Intel (INTC) Partners Tower to Boost Semiconductor Ecosystem

Intel Corporation INTC and Tower Semiconductor Ltd. TSEM have inked a pivotal agreement that promises to significantly impact the broader semiconductor ecosystem. The partnership underscores Intel's dedication to expanding its foundry services and manufacturing capabilities, while also positioning Tower for substantial growth.

Per the agreement, Tower will utilize Intel's advanced manufacturing facility in New Mexico. With an investment of up to $300 million in equipment and assets, Tower aims to create a capacity corridor capable of supporting its customers’ rising demand for 300mm advanced analog processing. This move aligns with both companies’ strategies to broaden their foundry footprints and offer cutting-edge solutions at scale.

Intel Foundry Services (IFS) has emerged as a linchpin in Intel's integrated device manufacturing 2.0 strategy, aimed at regaining technological leadership and enhancing manufacturing scale. The partnership with Tower is another testament to IFS's rapid growth, boasting over 300% year-over-year revenue increase in second-quarter 2023.

For Tower, the collaboration opens doors to greater scale and customer partnerships in 300mm technologies, particularly in its 65nm BCD power management and RF SOI technologies. These innovations are poised to improve power efficiency and wireless connections, bolstering its position in the market.

Intel's open system foundry is likely to benefit the partnership with its secure, sustainable and resilient supply chain. This aligns with Tower's focus on advanced power management and RF SOI solutions, with full process flow qualification slated for 2024. Furthermore, this partnership will grant Tower access to Intel's global factory network, solidifying its presence across the globe.

Intel is betting big on the IoT business and is investing heavily to gain a higher market presence. While the focus was earlier on making the best computing chips and generating industry-leading margins from them, the company now prefers focusing on a product range targeting different market segments. Management believes that although the higher-end businesses in more developed economies continue to look up, the new strategy should help it get into many more device categories, where Intel products will likely keep enjoying a premium based on performance.

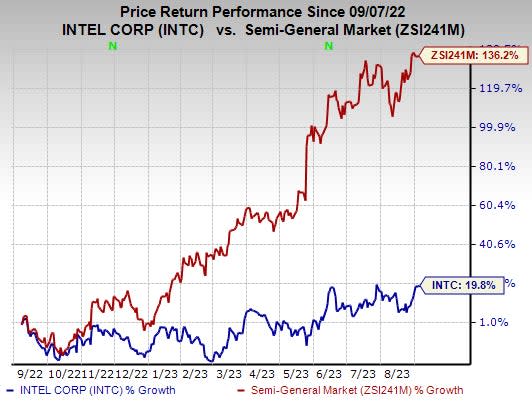

The stock has gained 19.8% over the past year compared with the industry’s growth of 136.2%.

Image Source: Zacks Investment Research

Intel currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC is a Zacks Rank #2 stock. It has a long-term earnings growth expectation of 4.3% and delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Tower Semiconductor Ltd. (TSEM): Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report