Intel (INTC) to Expand Chip Manufacturing Facility in Israel

Intel Corporation INTC has inked an agreement with the federal government of Israel to invest $25 billion to expand its chip manufacturing facility in the Middle Eastern country. The investment, dubbed the biggest of its kind in Israel’s history, is likely to generate significant employment opportunities and foster the economic development of the region.

The strategic decision assumes significance as the investment comes at a time when the country is ravished by the ongoing conflicts with Hamas – a Palestinian Sunni Islamist political and military organization governing the Gaza Strip of the Palestinian territories, which are occupied by Israel under international law.

Undeterred by the geopolitical conflicts, Intel intends to expand its existing chipmaking factory at Kiryat Gat — about 16 miles northeast of Gaza. The company expects the expanded manufacturing capacity to equip it better to regain its leading market position within the semiconductor industry and improve its supply chain mechanism in the region amid the prevailing unrest.

The company expects the new production facility to open in 2028 and operate through 2035. The government will provide a grant of $3.2 billion for the expansion of the Kiryat Gat plant, spread over several years. Including Kiryat Gat, Intel has four development and production sites in Israel, employing about 11,700 people and investing more than $50 billion in the country over the last five decades.

Intel is strategically investing to expand its manufacturing capacity to accelerate its IDM 2.0 (Integrated Device Manufacturing) strategy. Earlier this year, the company invested more than 30 billion euros to expand its upcoming semiconductor manufacturing facility in Germany. Dubbed “Silicon Junction,” it involves the construction of two new processor factories in Magdeburg, Germany.

Intel also announced that it will develop a state-of-the-art semiconductor assembly and test facility near Wroclaw, Poland, at an anticipated investment of about $4.6 billion to cater to the increased demand for advanced semiconductor solutions. It is likely to work in unison with its existing wafer fabrication facility in Leixlip, Ireland, and its planned wafer fabrication facilities in Magdeburg to help create a first-of-its-kind end-to-end leading-edge semiconductor manufacturing value chain in Europe.

In a concerted effort to regain its mojo, Intel has launched AI chips for data centers and PCs. This marks one of the largest architectural shifts for the company in 40 years. The strategic decision is primarily aimed at gaining a firmer footing in the expansive AI sector, spanning cloud and enterprise servers to networks, volume clients and ubiquitous edge environments, in tune with the evolving market dynamics. The company also remains on track with its 5N4Y (five nodes in four years) program in order to regain transistor performance and power performance leadership by 2025.

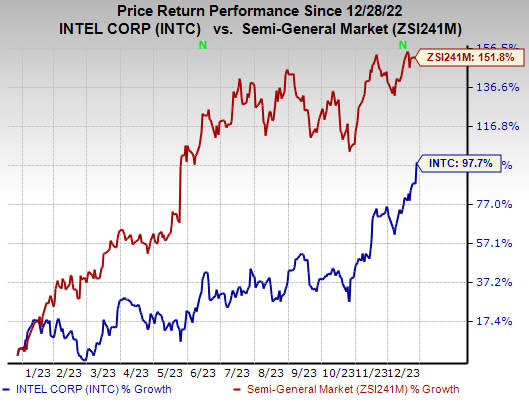

The stock has gained 97.7% over the past year compared with the industry’s growth of 151.8%.

Image Source: Zacks Investment Research

Intel currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

United States Cellular Corporation USM, sporting a Zacks Rank #1, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve the efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

InterDigital, Inc. IDCC: Headquartered in Wilmington, DE, InterDigital is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

This Zacks Rank #1 stock has a long-term earnings growth expectation of 17.4% and has surged 122.6% over the past year. A well-established global footprint, diversified product portfolio and ability to penetrate different markets are key growth drivers for InterDigital. Apart from a strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive considerable value, given the massive size of the market it offers licensing technologies to.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

United States Cellular Corporation (USM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report