International Flavors & Fragrances Inc (IFF) Faces Challenges Despite Revenue Resilience

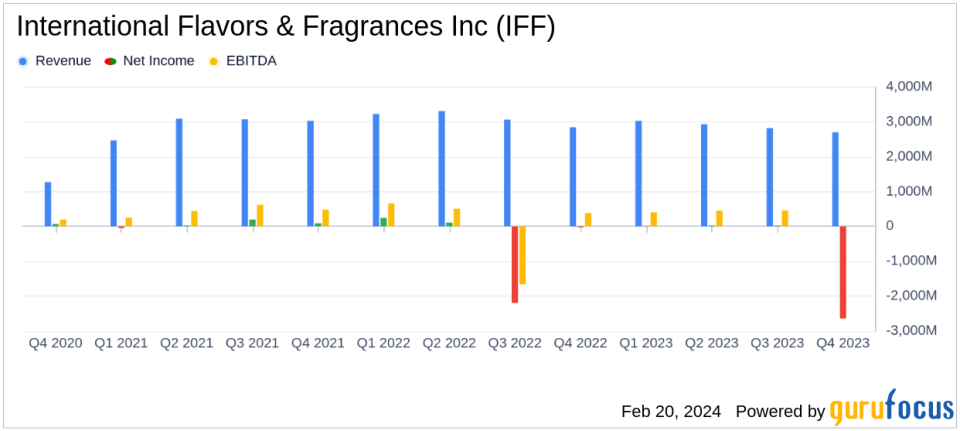

Sales: Q4 sales decreased by 5% year-over-year to $2.7 billion; full-year sales down 8% to $11.5 billion.

Net Loss: Reported a significant net loss of $2.61 billion in Q4 and $2.57 billion for the full year, largely due to a non-cash goodwill impairment charge.

Adjusted Operating EBITDA: Q4 adjusted operating EBITDA increased 17% on a currency neutral basis; full-year adjusted operating EBITDA declined 10%.

Earnings Per Share (EPS): Q4 reported EPS was $(10.21); adjusted EPS excluding amortization was $0.72.

Free Cash Flow: Generated $936 million in free cash flow for the full year.

Dividend Policy Update: Quarterly dividend reduced by approximately 50% to $0.40 per share to enable faster balance sheet deleveraging.

2024 Financial Guidance: Sales expected to be between $10.8 billion and $11.1 billion; adjusted operating EBITDA projected to be $1.9 billion to $2.1 billion.

On February 20, 2024, International Flavors & Fragrances Inc (NYSE:IFF) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in specialty ingredients for various industries, faced a challenging year marked by a non-cash goodwill impairment charge that significantly impacted its net income.

Company Overview

International Flavors & Fragrances is a prominent player in the production of specialty ingredients, catering to the food, beverage, health, household goods, personal care, and pharmaceutical industries. With a focus on proprietary formulations, IFF works closely with customers to provide tailored solutions. The company's Nourish segment, responsible for approximately half of its revenue, is a leading flavor producer and also offers texturants and plant-based proteins. The Health and Biosciences segment, accounting for about a quarter of revenue, is a global leader in probiotics and enzymes. Additionally, IFF is a top fragrance producer and supplies pharmaceutical ingredients such as excipients and time-release polymers.

Financial Performance and Challenges

IFF's fourth quarter saw a 5% decline in sales compared to the previous year, with full-year sales also decreasing by 8% to $11.5 billion. The company reported a substantial net loss attributable to shareholders, primarily due to a $2.6 billion non-cash goodwill impairment charge related to the Nourish reporting unit. This impairment was driven by increased interest rates, lower business projections, and continued cost inflation.

Despite these challenges, IFF achieved a 17% increase in currency neutral adjusted operating EBITDA for the fourth quarter, reflecting favorable net pricing and productivity gains. However, the full-year currency neutral adjusted operating EBITDA decreased by 10%, mainly due to lower volumes and unfavorable manufacturing absorption related to inventory reduction efforts.

Financial Achievements and Importance

IFF's financial achievements in the fourth quarter, such as the growth in adjusted operating EBITDA, underscore the company's ability to navigate a tough economic environment through strategic pricing and productivity improvements. These achievements are crucial for maintaining competitiveness in the chemicals industry, where margins can be significantly impacted by raw material costs and economic fluctuations.

Key Financial Metrics

Key metrics from IFF's financial statements include:

A reported net loss per share of $(10.21) for Q4 and $(10.05) for the full year.

Adjusted EPS excluding amortization of $0.72 for Q4 and $3.34 for the full year.

Operating cash flow of $1.44 billion for the full year, with free cash flow totaling $936 million.

Total debt to trailing twelve months net loss at (3.9)x and net debt to credit-adjusted EBITDA at 4.5x at the end of Q4.

"In the fourth quarter, IFF delivered solid results, including a sequential improvement in volume and double-digit adjusted operating EBITDA growth on a comparable currency neutral basis," said IFF CEO Erik Fyrwald. "As we look ahead, we recognize that the operating environment remains uncertain, yet we are cautiously optimistic that we can deliver improved financial results for our shareholders in 2024."

Analysis of Performance

IFF's performance in 2023 was a mix of resilience and setbacks. The company's ability to grow its adjusted operating EBITDA amidst a challenging economic landscape demonstrates its operational strength. However, the significant goodwill impairment indicates the need for strategic reassessment, particularly within the Nourish segment. The revised dividend policy reflects a prudent approach to balance sheet management, prioritizing financial flexibility and debt reduction.

Looking forward, IFF's guidance for 2024 suggests cautious optimism, with expected sales growth and a focus on volume improvements and productivity gains. The company's strategic adjustments, including the dividend cut, aim to position it for a stronger financial footing in the face of ongoing macroeconomic uncertainty.

For a more detailed analysis and up-to-date information on International Flavors & Fragrances Inc (NYSE:IFF), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from International Flavors & Fragrances Inc for further details.

This article first appeared on GuruFocus.