Introducing Kin Pang Holdings (HKG:1722), The Stock That Tanked 74%

Even the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So spare a thought for the long term shareholders of Kin Pang Holdings Limited (HKG:1722); the share price is down a whopping 74% in the last twelve months. A loss like this is a stark reminder that portfolio diversification is important. Kin Pang Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 52% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Kin Pang Holdings

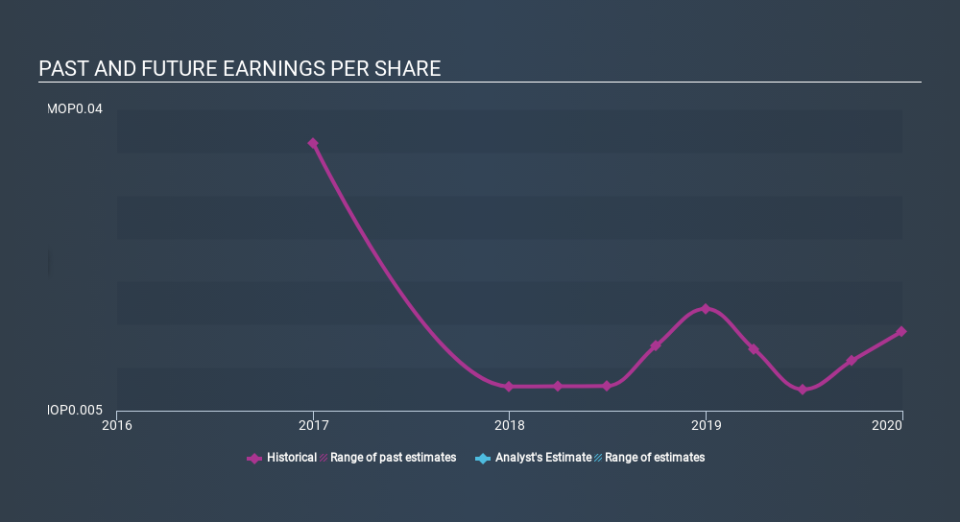

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Kin Pang Holdings had to report a 16% decline in EPS over the last year. This reduction in EPS is not as bad as the 74% share price fall. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 7.25 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Kin Pang Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kin Pang Holdings shareholders are down 74% for the year, even worse than the market loss of 17%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 52% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Kin Pang Holdings is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.