Introducing HireQuest (NASDAQ:HQI), A Stock That Climbed 45% In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the HireQuest, Inc. (NASDAQ:HQI) share price is 45% higher than it was a year ago, much better than the market return of around 23% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow HireQuest for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for HireQuest

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year HireQuest grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 20% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

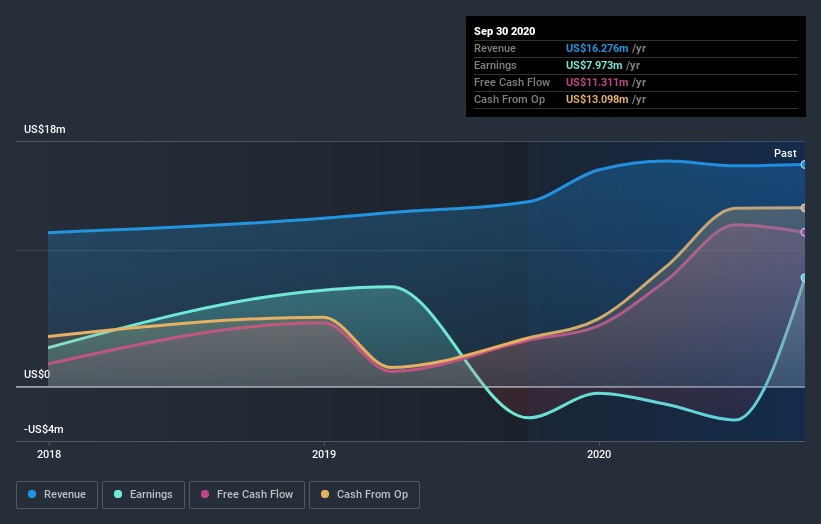

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of HireQuest's earnings, revenue and cash flow.

A Different Perspective

HireQuest shareholders should be happy with the total gain of 47% over the last twelve months, including dividends. And the share price momentum remains respectable, with a gain of 30% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - HireQuest has 3 warning signs (and 1 which is concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.