Interactive Brokers: A Brokerage Powerhouse With Upside Potential

Interactive Brokers Group Inc. (NASDAQ:IBKR) recently announced its fourth-quarter earnings results, demonstrating robust growth in total account numbers, client equity and the highest margin in the brokerage industry. Given these factors, I believe the current trading price undervalues the stock, suggesting potential opportunities.

Evolving revenue dynamics

One of the world's largest automated global electronic brokers, Interactive Brokers serves a diverse clientele, including mutual funds, exchange-traded funds, registered investment advisors and individual investors. The company facilitates orders across over 150 electronic exchanges and market centers in 33 countries, dealing with 26 currencies. A key strength is its commitment to internal development and the deployment of automated technology tailored for the financial markets. The company continuously revises and upgrades its software to ensure optimal performance and to adapt to rapidly evolving market conditions. By 2023, Interactive Brokers had amassed 2.56 million customers across more than 200 countries and territories.

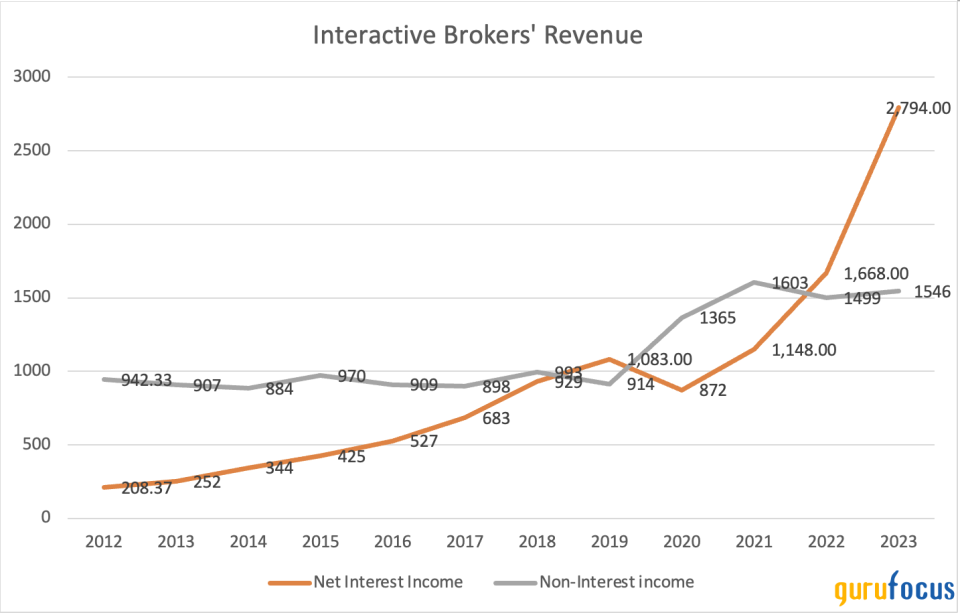

Interactive Brokers' revenue streams are primarily composed of net interest income and non-interest income. While the non-interest income, encompassing commissions and other trading fees & services, previously held more prominence, the net interest income, which is generated from interest on customer margin loans and interest earned on customers' cash balances, has evolved to become the most significant part of the company's business.

In 2012, non-interest income was the predominant revenue source for the company, contributing $942.3 million, nearly 82% of the total revenue for that year. However, since then, there has been a significant shift. From 2012 to 2023, net interest income surged dramatically, increasing more than 13 times from $208.40 million to $2.75 billion. Meanwhile, the non-interest income also grew, but at a slower pace, rising by 64% during the same period, from $942.30 million to $1.55 billion. In 2023, net interest income accounted for 64.4% of the total revenue, while non-interest income represented 35.6%. This shift underscores the growing importance of net interest income in Interactive Brokers' business model over the past decade.

Source: Author's table

Record financial performance and market expansion

In 2023, Interactive Brokers demonstrated a strong financial performance characterized by diverse revenue streams and effective expense management. The company reported a significant increase in commissions, reaching $348 million for the quarter and accumulating to $1.4 billion for the entire year, marking a 3% growth from 2022. This rise was primarily fueled by heightened trading volumes in options and futures. Notably, net interest income stood out as a robust revenue source, hitting $730 million for the quarter and culminating in a record $2.8 billion for the year, reflecting a risk-on environment that spurred higher margin lending and increased yields on margin loans and segregated cash. Chief Financial Officer Paul Brody highlighted its sensitivity to interest rate changes, estimating a $56 million reduction in annual net interest income for each 25-basis point decrease in the benchmark federal funds rate.

