Intevac Inc Reports Revenue Growth Amidst Industry Challenges in Q4 and Full Year 2023

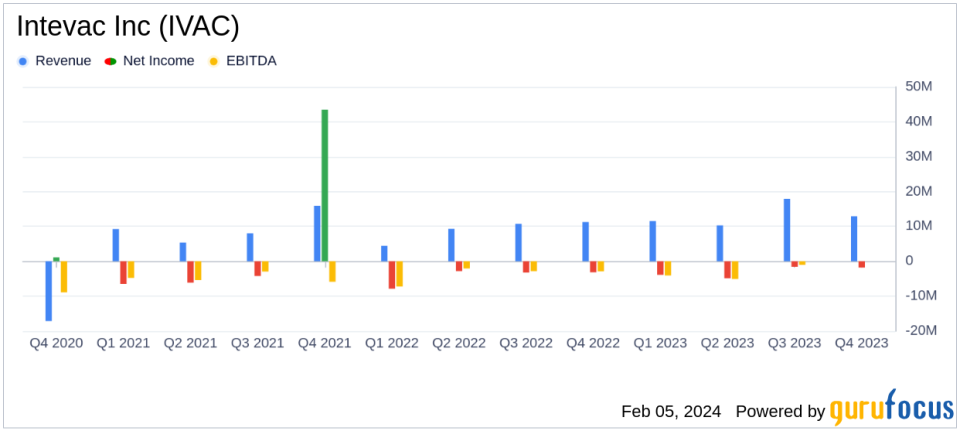

Revenue Growth: Intevac Inc (NASDAQ:IVAC) reported a 47% year-over-year revenue increase in its HDD business for the full year 2023.

Operating Loss Reduction: IVAC reduced its operating loss from $16.5 million in 2022 to $13.2 million in 2023.

Net Loss Improvement: The company's net loss improved from $17.1 million in 2022 to $12.2 million in 2023.

Backlog Decrease: Order backlog decreased to $42.4 million at the end of 2023, down from $121.7 million at the end of 2022.

Balance Sheet Strength: IVAC maintained a strong balance sheet with $72.2 million in total cash, cash equivalents, restricted cash, and investments.

TRIO Platform Milestone: The qualification of the first TRIO system in Q4 marks a significant step in addressing an estimated $1 billion served market.

On February 5, 2024, Intevac Inc (NASDAQ:IVAC), a leader in thin-film processing systems, announced its financial results for the fourth quarter and full year ended December 30, 2023. The company released its 8-K filing, highlighting a strong finish to the year, particularly in its hard disk drive (HDD) business, which saw a 47% increase in year-over-year revenue growth. This growth was primarily driven by sales related to new technology transitions in the industry, such as heat-assisted magnetic recording (HAMR) technology.

Intevac's President and CEO, Nigel Hunton, expressed optimism about the company's future, particularly with the qualification of the TRIO platform, which is expected to drive future revenue growth. Despite the positive developments, the company faced challenges, including a decrease in order backlog from the previous year and an operating loss, though reduced from the prior year.

Financial Performance and Challenges

For the fourth quarter of 2023, Intevac reported revenues of $12.9 million, up from $11.3 million in the same quarter of the previous year. The company's gross margin improved slightly to 46.0% in Q4 2023 from 44.3% in Q4 2022. Operating expenses decreased to $7.8 million from $8.3 million year-over-year. The net loss for Q4 2023 was $1.8 million, or $0.07 per diluted share, an improvement from a net loss of $3.2 million, or $0.12 per diluted share, in Q4 2022.

For the full year, Intevac's revenues were $52.7 million, up from $35.8 million in 2022. The operating loss was $13.2 million, which included $2.0 million of restructuring-related costs. The net loss for the year was $12.2 million, or $0.47 per diluted share, compared to a net loss of $17.1 million, or $0.68 per diluted share, in 2022. The non-GAAP net loss was $10.9 million, or $0.42 per diluted share, compared to the non-GAAP net loss of $14.1 million, or $0.56 per diluted share, in 2022.

The achievements of 2023 place Intevac on a solid trajectory for future growth, with the strength of the balance sheet maintained, said Nigel Hunton, President and CEO of Intevac.

Analysis of Intevac's Performance

The company's performance in 2023 demonstrates resilience in a challenging industry environment. The significant revenue growth in the HDD business and the advancement of the TRIO platform are positive indicators for Intevac's strategic direction. However, the decrease in order backlog and the operating loss highlight the ongoing challenges the company faces. The strength of the balance sheet, with a substantial cash position, provides Intevac with a buffer to navigate future uncertainties and invest in growth opportunities.

Intevac's focus on maintaining a strong balance sheet and diversifying its product portfolio is crucial for its long-term success. The company's ability to innovate and adapt to new market demands, as evidenced by the development of the TRIO platform, is a testament to its commitment to growth and value creation for shareholders.

Value investors may find Intevac's progress in technology and market positioning compelling, especially considering the company's improved financial metrics and strategic initiatives aimed at capturing new market opportunities.

For more detailed information, investors are encouraged to review the full earnings report and listen to the conference call, which provides additional insights into the company's performance and outlook.

Intevac's continued investment in technology and market expansion, coupled with a disciplined approach to financial management, positions the company to potentially benefit from the evolving demands of the thin-film processing industry.

For further details and to stay updated on Intevac's progress, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Intevac Inc for further details.

This article first appeared on GuruFocus.