International Paper Co Reports Mixed Results Amidst Market Challenges

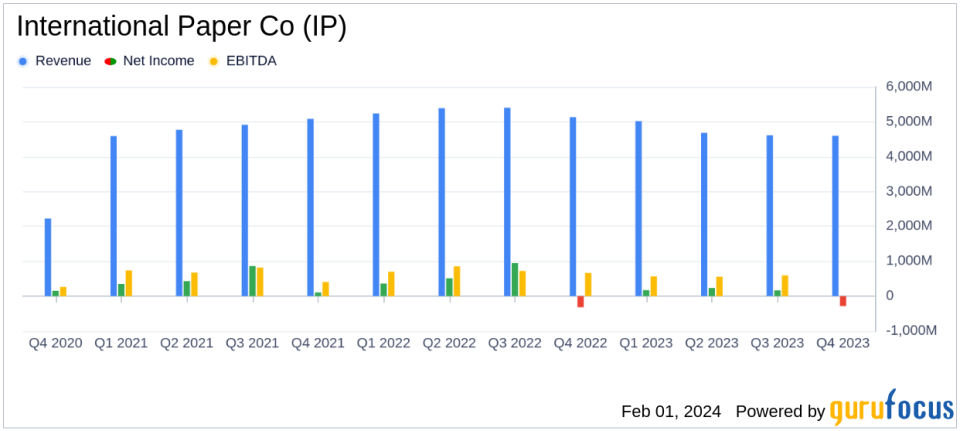

Net Earnings: Full-year net earnings of $288 million, with a fourth-quarter net loss of $(284) million.

Adjusted Operating Earnings: $755 million for the full year and $142 million for the fourth quarter.

Revenue: Full-year net sales of $18.9 billion, a decrease from $21.2 billion in the previous year.

Shareholder Returns: Returned $839 million to shareholders through repurchases and dividends.

Capital Investments: $1.1 billion invested, focusing on packaging growth.

Cash Flow: Generated $1.8 billion in cash from operations and $692 million in free cash flow for the year.

Operational Challenges: Lower demand and cost inflation impacted earnings, despite cost reduction efforts.

On February 1, 2024, International Paper Co (NYSE:IP) released its 8-K filing, detailing its financial results for the full year and fourth quarter of 2023. The company, a leading manufacturer of packaging products and cellulose fibers, faced a challenging market environment but managed to exceed its annual target for the Building a Better IP initiative benefits.

International Paper Co, which controls approximately one-third of the North American corrugated packaging market and has significant operations in Brazil, Russia, India, and China, reported a decline in full-year net sales to $18.9 billion from $21.2 billion in the previous year. Despite this, the company's full-year adjusted operating earnings reached $755 million, or $2.16 per diluted share, outperforming the prior year's $1,168 million.

Financial Performance and Strategic Actions

The full-year net earnings were reported at $288 million, or $0.82 per diluted share, including a pre-tax charge of $540 million related to mill strategic actions. The fourth quarter saw a net loss of $(284) million, or $(0.82) per diluted share. However, when adjusted for special items, the fourth quarter operating earnings were $142 million, or $0.41 per diluted share.

Chairman and CEO Mark Sutton highlighted the company's agility in navigating market conditions, emphasizing the execution of strategic actions to optimize the mill system and invest in future growth. Despite lower demand and cost inflation, the company managed to deliver significant benefits from its Building a Better IP initiatives, totaling $260 million for the year.

"In 2023, the International Paper team demonstrated our agility by navigating through challenging market conditions, said Mark Sutton, Chairman and Chief Executive Officer. We executed well and delivered $260 million of Building a Better IP benefits, while accelerating cost reduction efforts across our operations and supply chain."

Segment Performance and Capital Allocation

International Paper Co's Industrial Packaging segment reported operating profits of $315 million in the fourth quarter, a slight decrease from the third quarter. The Global Cellulose Fibers segment faced a loss of $(58) million, attributed to lower pulp pricing and higher planned outage costs.

The company remained committed to shareholder returns, repurchasing shares and paying dividends totaling $839 million. Capital investments for the year amounted to $1.1 billion, with a focus on packaging for future growth. Cash provided by operations was robust at $1.8 billion, and the company generated $692 million in free cash flow.

Outlook and Market Conditions

Looking ahead to 2024, CEO Sutton expressed confidence in the company's ability to create value for customers and shareholders, with a focus on demand growth across markets served and continued acceleration of commercial strategies to drive operational excellence and improve profitability.

"As we enter 2024, Sutton added, we remain committed to creating value for our customers and shareowners. We see demand growth across the markets we serve. Because our Building a Better IP mindset is embedded into our culture, we will continue to accelerate our commercial strategies and drive operational excellence to improve profitability."

International Paper Co's performance in 2023 reflects a company adapting to market challenges while maintaining a focus on strategic growth and shareholder value. The full-year and fourth quarter results, though mixed, demonstrate the company's resilience and commitment to long-term success.

For a more detailed analysis of International Paper Co's financial results and strategic initiatives, investors and interested parties can access the full earnings webcast and additional information on the company's website.

Explore the complete 8-K earnings release (here) from International Paper Co for further details.

This article first appeared on GuruFocus.