Interpublic Group Reports Mixed 2023 Results with Organic Growth in Q4

Organic Growth: Q4 organic net revenue growth of 1.7%, despite a full year organic decrease of 0.1%.

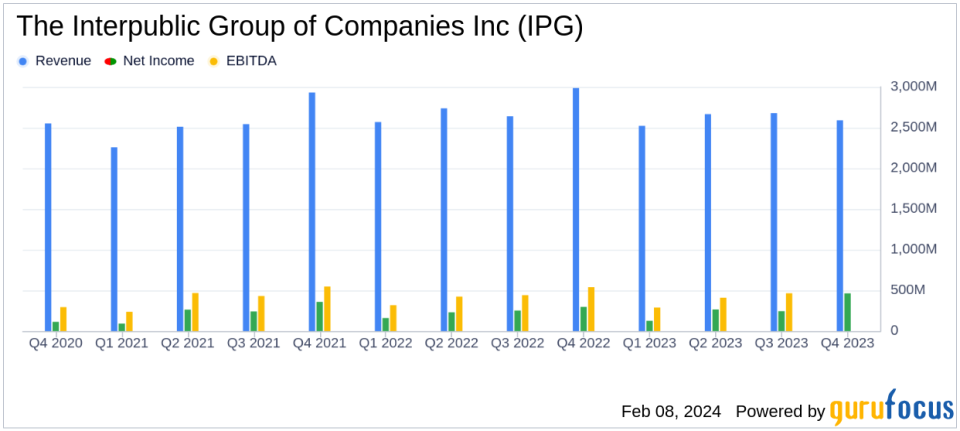

Revenue: Full year 2023 total revenue slightly down to $10.89 billion from $10.93 billion in 2022.

Net Income: Reported net income for 2023 stands at $1.1 billion.

Earnings Per Share (EPS): Diluted EPS of $2.85 as reported and $2.99 as adjusted, including a tax benefit of $0.17 per share.

Dividend and Share Repurchase: 6% dividend increase to $0.33 per share and additional share repurchase authorization of $320 million.

Margin Improvement: Full year adjusted EBITA margin improved slightly to 16.7%.

The Interpublic Group of Companies Inc (NYSE:IPG) released its 8-K filing on February 8, 2024, disclosing its fourth quarter and full year 2023 financial results. The company, a global leader in marketing solutions, reported a slight organic growth in the fourth quarter, contrasting with a marginal full-year organic revenue decline. Amidst these mixed results, IPG announced a dividend increase and an additional share repurchase authorization, signaling confidence in its financial health and strategic trajectory.

Company Overview

Interpublic Group is one of the world's preeminent advertising holding companies, offering a suite of services including traditional advertising, digital marketing, public relations, and specialty marketing. With a presence in over 100 countries, IPG generates the majority of its revenue from developed regions like the United States and Europe. The company's expansive portfolio includes notable brands such as Acxiom, FCB, and McCann.

Financial Performance and Challenges

IPG's fourth quarter showed resilience with a 1.7% organic net revenue growth, reaching $2.6 billion. However, the full year presented a slight organic net revenue decrease of 0.1%, with total revenue dipping to $10.9 billion from $10.93 billion in 2022. This performance reflects the broader challenges faced by the advertising industry, including macroeconomic uncertainties and specific client challenges within the technology sector.

The importance of IPG's performance lies in its ability to navigate a complex and rapidly changing industry landscape. The company's strategic investments in data-powered tools, retail and performance media, and AI technology are crucial for maintaining competitive advantage and driving future growth. However, the challenges posed by economic headwinds and sector-specific issues could potentially impact client spending and IPG's organic growth trajectory.

Financial Achievements and Industry Significance

Despite the challenges, IPG's financial achievements in 2023 included a reported net income of $1.1 billion and an adjusted EBITA before restructuring charges of $1.6 billion, reflecting a margin of 16.7%. The diluted EPS was reported at $2.85 and adjusted at $2.99, benefiting from a second-quarter tax advantage. These achievements are significant as they demonstrate IPG's ability to maintain profitability and shareholder value in a competitive and diversified media industry.

Key Financial Metrics

IPG's financial health is further evidenced by its strong balance sheet, with cash and cash equivalents totaling $2.39 billion at the end of 2023. The company's total debt increased slightly to $3.20 billion from $2.92 billion in the previous year. The Board's approval of a 6% dividend increase and an additional share repurchase authorization of $320 million underscores the confidence in IPG's financial stability and future prospects.

Operating income for the fourth quarter was notably higher at $606.8 million, compared to $444.6 million in the same period of 2022. The full year operating income also saw an increase to $1.48 billion from $1.38 billion. These improvements reflect effective cost management and operational efficiency.

"We are pleased to report growth in the fourth quarter ahead of expectations, during our seasonally largest quarter and across each of our segments," said Philippe Krakowsky, CEO of IPG. "Looking ahead, we remain confident in the foundational strengths of our company."

Analysis of Company's Performance

IPG's performance in 2023 illustrates a company adapting to the dynamic demands of the advertising industry. The modest organic growth in the fourth quarter, coupled with disciplined cost management, has allowed IPG to deliver solid financial results. The company's strategic focus on expanding its digital and data capabilities, as well as its investment in AI, positions it well for future growth despite the current challenges.

The announced dividend increase and share repurchase program reflect a commitment to returning value to shareholders and a belief in the company's ability to generate sustainable earnings. As IPG navigates the complexities of the global advertising market, its financial discipline and strategic investments will be key to driving long-term success.

For detailed financial tables and further information regarding IPG's financial results and non-GAAP measures, please refer to the appendix within the company's press release.

Investors and stakeholders in the diversified media industry will continue to monitor IPG's performance as an indicator of the sector's health and the effectiveness of the company's strategic initiatives.

For more in-depth analysis and updates on The Interpublic Group of Companies Inc (NYSE:IPG) and the advertising industry, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Interpublic Group of Companies Inc for further details.

This article first appeared on GuruFocus.