievements underscore the company's commitment to innovation and global expansion, which are vital for maintaining a competitive edge in the medical technology market.

Income Statement and Balance Sheet Highlights

The company's adjusted EBITDA for the fourth quarter was $100.5 million, a decrease from $109.7 million in the same period last year. The adjusted net income for the fourth quarter stood at $69.1 million, or $0.89 per diluted share, compared to $78.8 million, or $0.94 per diluted share, in the fourth quarter of 2022. The full-year cash flow from operations totaled $140.0 million, and the company executed $275 million in share repurchases, demonstrating its commitment to returning value to shareholders.

"In 2023, we saw stability in our markets and resilience of our product portfolio, which demonstrates the impact of our products and technologies on restoring patients lives," said Jan De Witte, president and chief executive officer. "Despite the operational challenges last year, I am extremely proud of our colleagues around the world for remaining focused on advancing our key pillars of growth and operational excellence, and for their unwavering commitment to our customers and patients.

Analysis of Company Performance

Integra's performance in 2023 reflects a company navigating through a complex market environment while laying the groundwork for future growth. The slight decline in reported revenue and earnings per share indicates the impact of external challenges, including the Boston product recall. However, the company's proactive measures, such as the relaunch of the Boston portfolio and the acquisition of the Acclarent ENT business, are expected to contribute positively to its performance in 2024.

The company's guidance for 2024 suggests confidence in the stability of its markets and the demand for its differentiated portfolio. With a focus on gradual improvements in supply, international expansion, and strategic acquisitions, Integra is positioning itself for a stronger performance in the coming year.

For a detailed analysis of Integra Lifesciences Holdings Corp's financial results and future outlook, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Integra Lifesciences Holdings Corp for further details.

This article first appeared on GuruFocus.