Internet Software Stock Q1 Earnings on Apr 27: PINS, NET & More

The Zacks Internet Software industry players are expected to have benefited from high demand for Software as a Service or SaaS-based solutions due to the increasing need for remote working, learning and diagnosis software, as well as cybersecurity applications, in the first quarter of 2023.

Industry participants, including Pinterest PINS, Cloudflare NET, Snap Inc. SNAP and AppFolio APPF, have been gaining from accelerated demand for digital transformation and the ongoing shift to the cloud, as well as the rapid evolution of the Metaverse. Steady subscription and advertising revenues are also expected to have aided top-line growth in the to-be-reported quarter.

The pay-as-you-go model helps Internet Software providers scale their offerings according to the needs of different users. The affordability of the SaaS delivery model, particularly for small and medium-sized businesses, has been another major driver. The cloud-based applications are easy to use. Hence, the need for specialized training reduces significantly, which lowers expenses, thereby driving profits.

The growing demand for solutions, which support hybrid operating environments, has been noteworthy. Internet-Software companies are expected to have sustained the growing need by enterprises to secure cloud platforms amid rising incidences of cyber-attacks and hacking, which are expected to have driven the demand for web-based cyber security software.

The Internet-Software space is housed within the broader Technology sector (one of the 16 broad Zacks sectors within the Zacks Industry classification). Per the latest Earnings Preview, the total earnings of technology companies for first-quarter 2023 are expected to be down 17.3% from the same period last year on 4.4% lower revenues.

Persistent headwinds like higher wage inflation, currency fluctuations and the pandemic-induced supply-chain disruptions might have adversely impacted the bottom-line performance of the industry players.

Insight Into Key Releases

Here we discuss four Internet-Software stocks scheduled to release their quarterly earnings on Apr 27.

The Zacks model suggests that a company needs to have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today's Zacks #1 Rank stocks here.

Pinterest: Enhanced product offerings, new conversion insights, wider Pinner and advertiser base, simplified ad systems and improved advertisers’ ability to measure the effectiveness of their ad spend are expected to have aided advertising revenues in the to-be-reported quarter. The company has been undertaking various initiatives to attract more businesses to its platform and increase its user base through better content. Backed by these developments, this San Francisco-based Internet content provider is likely to have recorded higher revenues year over year in the to-be-reported quarter. (Read more: Will Modest Revenue Growth Aid Pinterest Q1 Earnings?)

The Zacks Consensus Estimate for PINS first-quarter 2023 adjusted earnings per share is pegged at breakeven, indicating a decline from 10 cents reported in the prior-year quarter. For the March quarter, the Zacks Consensus Estimate for total revenues is pegged at $598 million, suggesting growth from the year-ago quarter’s reported figure of $575 million.

Pinterest has an Earnings ESP of +600.01% and a Zacks Rank #2. The company’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 59.57%.

Pinterest, Inc. Price and EPS Surprise

Pinterest, Inc. price-eps-surprise | Pinterest, Inc. Quote

Cloudflare: Its first-quarter performance is likely to have benefited from its recurring subscription-based business model and the solid demand for security solutions, which became imperative due to aggravated cyberattacks, hybrid working trend and a zero-trust approach. The to-be-reported quarter’s top line is likely to have witnessed the impact of the accelerated global footprint expansion outside the United States. It is worth mentioning that the United States, EMEA and APAC represented 52.7%, 26.6% and 13.4% of total revenues, respectively, in the fourth quarter. Moreover, a diversified customer base is likely to have contributed to NET’s first-quarter top line. (Read more: Is Cloudflare Likely to Surpass Q1 Earnings Estimates?)

The Zacks Consensus Estimate for the company’s first-quarter 2023 top line is currently pegged at $291 million, indicating an improvement of 37.2% year over year. The consensus mark for the same is pegged at 4 cents per share, implying a robust improvement from the year-ago quarter’s earnings of a penny. Cloudflare has an Earnings ESP of +12.50% and a Zacks Rank #2.

Cloudflare, Inc. Price and EPS Surprise

Cloudflare, Inc. price-eps-surprise | Cloudflare, Inc. Quote

Cloudflare, Inc. Price and EPS Surprise

Snap: The company’s first-quarter 2023 results are likely to reflect steady usage of the Snapchat platform and an increase in Snapchat+ subscribers. The growing adoption of Snapchat among the Gen Z (13-24 years) population is expected to have driven Daily Active Users (DAUs), thus expanding the company’s advertiser base. In addition to the strong adoption of AR Lenses, the Discover content and Shows are expected to have driven user growth. A steady yet slow ad-spending environment is expected to have impacted Snap’s first-quarter top-line numbers. (Read more: SNAP Gearing Up to Report Q1 Earnings: What's in the Cards?)

The Zacks Consensus Estimate for Snap’s first-quarter 2023 revenues is currently pegged at $1.01 billion, indicating a 5.42% decline from the year-ago quarter’s reported figure. The consensus mark for the bottom line has been steady at a loss of 1 cent per share, indicating 50% improvement from the year-ago quarter’s reported figure. Snap has an Earnings ESP of 0.00% and a Zacks Rank #3.

Snap Inc. Price and EPS Surprise

Snap Inc. price-eps-surprise | Snap Inc. Quote

AppFolio: The company is expected to have benefited from top-line improvement in the Core Solutions and Value+ Services divisions in the first quarter 2023. Higher uptake of APPF’s electronic payment services is expected to have bolstered Value+ Services revenues in the to-be-reported quarter. Growth in the number of property manager customers and property management units are expected to have been key growth drivers. Increased adoption of AppFolio Property Manager Plus, which is focused on larger unit count customers, is likely to have boosted top-line growth.

The Zacks Consensus Estimate for APPF’s first-quarter 2023 revenues is currently pegged at $128.34 Million, indicating 21.86% growth from the year-ago quarter’s reported figure. The consensus mark for the bottom line has been steady at a loss of 8 cents per share, indicating 80.4% growth from the year-ago quarter’s reported figure.

APPF has an Earnings ESP of 0.00% and a Zacks Rank #3. The company’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average negative surprise being 92.07%.

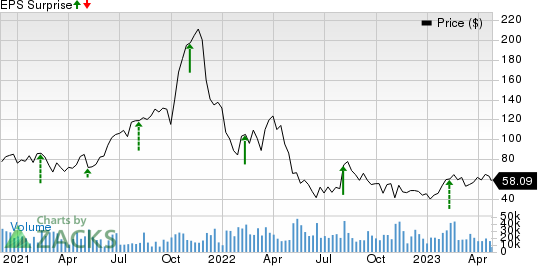

AppFolio, Inc. Price and EPS Surprise

AppFolio, Inc. price-eps-surprise | AppFolio, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report