Integra's (IART) Q2 Earnings Top Estimates, 2023 View Cut

Integra LifeSciences Holdings Corporation IART delivered adjusted earnings per share (EPS) of 71 cents in the seccond quarter of 2023, down 13.4% year over year. The metric surpassed the Zacks Consensus Estimate by 24.6%.

The adjustment excludes the impact of certain non-recurring charges like amortization expenses, Boston recall and EU Medical Device Regulation charges, among others.

GAAP EPS in the second quarter was 5 cents, a 90.6% plunge from 54 cents in the year-ago quarter.

Revenue Discussion

Total revenues in the reported quarter fell 4.2% year over year to $381.3 million. The metric exceeded the Zacks Consensus Estimate by 1.9%. Organically, revenues dropped 2.7% year over year.

Segmental Details

Coming to product categories, revenues in the Codman Specialty Surgical (“CSS”) segment rose 5.1% year over year on a reported basis to $271 million (organically, up 6.3%). This improvement can be attributed to high single-digit growth in Advanced Energy driven by CUSA capital and disposables, mid-single-digit growth in CSF management, driven by Certas Plus valves, mid-single-digit growth in Dural Access and Repair driven by Mayfield and DuraGen. This figure compares with our second quarter’s CSS model’s projection of $261 million.

Tissue Technologies revenues totaled $110.2 million in the second quarter, down 21.2% year over year on a reported basis and 19.7% on an organic basis. The downside was due to the impact of lost revenues and return provision for the Boston recall that was partially offset by double digit growth from MicroMatrix, Cytal, MediHoney and nerve franchise. This figure compares with our second quarter’s Tissue Technologies model’s projection of $137.9 million.

Margin Trend

In the reported quarter, gross profit totaled $207 million, down 16.9% year over year. The gross margin contracted 840 basis points (bps) to 54.3%. The company-adjusted gross margin was 67.6%.

Selling, general and administrative expenses rose 2.6% to $164.9 million in the quarter under review, while research and development expenses increased 3.9% to $26.6 million.

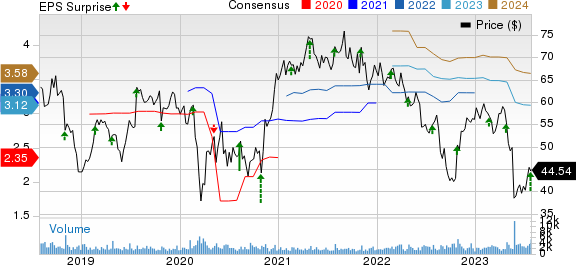

Integra LifeSciences Holdings Corporation Price, Consensus and EPS Surprise

Integra LifeSciences Holdings Corporation price-consensus-eps-surprise-chart | Integra LifeSciences Holdings Corporation Quote

Overall, adjusted operating profit were $15.5 million, up 75.4% year over year. Adjusted operating margin saw an 1180-bps contraction year over year to 4.1%.

Financial Position

Integra exited the second quarter with cash and cash equivalents of $309.2 million, up from $307.4 million at the end of first-quarter 2023.

Cumulative net cash flow from operating activities at the end of the second quarter was $28.3 million compared with $26.2 million at the end of first-quarter 2023.

Guidance

The company updated its financial guidance for 2023.

For the full year, IART projects revenues in the band of $1.55-$1.56 billion (down from the previous guidance of $1.60-$1.62 billion). This suggests reported growth of approximately (0.6%)-0.2% and organic growth of 0.3-1.1%.

The Zacks Consensus Estimate for the same is pegged at $1.55 billion.

The company projects adjusted EPS guidance for 2023 in the band of $3.10-$3.18 (down from previous guidance of $3.43-$3.51). The Zacks Consensus Estimate for the same is pegged at $3.12.

Integra also provided its guidance for the third quarter of 2023.

For the third quarter, Integra expects revenues in the range of $386-$390 million, which suggests growth of approximately 0.2% to 1.3% and organic growth of 0.3-1.3% year over year. The Zacks Consensus Estimate for the same is pegged at $387.2 million.

Adjusted EPS is estimated in the range of 76-80 cents. This considers the impact of the acceleration of Boston recall.

The Zacks Consensus Estimate for adjusted EPS is pegged at 84 cents.

Our Take

Integra exited the second quarter of 2023 with better-than-expected earnings and revenues.

In CSS, the company registered strong growth on the back of high single-digit growth in Advanced Energy driven by CUSA capital and disposables and mid-single-digit growth in CSF management driven by Certas Plus valve. It also registered double-digit growth from MicroMatrix, Cytal, MediHoney and nerve franchise. In the reported quarter, IART expanded the global DuraGen portfolio with approvals in China and Japan and launched CUSA Lap Tip in Japan, Canada, South Africa and Israel.

On the flip side, unfavorable product and geographic mix and Boston quality project expenses are exerting pressure on the bottom line. Escalating costs and the contraction of both margins are discouraging. The company also narrowed its 2023 view, which is a concern.

Zacks Rank & Key Picks

Integra currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Intuitive Surgical, Inc. ISRG.

Abbott, carrying a Zacks Rank of 2 (Buy), reported second-quarter 2023 adjusted EPS of $1.08, beating the Zacks Consensus Estimate by 3.8%. Revenues of $9.98 billion outpaced the consensus mark by 2.9% You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 12.4%.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, beating the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

Intuitive Surgical has a long-term estimated growth rate of 14.5%. ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Integra LifeSciences Holdings Corporation (IART) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report