Inter Parfums's (NASDAQ:IPAR) Q4 Sales Top Estimates

Fragrance and perfume company Inter Parfums (NASDAQ:IPAR) announced better-than-expected results in Q4 FY2023, with revenue up 5.8% year on year to $328.7 million. On the other hand, the company's full-year revenue guidance of $1.45 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $0.32 per share, down from its profit of $0.52 per share in the same quarter last year.

Is now the time to buy Inter Parfums? Find out by accessing our full research report, it's free.

Inter Parfums (IPAR) Q4 FY2023 Highlights:

Revenue: $328.7 million vs analyst estimates of $323.8 million (1.5% beat)

EPS: $0.32 vs analyst expectations of $0.35 (9.5% miss)

Management's revenue guidance for the upcoming financial year 2024 is $1.45 billion at the midpoint, missing analyst estimates by 0.5% and implying 10% growth (vs 21.9% in FY2023)

Gross Margin (GAAP): 64.7%, up from 56.1% in the same quarter last year

Market Capitalization: $4.88 billion

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

Personal Care

Personal care products may seem more discretionary than food, but consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

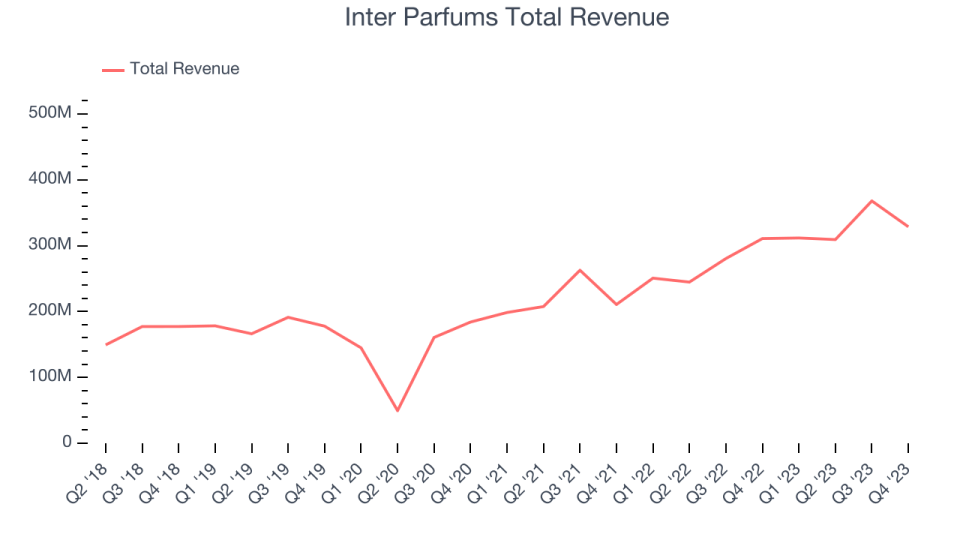

As you can see below, the company's annualized revenue growth rate of 34.7% over the last three years was incredible for a consumer staples business.

This quarter, Inter Parfums reported solid year-on-year revenue growth of 5.8%, and its $328.7 million in revenue outperformed Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects sales to grow 10.7% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

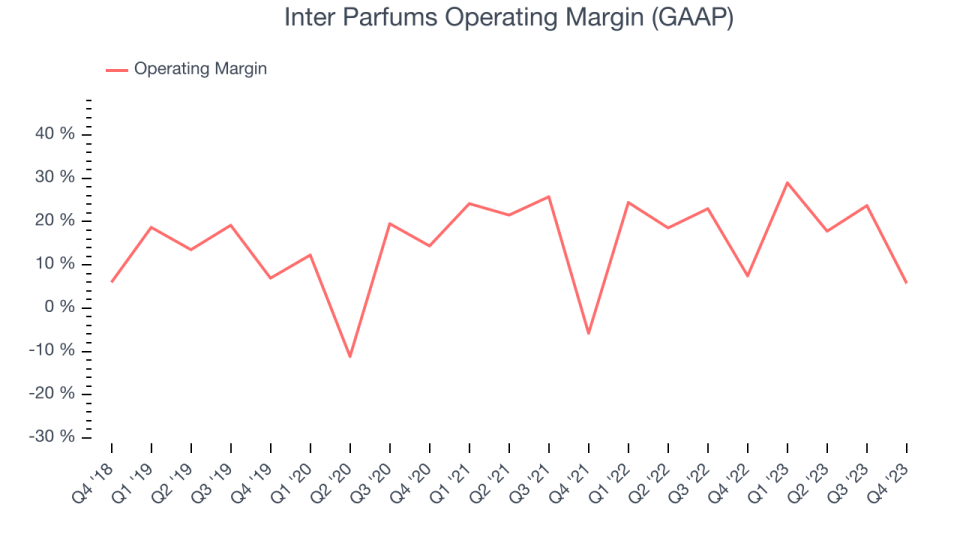

This quarter, Inter Parfums generated an operating profit margin of 5.7%, down 1.7 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, Inter Parfums has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.5%. On top of that, its margin has risen by 1.2 percentage points on average over the last year, showing the company is improving its fundamentals.

Key Takeaways from Inter Parfums's Q4 Results

It was good to see Inter Parfums beat analysts' revenue expectations this quarter. On the other hand, its EPS and operating margin missed analysts' expectations and sales outlook was also weaker than expected. Overall, this was a mediocre quarter for Inter Parfums. The stock is flat after reporting and currently trades at $154 per share.

So should you invest in Inter Parfums right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.