Intercontinental Exchange Inc (ICE) Reports Record Full Year 2023 Results

Full Year 2023 Net Revenues: $8.0 billion, a 10% increase year-over-year.

GAAP Diluted EPS: $4.19 for 2023, up 62% compared to the previous year.

Adjusted Diluted EPS: $5.62 for 2023, representing a 6% year-over-year growth.

Operating Income: Record $3.7 billion in 2023, with a 2% increase from the prior year.

Operating Margin: Reported at 46% for 2023, with an adjusted operating margin of 59%.

Dividends: Nearly $1 billion returned to stockholders in 2023.

Strategic Acquisitions: Completed acquisition of Black Knight on September 5, 2023.

On February 8, 2024, Intercontinental Exchange Inc (NYSE:ICE), a leading operator of global exchanges and provider of data services, released its 8-K filing, announcing robust financial results for the full year of 2023. ICE's performance reflects its 18th consecutive year of record revenues, underscoring the company's ability to thrive amidst a dynamic macroeconomic environment and capitalize on strong secular tailwinds.

Intercontinental Exchange is a vertically integrated operator of financial exchanges, including the renowned New York Stock Exchange, and provides a suite of ancillary data products. The company's derivatives exchange is a significant part of its operations, with the ICE Brent crude futures contract being its largest commodity futures product. ICE's business is divided into three main segments: exchanges, which contribute about 56% of net revenue; mortgage technology, accounting for 15% of net revenue; and fixed-income and data services, making up 29% of net revenue.

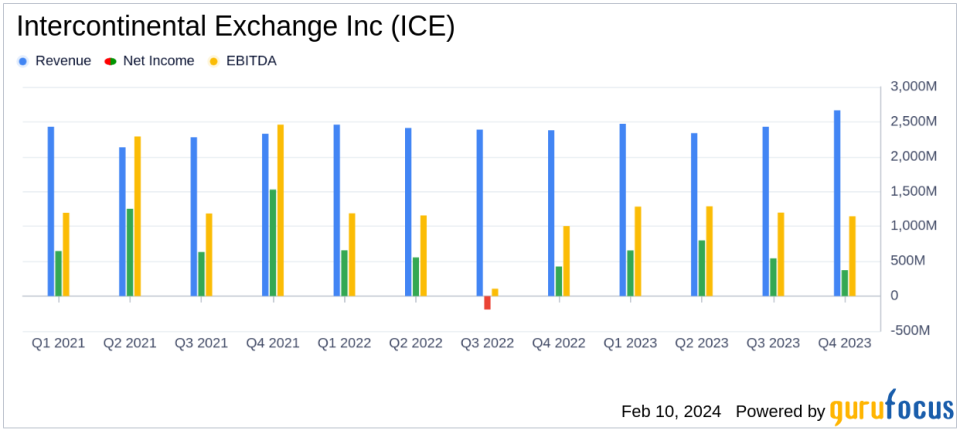

ICE's full-year 2023 net revenues reached $8.0 billion, a 10% increase year-over-year, driven by growth across all business segments. The company's GAAP diluted earnings per share (EPS) soared to $4.19, marking a 62% increase from the previous year, while adjusted diluted EPS grew by 6% to $5.62. The record operating income of $3.7 billion, up 2% year-over-year, and an adjusted operating income of $4.7 billion, up 9% year-over-year, reflect ICE's operational efficiency and strategic execution.

Jeffrey C. Sprecher, ICE Chair & Chief Executive Officer, emphasized the company's commitment to innovation and growth, stating:

"We are pleased to report our 18th consecutive year of record revenues and another year of earnings per share growth. A dynamic macro environment and strong secular tailwinds across our business continue to drive customers to our diverse, liquid markets and our mission-critical data and SaaS technologies to manage risk and capture efficiencies. As we look to 2024 and beyond, we remain focused on innovating across asset classes to serve the needs of our customers and deliver growth for our stockholders."

ICE's financial achievements are particularly significant for a company in the capital markets industry, where the ability to adapt to changing market conditions and maintain a diverse portfolio of revenue-generating activities is critical. The company's robust operating margin of 46% and adjusted operating margin of 59% demonstrate its strong profitability and operational leverage.

Key financial metrics from ICE's income statement include a 25% year-over-year increase in fourth-quarter consolidated net revenues to $2.2 billion, with exchange net revenues of $1.1 billion, fixed income and data services revenues of $563 million, and mortgage technology revenues of $502 million. The balance sheet remains solid, with nearly $1 billion returned to stockholders through dividends in 2023, highlighting ICE's commitment to shareholder returns. The cash flow statement reflects the company's healthy cash generation capabilities, with adjusted free cash flow providing the liquidity needed to pursue strategic acquisitions, such as the recent purchase of Black Knight.

Warren Gardiner, ICE Chief Financial Officer, added:

"In 2023, we once again generated record revenues and record operating income. This performance is a clear testament to the strength of our strategically diversified business model, which, through an array of macroeconomic environments, continues to deliver consistent and compounding growth for our stockholders. As we enter 2024, we remain well positioned to benefit from numerous cyclical tailwinds and secular trends."

Overall, ICE's financial performance in 2023 underscores its resilience and strategic agility in navigating a complex and evolving market landscape. With a focus on innovation and customer service, ICE is well-positioned to continue its growth trajectory and deliver value to its stockholders.

For a more detailed analysis of ICE's financial results and future outlook, investors and interested parties are encouraged to review the full earnings release and join the earnings conference call.

Explore the complete 8-K earnings release (here) from Intercontinental Exchange Inc for further details.

This article first appeared on GuruFocus.