Inter Parfums (IPAR) Expects Sales & Earnings Growth in 2024

Inter Parfums, Inc. IPAR appears well-positioned in the booming fragrance market due to its legacy scents and innovative extensions. Buoyed by robust momentum in the fragrance space, along with gains from product newness, the company is set to witness another record year in 2024.

For the full year 2024, the company anticipates net sales of $1.45 billion and earnings of $5.15 per share. Markedly, this guidance suggests 12% growth in net sales and an 8% improvement in the bottom line from the 2023 projections. On its third-quarter earnings call, management had forecasted net sales of $1.3 billion and earnings per share of $4.75 for 2023.

Inter Parfums anticipates approximately 5% organic growth across its global business, including travel retail, for the full year 2024. While the 2024 gross margin is expected to be in line with 2023, the sales growth rate for 2024 surpasses that of earnings. This is mainly due to launch investments related to the company’s two newest brands, Cavalli and Lacoste.

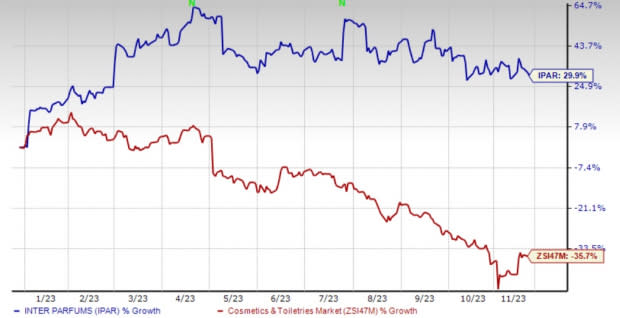

Image Source: Zacks Investment Research

What’s More?

Management offered greater insights into the company's plans for its European and U.S. operations. For the European operations, IPAR has several new programs underway for various brands, such as Montblanc, Jimmy Choo, Coach, Van Cleef & Arpels, Rochas Mademoiselle and Lanvin Eclat dArpege.

For the U.S.-based operations, the company unveiled product launch and extension plans for its largest brand, GUESS. It also stated that its Donna Karan/DKNY brand delivered a solid performance in 2023 and is expected to grow further going forward. Inter Parfums is on track with the distribution of Abercrombie & Fitch Fierce and has strong expectations from the Cavalli and Lacoste fragrances.

Moving on, the company intends to bolster Ferragamo’s fragrance lines with two extensions. Also, it emphasized its commitment to its Italian operations by entitling its Florence, Italy office as a distribution center for all brands in both European and U.S.-based operations, starting in 2024.

Inter Parfums has been reaping the benefits of favorable trends and the momentum in the fragrance market. The company is growing its market share with innovative programs. These positives collectively boosted IPAR's third-quarter 2023 results, with the top and bottom lines increasing year over year and beating the Zacks Consensus Estimate. The company is set to reach greater heights.

Shares of this Zacks Rank #3 (Hold) company have rallied 29.9% year to date against the industry’s decline of 35.7%

3 Solid Bets

Lamb Weston LW, which offers frozen potato products, sports a Zacks Rank #1 (Strong Buy) at present. LW has a trailing four-quarter earnings surprise of 46.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 28.3% and 24.8%, respectively, from the year-ago reported numbers.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 9.9%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 1.2% from the corresponding year-ago reported figure.

Post Holdings POST, operating as a cosmetic and skin care product provider, currently carries a Zacks Rank of 2. POST has a trailing four-quarter earnings surprise of 59.2%, on average.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales suggests growth of 10.9% from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report