Intrepid Potash Inc (IPI) Faces Net Loss in Q4 and Full-Year 2023 Despite Revenue Growth

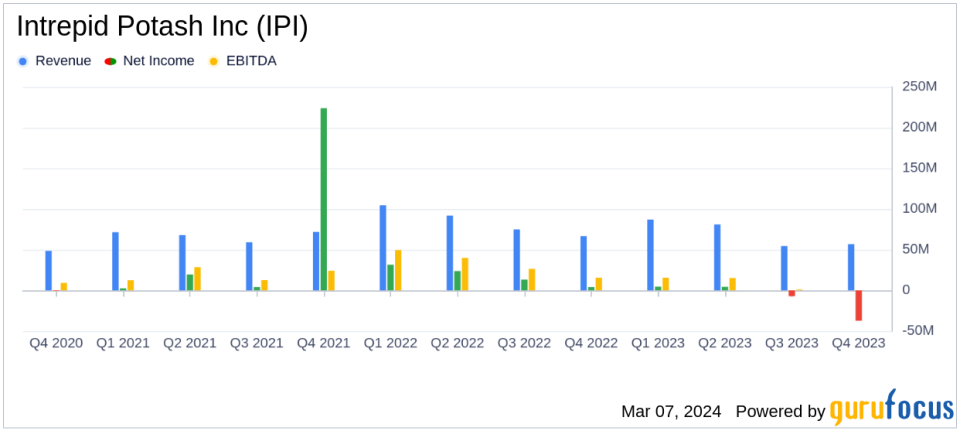

Total Sales: $56.7 million in Q4 and $279.1 million for full-year 2023.

Net Loss: Reported a net loss of $37.3 million in Q4 and $35.7 million for the full year.

Adjusted EBITDA: $7.1 million in Q4, totaling $41.6 million for 2023.

Cash Flow: Operations generated $4.6 million in Q4, contributing to $43.2 million for the year.

Capital Expenditures: Totaled $65.1 million in 2023, with a guidance range of $40 to $50 million for 2024.

Liquidity: Ended 2023 with $4.1 million in cash and equivalents, and a total liquidity of approximately $185.4 million as of March 1, 2024.

On March 6, 2024, Intrepid Potash Inc (NYSE:IPI) released its 8-K filing, detailing its financial results for the fourth quarter and the full year of 2023. Intrepid Potash Inc, a company specializing in the production and sale of potash and related products, faced a challenging year with a reported net loss despite an increase in total sales. The company's operations span across three main segments: Potash, Trio, and Oilfield solutions, with the majority of its revenue generated in the United States.

Financial Performance and Challenges

Intrepid Potash Inc's financial performance in 2023 was marked by a net loss of $37.3 million in the fourth quarter and $35.7 million for the full year. These figures include substantial non-cash impairment charges totaling $42.8 million in Q4 and $43.3 million for the year. The adjusted net loss, which excludes these charges, was $5.2 million for Q4 and $3.0 million for the full year. The impairment charges were primarily related to the company's conventional langbeinite mine and assets at its West mine, which has been in care and maintenance since 2016.

The company's total sales for the year reached $279.1 million, a decrease from the previous year's $337.6 million, largely due to lower pricing after record levels seen in 2022. This was partially offset by higher sales volumes. The average net realized sales price for potash was $466 per ton, while for Trio it was $321 per ton.

Strategic Focus and Capital Expenditures

Intrepid Potash Inc's capital expenditures for 2023 totaled $65.1 million, which was at the lower end of their guidance range. The company's strategic focus for growth capital is on improving production rates at its solar solution potash assets. Key projects include the HB Solution Mine in Carlsbad, New Mexico, and the Brine Recovery Mine in Wendover, Utah, which are expected to deliver higher production starting in the second half of 2024.

Additionally, the company has engaged advisors to maximize the value of its lithium resource at Wendover and received the final air permit for its sand project in Southeastern New Mexico, indicating progress in diversifying its product offerings.

Liquidity and Investments

Intrepid Potash Inc ended 2023 with cash and cash equivalents of approximately $4.1 million and had $4.0 million of outstanding borrowings on its $150 million revolving credit facility. As of March 1, 2024, the company's cash and cash equivalents totaled approximately $35.4 million, with no outstanding borrowings, resulting in total liquidity of approximately $185.4 million.

Management Commentary and Outlook

Bob Jornayvaz, Intrepid's Executive Chairman and CEO, commented on the company's performance, noting the continuation of strong demand for potash and Trio with combined 2023 sales volumes up approximately 16% compared to 2022. He acknowledged the challenges faced with lower fertilizer pricing and higher production costs but expressed optimism for the future, highlighting the company's strategic priorities and the positive impacts expected from higher potash production rates.

Intrepid's primary strategic priority has been to revitalize our potash assets and I'm very pleased to share that we are on track to successfully achieve this goal. We still have a couple projects to bring online over the next few months but our potash production outlook is improving, highlighted by the significantly improved brine grades we're already seeing in our harvest ponds at HB from the Eddy Shaft project. We are a few quarters away from seeing the first inflection to higher production from our HB mine and we want to be clear that our investments are designed to sustainably support higher potash production over the long-term." - Bob Jornayvaz, Executive Chairman and CEO

Intrepid Potash Inc's performance in 2023 reflects the volatility and challenges inherent in the agriculture industry. While the company faced a net loss, its strategic initiatives and capital investments are aimed at improving production and diversifying its product offerings, which may contribute to a more robust financial performance in the future.

Explore the complete 8-K earnings release (here) from Intrepid Potash Inc for further details.

This article first appeared on GuruFocus.