Interface Inc (TILE) Reports Mixed Fiscal Year 2023 Results Amid Market Challenges

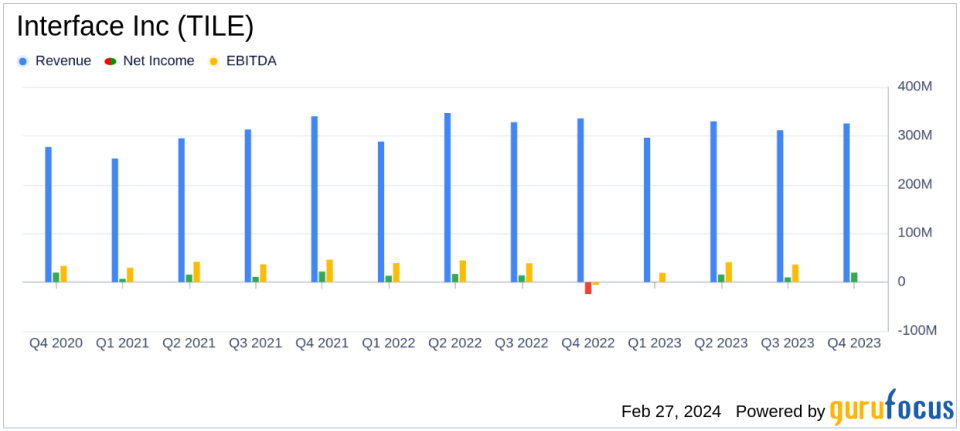

Net Sales: $1,261.5 million for FY 2023, a decrease of 2.8% year-over-year.

Gross Profit Margin: Improved to 35.0% for FY 2023, up 124 basis points from the previous year.

Net Income: GAAP net income of $44.5 million, or $0.76 per diluted share for FY 2023.

Debt Repayment: Repaid $105.3 million of debt in FY 2023, strengthening the balance sheet.

Cash Flow: Generated $142.0 million of cash from operations during FY 2023.

Interface Inc (NASDAQ:TILE), a global leader in commercial flooring and sustainability, released its 8-K filing on February 27, 2024, detailing its financial performance for the fourth quarter and the full fiscal year ended December 31, 2023. The company, known for its carpet tile, Luxury Vinyl tiles, and rubber flooring, serves various markets including corporate and non-corporate offices, government, education, healthcare, hospitality, and retail across the Americas, Europe, and Asia-Pacific regions.

Despite a 3.1% year-over-year decline in fourth-quarter net sales, which totaled $325.1 million, Interface Inc (NASDAQ:TILE) saw a significant increase in its gross profit margin, which rose to 37.9%, up 646 basis points from the previous year. The full-year net sales experienced a slight decrease of 2.8% to $1,261.5 million, with a gross profit margin increase of 124 basis points to 35.0%. The company attributes these margin improvements to input cost deflation, higher selling prices, and favorable product mix, which helped offset the impact of lower sales volumes and fixed cost absorption.

Financial Highlights and Challenges

For the fiscal year 2023, Interface Inc (NASDAQ:TILE) reported GAAP earnings per share of $0.76 and adjusted earnings per share of $1.00. The company generated a robust $142.0 million in cash from operations and made significant strides in debt reduction, repaying $105.3 million. The education market segment emerged as a strong performer with a 5% increase in sales, particularly in the Americas. However, Interface faced challenges in the retail sector, which contributed to the overall decline in net sales for both the fourth quarter and the full year.

CEO Laurel Hurd acknowledged the impact of retail softness on net sales but expressed confidence in the company's strategy and commercial excellence. CFO Bruce Hausmann highlighted the company's momentum in gross profit margin and commitment to debt repayment and reinvestment in the business.

"Strong fourth quarter performance rounded out a solid year, reinforcing our confidence that our strategy is working," said Laurel Hurd, CEO of Interface.

"We are intently focused on commercial excellence and leveraging our strengths as one global organization," Hurd added.

"Interface ended 2023 with strong momentum on the gross profit margin line as we continued to hold price and drive favorable mix geographically and across product lines," stated Bruce Hausmann, CFO of Interface.

Segment Performance and Outlook

The Americas segment reported a 3.9% decrease in Q4 net sales, while the EAAA segment saw a 1.9% decline. For the full year, the Americas segment's net sales decreased by 2.2%, and the EAAA segment's net sales fell by 3.6%. Despite these decreases, both segments reported improvements in operating income and adjusted operating income (AOI).

Looking ahead to the first quarter of fiscal year 2024, Interface anticipates net sales between $280 million and $290 million, with an adjusted gross profit margin of approximately 36.0%. For the full fiscal year 2024, the company expects net sales between $1.26 billion and $1.28 billion, with an adjusted gross profit margin between 35.5% and 35.8%.

Interface Inc (NASDAQ:TILE) continues to navigate a dynamic market environment while maintaining a focus on growth, operational efficiency, and shareholder value. The company's commitment to sustainability and innovation positions it to capitalize on future opportunities despite ongoing challenges in the retail sector.

For a detailed analysis of Interface Inc's financial performance and future outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Interface Inc for further details.

This article first appeared on GuruFocus.