Inter Parfums (IPAR) Ups '23 EPS Guidance on Q2 Earnings Beat

Inter Parfums, Inc. IPAR delivered impressive second-quarter 2023 results, with the top and the bottom line increasing year over year. Earnings surpassed the Zacks Consensus Estimate. Management reaffirmed its 2023 net sales guidance and raised its earnings per share (EPS) guidance.

Results in Detail

Inter Parfums posted second-quarter earnings of $1.09 per share, up 26.7% from the year-ago quarter’s level. The metric surpassed the Zacks Consensus Estimate of 89 cents per share.

Quarterly net sales rallied 26% to $309 million compared with $245 million reported in the year-ago quarter. The company has been reaping benefits from the favorable trends and momentum in the fragrance market. The company is growing its market share with innovative programs. At comparable foreign currency rates, second-quarter net sales rallied 25% year over year.

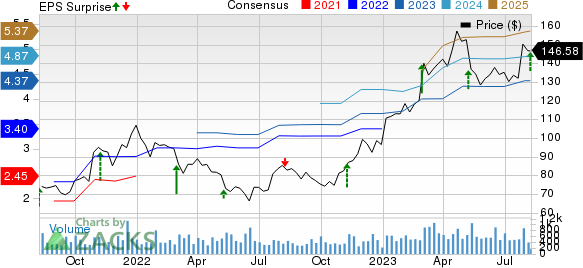

Inter Parfums, Inc. Price, Consensus and EPS Surprise

Inter Parfums, Inc. price-consensus-eps-surprise-chart | Inter Parfums, Inc. Quote

In an earlier press release, management highlighted that Inter Parfums’ second-quarter Europe-based product sales came in at $198 million, up 19% from 2022 levels. U.S.-based product sales amounted to $111 million, increasing 42% from second-quarter 2022 figures.

Three of the company’s largest brands backed up European operation's net sales increase. Coach, Jimmy Choo and Montblanc delivered sales growth of 28%, 21% and 16%, respectively. In addition, IPAR’s fragrance "jewels" — Van Cleef & Arpels and Boucheron and fashion houses — Rochas and Kate Spade performed well.

In the press release, management highlighted that strength across the overall market and 2023 launches and brand extensions, like Jimmy Choo Rose Passion, Montblanc Signature Absolue and Explorer Platinum, Coach Green and Love and Girl Life among others, led to year-to-date sales increase of 23% in European-based operations.

Growth in its U.S. operations was fueled by the solid performance of key brands in the portfolio. The company is impressed by the continued success of GUESS brands’ fragrances, up 30% year over year. The upside can be attributed to sales of the newest pillars — Seductive Blue and Uomo Acqua. IPAR also saw solid sales of Ferragamo fragrances. Oscar de la Renta also delivered an impressive performance during the second quarter. Donna Karan/DKNY brands is also performing well and has gone up to become the company’s second largest U.S.-based brand.

Meanwhile, Inter Parfums’ second-quarter gross margin came in at $188 million, up 23% from $154 million reported in the year-ago quarter. We had expected gross margin of $193.2 million. Gross margin, as a percentage of net sales was 60.9%, down 190 basis points (bps) from 62.8% reported in the year-ago quarter. We had expected the mertic to come in at 62.5%.

Quarterly operating margin came in at 17.8%, down 80 bps from 18.6% reported in the year-ago quarter. We had expected the metric to be 18.3%.

SG&A expenses in the second quarter amounted to $133.4 million, up from $108.4 million reported in the year-ago quarter.

Image Source: Zacks Investment Research

Other Financial Aspects

Inter Parfums ended the quarter with cash and cash equivalents of $74.3 million, long-term debt (excluding the current portion) of $138.6 million and total equity of $846.9 million.

Inter Parfums announced a dividend of 62.50 cents, payable on Sep 30, 2023, to shareholders of record as of Sep 15.

During the first half of 2023, management repurchased 85,060 shares worth $11.3 million. The company is likely to keep repurchasing shares during 2023.

Guidance

Management reaffirmed its 2023 net sales guidance. IPAR expects 2023 net sales to come in at $1.3 billion, reflecting 20% growth from the reported figure in 2022. The company raised its 2023 EPS guidance to $4.55 compared with $4.25 projected earlier. The outlook reflects a growth of 20% from $3.78 reported in 2022.

The guidance is based on the assumption of no major resurgence in coronavirus cases and the current level of the average dollar/euro exchange rate.

The Zacks Rank #2 (Buy) stock has increased 8.4% in the past three months against the industry’s 6.1% decline.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely Post Holdings POST, TreeHouse Foods, Inc. THS and Utz Brands Inc. UTZ.

Post Holdings, a consumer-packaged goods holding company, currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 59.6% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current fiscal year sales and earnings suggests growth of 13% and 141.1%, respectively, from the corresponding year-ago reported figures.

TreeHouse Foods, a packaged food and beverage manufacturer, currently carries a Zacks Rank #2 (Buy). THS has a trailing four-quarter earnings surprise of 31.4% on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported numbers.

Utz Brands, which manufactures a diverse portfolio of salty snacks, currently has a Zacks Rank #2. UTZ’s expected EPS growth rate for three to five years is 10.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal-year sales suggests growth of 3.5% from the year-ago reported numbers. UTZ has a trailing four-quarter earnings surprise of 16.9% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report