Integral Ad Science Holding Corp CEO Lisa Utzschneider Sells 13,113 Shares

Lisa Utzschneider, CEO of Integral Ad Science Holding Corp (NASDAQ:IAS), executed a sale of 13,113 shares in the company on February 6, 2024, according to a recent SEC Filing. The transaction was carried out at an average price of $15.79 per share, resulting in a total value of $207,113.27.

Integral Ad Science Holding Corp is a global technology and data company that empowers the advertising industry to effectively influence consumers everywhere, on every device. The company focuses on delivering solutions that ensure ad viewability, brand safety, fraud protection, and advertising effectiveness. This technology-driven approach to digital advertising ensures that both publishers and advertisers can maximize their ROI in a complex digital landscape.

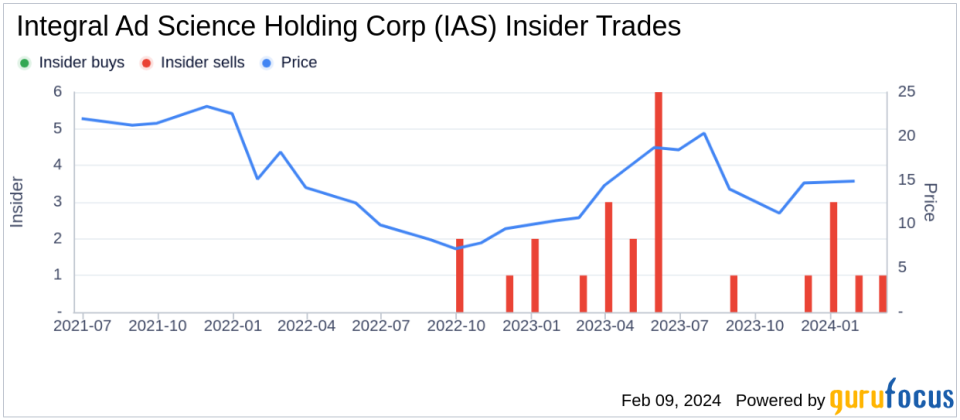

Over the past year, the insider has sold a total of 105,843 shares of Integral Ad Science Holding Corp and has not made any purchases. The recent sale by the insider is part of a trend observed over the past year, where there have been 18 insider sells and no insider buys.

On the date of the insider's recent transaction, shares of Integral Ad Science Holding Corp were trading at $15.79, giving the company a market capitalization of $2.56 billion. The price-earnings ratio of the company stands at 323.00, which is significantly above both the industry median of 18.145 and the company's historical median price-earnings ratio.

The insider's activity can be an important indicator of a company's performance and potential future direction. Investors often monitor insider transactions as part of their due diligence process when evaluating investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.