Inter Parfums (IPAR) Queued for Q2 Earnings: Things to Note

Inter Parfums, Inc. IPAR is likely to register bottom-line growth when it reports second-quarter 2023 earnings on Aug 8. The Zacks Consensus Estimate for quarterly earnings has moved up by a penny in the past seven days to 89 cents per share. The projection suggests an improvement of 3.5% from that reported in the year-ago quarter.

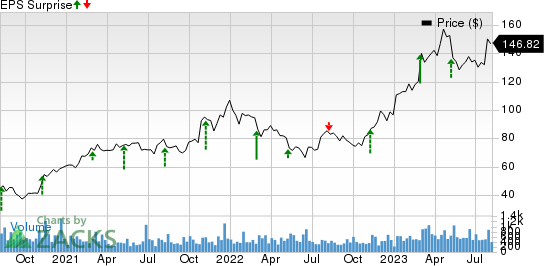

The fragrances and related products company has a trailing four-quarter earnings surprise of 37.2%, on average. IPAR reported an earnings surprise of 20.9% in the last reported quarter.

Inter Parfums, Inc. Price and EPS Surprise

Inter Parfums, Inc. price-eps-surprise | Inter Parfums, Inc. Quote

Things To Note

Inter Parfums has been reaping benefits from the booming fragrance market globally. The company’s largest and mid-sized brands have been performing well. IPAR is also benefiting from strategic partnerships and product launches to boost assortment strength.

A Look at Q2 Sales

Inter Parfums recently released record second-quarter 2023 net sales, which rallied 26% to $309 million compared with $245 million reported in the year-ago quarter. At comparable foreign currency rates, second-quarter net sales rallied 25% year over year. During the second quarter, Inter Parfums’ Europe-based product sales came in at $198 million, up 19% from 2022 levels. U.S.-based product sales amounted to $111 million, up 42% from second-quarter 2022 figures.

The three largest brands backed the European operations' net sales increase. During the second quarter, Coach, Jimmy Choo and Montblanc delivered sales growth of 28%, 21% and 16%, respectively. In addition, IPAR’s fragrance "jewels" — Van Cleef & Arpels and Boucheron and fashion houses — Rochas and Kate Spade performed well. Management highlighted that strength across the overall market and 2023 launches and brand extensions, like Jimmy Choo Rose Passion, Montblanc Signature Absolue and Explorer Platinum, Coach Green and Love as well as Girl Life, among others, led to year-to-date sales increase of 23% in European-based operations.

The solid performance of key brands in the portfolio fueled growth in its U.S. operations. The company is impressed by the continued success of GUESS brands’ fragrances, up 30% year over year. The upside can be attributed to sales of the newest pillars — Seductive Blue and Uomo Acqua. IPAR also saw solid sales of Ferragamo fragrances. Oscar de la Renta also delivered an impressive performance during the second quarter. Donna Karan/DKNY brands is also performing well and has become the company’s second-largest U.S.-based brand.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Inter Parfums this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Inter Parfums currently carries a Zacks Rank #2 and has an Earnings ESP of +6.22%.

Other Stocks With a Favorable Combination

Here are some companies you may want to consider, as our model shows that these too have the right combination of elements to deliver an earnings beat.

Coty COTY has an Earnings ESP of +20.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s top and the bottom line are expected to increase year over year when it reports its upcoming quarterly results. The Zacks Consensus Estimate for Coty’s quarterly revenues is pegged at $1.3 billion, suggesting a rise of 13.4% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for the quarterly EPS is pegged at 2 cents, indicating a 300% growth from the year-ago period’s figure. COTY has a trailing four-quarter earnings surprise of 145%, on average.

Celsius Holdings, Inc. CELH currently has an Earnings ESP of +16.51% and a Zacks Rank #3. The company’s top and bottom lines are expected to increase year over year when it reports second-quarter 2023 results. The Zacks Consensus Estimate for Celsius Holdings’ quarterly revenues is pegged at $281.9 million, calling for 83.1% growth from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for the quarterly EPS is pegged at 26 cents, indicating an improvement from 12 cents reported in the year-ago quarter. CELH had an earnings surprise of 81.8% in the last reported quarter.

Hormel Foods HRL has an Earnings ESP of +0.99% and a Zacks Rank #3 at present. The company is likely to register top-line growth when it reports third-quarter fiscal 2023 earnings. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.12 billion, suggesting a 2.8% rise from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Hormel Foods’s quarterly earnings has been unchanged in the past 30 days to 41 cents per share, suggesting an increase of 2.5% from the year-ago quarter’s reported number. HRL has a negative trailing four-quarter earnings surprise of 2.3%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report