International Paper (IP) Down 11% in a Year: Will It Recover?

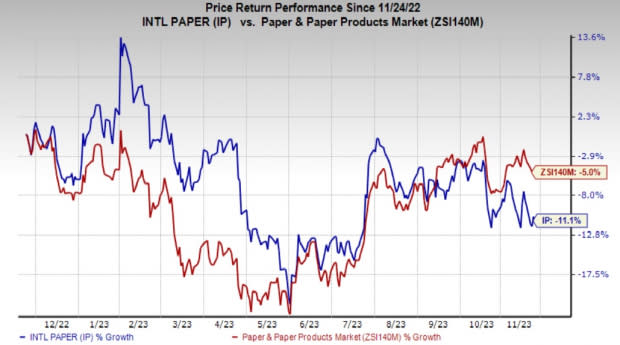

Shares of International Paper Company IP have lost 11% in the past year, reflecting the decline in volumes witnessed by the company in the past few quarters.

The industry it belongs to has witnessed a 5% fall in the same timeframe.

Image Source: Zacks Investment Research

Decline in Volumes Ails International Paper

International Paper has been witnessing weak demand as current inflationary pressures have been impacting consumers, leading to lower demand for goods. This had a large impact on packaging demand, as consumer priorities have shifted toward non-discretionary goods and services. Also, International Papers’ customers and the broader retail channel have been trying to lower their elevated inventories, which further impacted the demand.

In fiscal 2022, the company had reported a 5.7% decline in sales volumes in the Industrial Packaging segment and 2.6% lower volumes in the Global Cellulose Fibers segment. This continued in the first three quarters of 2023 as well. Volumes in Industrial Packaging were down 10.2% in the first quarter of 2023, followed by an 8.9% drop in the second quarter and 5.5% in the third quarter.

The Global Cellulose Fibers segment reported volume declines of 3.4%, 13.2% and 7.7% in the first, second and third quarters respectively. This negative trend in volume growth, along with lower prices and high costs, have weighed on the segments’ margin performances.

International Paper has a market capitalization of around $11.4 billion. It currently carries a Zacks Rank #3 (Hold). Let’s discuss the factors that indicate that the stock might stage a comeback.

Volume to Pick Up Eventually

The majority of customer destocking is expected to be completed by the end of this year. In the fourth quarter of 2023, volumes in the Industrial Packaging segment are expected to improve sequentially due to seasonal factors. We expect the severity of the volume declines to lessen in 2024 as the situation normalizes.

The company will gain on solid demand for corrugated and containerboard packaging going forward as it plays a critical role in the supply chain to bring essential products to consumers. This will aid the Industrial Paper segment’s results. The Global cellulose fibers segment will gain on the demand for absorbent personal care products.

Costs Headwinds to Lessen

IP, which had so far been impacted by higher-than-expected costs for chemicals, energy and distribution, stated that it now expects these costs to assume normal levels. The company now expects lower energy, fiber and freight to contribute to earnings growth henceforth. However, higher OCC costs remain a concern.

Savings from Initiatives to Boost Earnings

International Paper achieved $250 million in earnings through Building a Better IP initiatives in 2022, exceeding the target of $200-$225 million in gross incremental earnings. The company has already realized $195 million of year-over-year incremental earnings improvement in the first three quarters of 2023, exceeding its total expectation of $125 -$150 million stated for the full year.

The company has achieved this by streamlining the organization and reducing overhead spending. Efforts to drive process optimization by leveraging advanced technology and data analytics to improve efficiencies and lower costs across its large system of mills and box plants have aided earnings. Optimizing customer order scheduling and transportation planning as well as mill monitoring and process control have also contributed to the improvement.

Ongoing Investments to Aid Growth

The company's efforts to reduce its debt levels appear encouraging. International Paper’s total debt has gone down from $11 billion at the end of 2016 to $5.7 billion as of the end of the third quarter of 2023. The company has limited medium-term debt maturities, with about $1.6 billion due over the next 10 years. Its qualified pension plan is fully funded.

In the first nine-month period of 2023, the company has paid back $679 million to shareholders as dividends and share repurchases. The company has a remaining share repurchase authorization of $2.96 billion. For 2023, the company is targeting capital spending of $1.1 billion to $1.2 billion. It continues to assess disciplined and selective M&A opportunities, particularly in packaging businesses in North America and Europe. Mergers and acquisitions are a key strategy for International Paper to strengthen its packaging business.

Stocks to Consider

Some better-ranked stocks from the basic materials space are Axalta Coating Systems Ltd. AXTA, Universal Stainless & Alloy Products, Inc. USAP and The Andersons Inc. ANDE. AXTA sports a Zacks Rank #1 (Strong Buy), and USAP and ANDE each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axalta Coating’s 2023 earnings is pegged at 44 cents per share. The consensus estimate for 2023 earnings has moved 23% north in the past 60 days. Its shares have gained 15.7% in a year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares have gained 96% in the last year.

The consensus estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 32% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

International Paper Company (IP) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report