International Paper (IP) Q3 Earnings Beat Estimates, Down Y/Y

International Paper Company IP reported third-quarter 2023 adjusted earnings of 64 cents per share, surpassing the Zacks Consensus Estimate of adjusted earnings of 59 cents per share by a margin of 8%. The bottom line declined 23% year over year.

Including one-time items, the company posted earnings per share of 47 cents from continuing operations in third-quarter 2023 compared with earnings per share of $2.64 in the year-ago quarter.

Net sales were $4.6 billion in the quarter under review, down 15% from the year-ago quarter. The top line missed the Zacks Consensus Estimate of $4.85 billion.

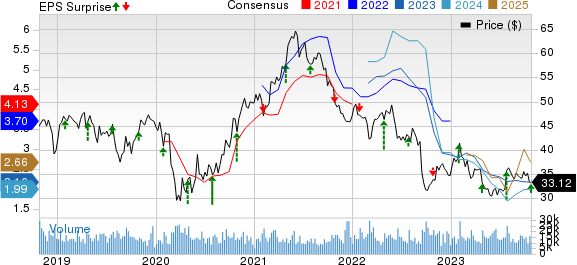

International Paper Company Price, Consensus and EPS Surprise

International Paper Company price-consensus-eps-surprise-chart | International Paper Company Quote

The cost of sales was $3,345 million in the quarter under review, down 13% from the prior-year quarter’s $3,830 million. Gross profit declined 19% year over year to $1,268 million.

Selling and administrative expenses were $286 million, which decreased 15% from $337 million in last year’s quarter. Total segment operating profit plunged 24% year over year to $352 million in the quarter. Adjusted operating profit in the quarter was $224 million compared with $300 million in the second quarter of 2022.

The company realized earnings of $75 million from its Building a Better IP set of initiatives in the third quarter of 2023. This brings the total to $195 million for the first nine-month period of 2023.

Segment Performances

Industrial Packaging: The segment’s sales were $3.8 billion, down 13.6% from the last year’s reported figure. Operating profit dipped 12% year over year to $325 million.

The segment reported corrugating packaging volumes of 2,329 thousand short tons, down 8% from last year’s comparable quarter. We had projected corrugating packaging volumes to be around 2,416 thousand short tons for the quarter.

Containerboard volumes in the third quarter were 677 thousand short tons, flat with the year-ago quarter. The figure came in higher than our estimate of 607.7 thousand short tons.

Recycling volumes dipped 3% year over year to 529 thousand short tons, lower than our projection of 540 thousand short tons. The Industrial Packaging segment also reported a year-over-year drop in volumes in Saturated Kraft (22%) and Gypsum /Release Kraft (12%) as well. EMEA Packaging, however, reported a 0.7% rise in volumes.

Overall, the volumes for the Industrial Packaging segment were 3,932 thousand short tons, which declined 6% from last year’s quarter. The figure came in lower than our projection of 3,986 thousand short tons, which was based on a 4.2% decline from last year quarter.

Global Cellulose Fibers: The segment’s sales declined 18% year over year to $725 million in the third quarter. The segment reported an operating profit of $27 million in the quarter, which marked a 72% slump from the year-ago quarter.

The segment’s volumes were reported to be 692 thousand metric tons, which was down 8% year over year. The figure came in higher than our expectation of 679 thousand metric tons, which had factored in a 9.5% year-over-year decline.

Financial Position

Cash and temporary investments aggregated $1.14 billion at the end of the third quarter of 2023 compared with $0.8 billion at the end of 2022. Throughout the third quarter of 2023, the company paid dividends worth $160 million. So far, in the nine-month period of 2023, the company has returned $679 million as share repurchases and dividends.

At the end of the third quarter of 2023, IP’s long-term debt was around $5.5 billion, compared with $4.8 billion as of 2022 end. Cash flow from operating activities was $1.34 billion in the first nine-month period of 2023 compared with $1.41 million in the prior-year comparable period.

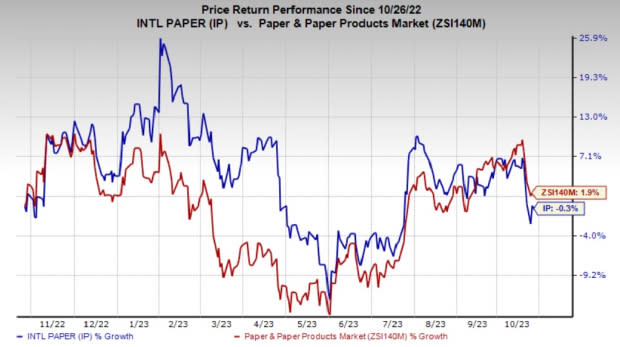

Price Performance

International Paper’s shares have fallen 0.3% in the past year against the industry’s 1.9% increase.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

International Paper currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are WestRock Company WRK, The Andersons Inc. ANDE and Koppers Holdings Inc. KOP, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK beat the consensus estimate in three of the last four quarters while missing in one quarter, the average earnings surprise being 30.7%. The company’s shares have rallied 4% in the past year.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward in the past 90 days. Andersons beat the consensus estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE’s shares have rallied around 37.3% in a year.

The consensus estimate for Koppers’ current fiscal year earnings is pegged at $4.45 per share, indicating year-over-year growth of 7.5%. KOP beat the Zacks Consensus Estimate in all four quarters, the average earnings surprise being 21.7%. The company’s shares have surged 47.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

International Paper Company (IP) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report