On the expenditure front, the execution, clearing and distribution costs increased to $100 million for the quarter and $386 million for the year, echoing the higher trading volumes in options and futures. The compensation and benefits expenses were steady at $136 million for the quarter, maintaining a consistent ratio of compensation expenses to adjusted net revenues at 12%, mirroring last year's figures. This consistency in managing expenses highlights the company's strategic approach to balancing growth and expenditure.

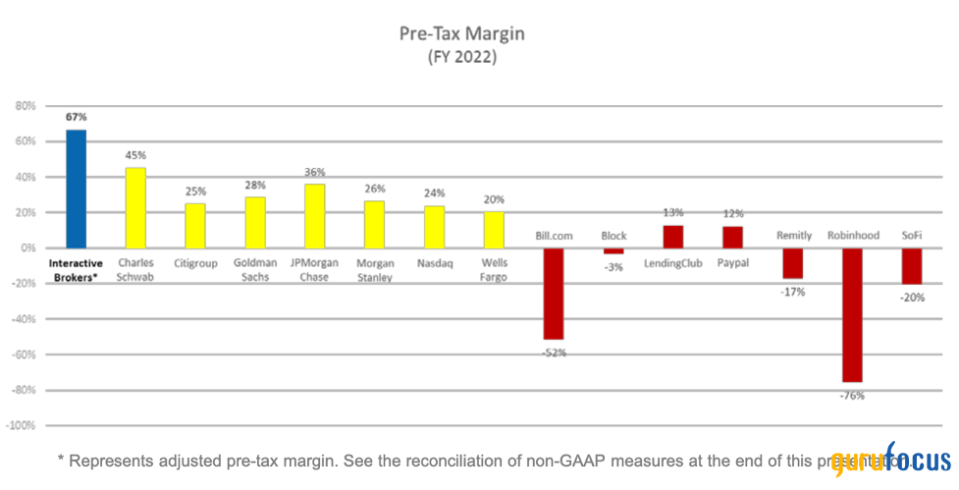

Interactive Brokers stands out in the industry, primarily due to its leading automation technology, which positions the company as one of the lowest cost processors while simultaneously enjoying the highest operating margin. Compared to its peers, which include Charles Schwab (NYSE:SCHW), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM), Interactive Brokers boasts an unparalleled pre-tax margin. It leads the industry with a 67% pre-tax margin, while Charles Schwab ranked second with a 45% pre-tax margin. Other notable competitors, such as JPMorgan Chase, Citigroup and Goldman Sachs, have significantly lower margins at 36%, 25% and 28%, respectively. Notably, the company further enhanced its competitive edge last year with its operating margin climbing to nearly 71%. This exceptional margin underscores the company's operational efficiency and ability to generate substantial profit relative to its earnings. Such a high pretax margin not only indicates the company's financial health, but also speaks volumes about its competitive edge.

Source: Interactive Brokers' presentation

2023 also marked a period of significant expansion for Interactive Brokers in terms of customer base and financial assets. The company's total customer accounts saw a 23% increase, reaching 2.56 million. In tandem, there was a substantial 39% increase in customer equity, rising to $426 billion. The growth trajectory continued with consumer credit, which experienced a 10% rise, reaching $104.5 billion, and customer margin loans surged by 14% to $44.4 billion. This overall growth underscores Interactive Brokers' expanding market presence and the increasing trust of its customers in its financial services.

Solid balance sheet

Interactive Brokers has a robust balance sheet. The company recorded a 12% growth in total assets, reaching $128 billion, driven mainly by higher customer cash and margin loan balances. Total equity amounted to $14.1 billion, including $3.75 billion in cash and cash equivalents. A key highlight of Interactive Brokers' financial stability is its absence of long-term debt, emphasizing its significant capital base and liquidity. This strategic financial positioning enables Interactive Brokers to support its business operations and customer needs effectively, especially during periods of market stress.

Potential upside

The trajectory of Interactive Brokers is not just a story of consistent growth and strategic innovation, but also significant investment potential. The company's robust financial performance, with its debt-free balance sheet, positions it as a stalwart in the brokerage industry. By 2024, it is expected to generate $4.64 billion in revenue, with around $6.27 in earnings per share. Applying a five-year average earnings multiple of 21.95, Interactive Brokers should be worth nearly $138 per share, 53% higher than the current share price, making it an intriguing prospect for investors seeking value and growth in a dynamic and competitive financial market.

This article first appeared on GuruFocus.