Inter Parfums (IPAR) Readies for Q2 Earnings: Things to Note

Inter Parfums, Inc. IPAR is likely to register bottom-line growth when it reports second-quarter 2022 earnings on Aug 9. The Zacks Consensus Estimate for quarterly earnings has jumped from 73 cents to 98 cents a share in the past 30 days, indicating a 38% surge from the figure reported in the prior-year quarter. This fragrances and related products company has a trailing four-quarter earnings surprise of 41.4%, on average. IPAR delivered an earnings surprise of roughly 17% in the last reported quarter.

Inter Parfums is on track to expand its business through new licenses or acquisitions. The company has been gaining from its strategic partnerships and product launches. Inter Parfums concluded its agreement with G-III Apparel Group, Ltd. to become the exclusive worldwide licensee for the Donna Karan and DKNY fragrance brands, effective Jul 1, 2022. In December 2021, Inter Parfums signed a 10-year exclusive global licensing agreement with Emanuel Ungaro through its subsidiary, Interparfums Italia. In October 2021, Inter Parfums finalized the agreement with Salvatore Ferragamo S.p.A. Per the agreement, IPAR now holds the exclusive worldwide license for the production and distribution of Salvatore Ferragamo brand perfumes. These alliances have been working well for the company.

However, the company has been facing several challenges, including inflation, supply-chain disruptions, lockdowns, store closures, transportation issues, sanctions and currency headwinds. Apart from these, the slow recovery of international travel, logistics challenges in the United States and the war in Eastern Europe have been hurdles.

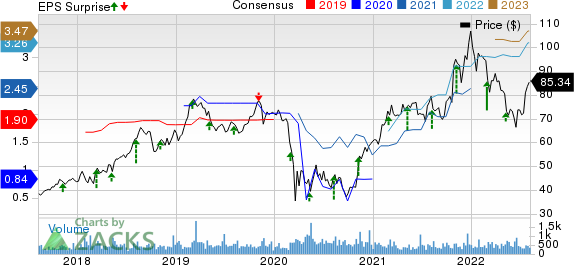

Inter Parfums, Inc. Price, Consensus and EPS Surprise

Inter Parfums, Inc. price-consensus-eps-surprise-chart | Inter Parfums, Inc. Quote

Q2 Sales Numbers

Inter Parfums recently released record sales numbers for the second quarter of 2022. For the three months ended Jun 30, 2022, net sales surged 18% to $244.7 million compared with the $207.6 million reported in the year-ago quarter. At comparable foreign currency rates, second-quarter net sales rallied 24% year over year. During the quarter, Inter Parfums’ Europe-based product sales came in at $166.3 million, up 3% from the 2021 levels. U.S.-based product sales amounted to $78.4 million, surging 69% from the second quarter of 2021.

The company highlighted that sales in its U.S. operations were impressive, with comparable quarterly gains from GUESS?, Abercrombie & Fitch, Oscar de la Renta and MCM rising 39%, 40%, 35% and 56%, respectively. Additional sales from Ferragamo fragrances also contributed to the upside. Further, legacy scents and flankers drove gains in other brands. Management launched new flankers, including Authentic Moment by Abercrombie & Fitch, and a collector’s edition of its MCM scent in the quarter under review. Also, the company launched Uomo by GUESS? in this period.

Talking about the European operations, Inter Parfums highlighted that a rise in the dollar masked the gains of well-known brands. However, brands like Montblanc, Jimmy Choo and Coach rose 6%, 4% and 13%, respectively, in the U.S dollar. In the second quarter, management launched the Moncler duo, Jimmy Choo Man Aqua and Lanvin Mon Eclat. In addition, it rolled out Montblanc Legend Red, Kate Spade Sparkle and Coach Wild Rose, which debuted in the previous quarter.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Inter Parfums this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Inter Parfums sports a Zacks Rank #1 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

Celsius Holdings CELH currently has an Earnings ESP of +17.39% and a Zacks Rank #1. CELH is expected to register top and bottom-line growth when it reports second-quarter 2022 numbers. The Zacks Consensus Estimate for Celsius Holdings’ quarterly revenues is pegged at $149.8 million, which suggests growth of 130% from the prior-year quarter’s reported figure. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celsius Holdings’ quarterly earnings has moved a penny up in the past 30 days to 8 cents per share, suggesting an improvement of 60% from the year-ago quarter’s tally. CELH delivered an earnings beat of 206.3%, on average, in the trailing four quarters.

Grocery Outlet GO currently has an Earnings ESP of +3.55% and a Zacks Rank #2. The company is likely to register a bottom-line improvement when it reports second-quarter 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 24 cents suggests a marginal improvement from the 23 cents reported in the year-ago quarter.

Grocery Outlet's top line is expected to have risen year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $859.6 million, which indicates an improvement of 10.8% from the figure reported in the prior-year quarter. GO has a trailing four-quarter earnings surprise of 4.8%, on average.

Ollie's Bargain Outlet OLLI currently has an Earnings ESP of +6.06% and a Zacks Rank of 3. The company is likely to register a rise in the top line when it reports second-quarter fiscal 2022 results. The Zacks Consensus Estimate for OLLI’s quarterly revenues is pegged at $457.5 million, which suggests a jump of 10% from the figure reported in the prior-year quarter.

The consensus mark for Ollie's Bargain’s quarterly earnings has remained unchanged at 33 cents per share in the past 30 days. The consensus estimate for OLLI’s quarterly earnings suggests a decline of 36.5% from the year-ago quarter’s reported figure. Ollie's Bargain delivered a negative earnings surprise of 17.1%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research