International Artal Sells 2,000,000 Shares of Cava Group Inc (CAVA)

Director and 10% Owner International Artal has sold 2,000,000 shares of Cava Group Inc (NYSE:CAVA) on March 21, 2024, according to a recent SEC filing. The transaction was executed at a price of $66.25 per share, resulting in a total value of $132,500,000.

Cava Group Inc is a culinary brand that operates a chain of fast-casual restaurants, offering Mediterranean-inspired dishes. The company focuses on providing healthy, flavorful food options with an emphasis on convenience and customization. Cava Group Inc has been expanding its presence and aims to cater to the growing consumer demand for quick and nutritious meals.

Over the past year, International Artal has sold a total of 5,500,000 shares of Cava Group Inc and has not made any purchases of the company's stock. This latest transaction continues the trend of share disposals by the insider.

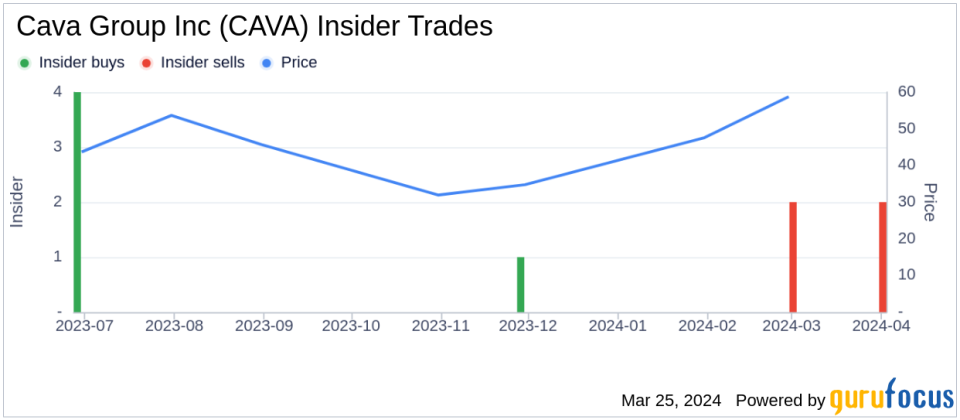

The insider transaction history for Cava Group Inc shows a pattern of insider activity. There have been 5 insider buys and 4 insider sells over the past year. This activity provides a glimpse into the sentiment of those with intimate knowledge of the company.

On the valuation front, Cava Group Inc's shares were trading at $66.25 on the day of the insider's recent sell, giving the company a market cap of approximately $7.78 billion. The price-earnings ratio stands at 1137.50, which is significantly above both the industry median of 23.67 and the company's historical median price-earnings ratio.

The insider's recent sell transaction is part of a broader context of insider trading activity at Cava Group Inc. Investors often monitor such insider transactions as part of their analysis, considering them alongside other financial data and market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.