Interactive Brokers Group Inc. Reports Solid Earnings Growth in Q4 2023

Adjusted Earnings Per Share (EPS): Increased to $1.52 in Q4 2023 from $1.30 in the year-ago quarter.

Net Revenues: Grew to $1,149 million, adjusted, compared to $958 million in the same period last year.

Income Before Income Taxes: Rose to $831 million, adjusted, from $671 million in Q4 2022.

Dividend Announcement: A quarterly cash dividend of $0.10 per share payable on March 14, 2024.

Comprehensive Income: Comprehensive income available for common stockholders was $197 million in Q4 2023.

Customer Equity: Increased to $352.7 billion, up 45% from the year-ago quarter.

Client Accounts: Grew 61% to 1.92 million in Q4 2023 compared to the prior year.

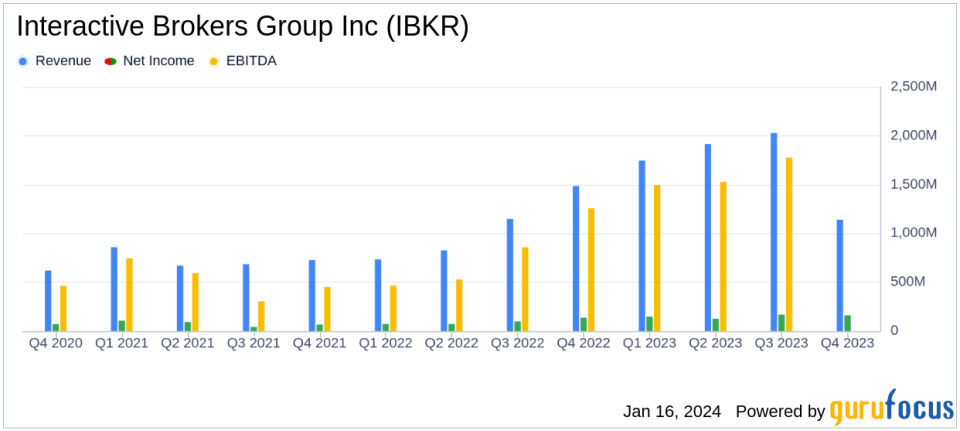

On January 16, 2024, Interactive Brokers Group Inc (NASDAQ:IBKR), a leading automated global electronic broker, released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The company reported a GAAP diluted EPS of $1.48 and an adjusted EPS of $1.52, marking an increase from the year-ago quarter's $1.31 and $1.30, respectively. Net revenues also saw a significant uptick, with GAAP net revenues at $1,139 million and adjusted net revenues at $1,149 million, compared to the previous year's $976 million and $958 million, respectively.

Interactive Brokers generates trading commissions, which account for approximately 43% of net revenue, by facilitating trades in a variety of products such as equity, options, futures, foreign exchange, bonds, mutual funds, and ETFs. The company also earns net interest income, representing about 54% of net revenue, from idle client cash and charges fees for ancillary services, contributing around 6% of net revenue. Despite a small negative impact from principal trading and other activities, the firm continues to derive the majority of its net revenue from the U.S., with international markets contributing about 30%.

Financial Performance and Strategic Highlights

Interactive Brokers Group Inc (NASDAQ:IBKR) reported income before income taxes of $816 million for the current quarter, with an adjusted figure of $831 million. This represents a substantial increase from the $689 million reported in the same quarter of the previous year, and an adjusted income of $671 million. The company's Board of Directors declared a quarterly cash dividend of $0.10 per share, payable on March 14, 2024, to shareholders of record as of March 1, 2024.

The company's currency diversification strategy, which involves basing its net worth in GLOBALsa basket of 10 major currenciesresulted in a $139 million increase in comprehensive earnings for the quarter, as the U.S. dollar value of the GLOBAL increased by approximately 1.05%. This strategy's effects are reported as components of Other Income (loss of $9 million) and Other Comprehensive Income (gain of $148 million).

Key Financial Metrics and Tables

Interactive Brokers Group Inc (NASDAQ:IBKR) has demonstrated robust financial health in its balance sheet, with total assets increasing to $128.423 billion as of December 31, 2023, from $115.143 billion the previous year. The company's equity also saw a significant rise, with stockholders' equity at $3.584 billion and noncontrolling interests at $10.483 billion, compared to $2.848 billion and $8.767 billion, respectively, at the end of 2022.

On the operational front, the company's trade volumes reflect a slight decrease in cleared customer trades and non-cleared customer trades, with a 9% and 16% year-over-year decline, respectively. However, principal trades increased by 12%, indicating a mixed performance in trading activity.

Interactive Brokers Group Inc (NASDAQ:IBKR) continues to attract and retain clients, as evidenced by the 61% increase in client accounts, reaching 1.92 million in the fourth quarter of 2023. Customer equity also grew significantly by 45% to $352.7 billion, showcasing the company's ability to expand its customer base and assets under management.

Conclusion and Forward Outlook

The fourth quarter results of Interactive Brokers Group Inc (NASDAQ:IBKR) reflect a company that is successfully navigating the complexities of the capital markets industry. With solid increases in key financial metrics such as adjusted EPS, net revenues, and income before income taxes, the company is well-positioned for continued growth. The strategic focus on technology and automation, coupled with a diversified currency strategy, has contributed to the company's strong performance and resilience in a competitive market.

Investors and analysts may find the adjusted financial measures particularly useful for evaluating the company's core operating results and for making meaningful comparisons to past and future periods. As Interactive Brokers Group Inc (NASDAQ:IBKR) moves forward, it will be important to monitor how these financial trends evolve and how the company adapts to the ever-changing landscape of global finance.

Explore the complete 8-K earnings release (here) from Interactive Brokers Group Inc for further details.

This article first appeared on GuruFocus.